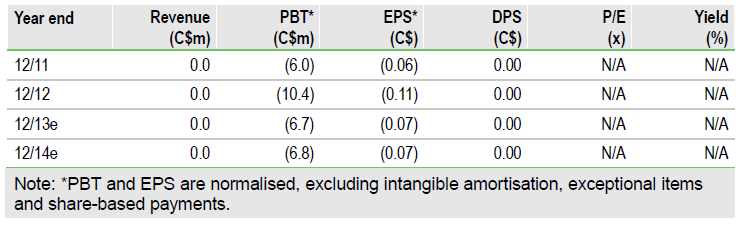

Northern Dynasty Minerals’ (NAK) Pebble project (50% owned) in south-west Alaska is the largest undeveloped copper and gold property globally. Due to high by-product credits, Pebble is projected to have a negative cash cost for copper. The preliminary assessment was released in February 2011 and the company projects Pebble will receive its environmental permits in late-2017 and commence production in late-2021. We believe the key to Pebble’s success is securing environmental permits. Pebble is one of the most exciting mining projects globally in terms of scale, with an internal rate of return to NDM equity investors, at the current share price, of 15.9% based on the 45 year case. Assuming the project is executed to plan, our valuation for Northern Dynasty is US$5.78/share based on a dividend discount model. It also represents a cheap way of buying resources at a multiple of just 0.6c per pound of in-situ copper.

Sensitivities: Permitting and execution key

Exploration and development-stage mining companies have permitting, geologic, execution, capital-raising and commodity price risks. Due to its size, scale and location, there is some opposition to permitting the Pebble project, but there is also meaningful local support due to the potentially favourable economic impact of the project. There is a risk the geology is more challenging than the engineering studies predict, and there is the possibility management may have difficulty raising capital.

Financing

The preliminary assessment (PA) estimates Pebble capex at US$6bn and we estimate it will require US$300m for permitting. We assume third parties provide US$1.3bn for infrastructure and the Partners sign a US$1.4bn gold-streaming agreement. We assume it raises the remaining US$3.3bn 60-40 debt equity, leaving US$620m in equity to be split equally between the partners after Anglo applies its remaining US$700m in earn-in capital to the equity requirement.

Valuation: C$5.78 per share

In calculating a dividend discount valuation, we use a 10% discount rate, a 45-year mine life and long-term price assumptions of US$2.96/lb for copper, US$1,676/oz for gold and US$12/lb for molybdenum. We assume the financial steps as outlined above, on which basis the dividend discount model values Northern Dynasty at US$5.78/share. Alternatively, were it to be valued at the average global rating of in-situ copper resources, the value of its 50% interest in Pebble would be US$1.32bn or US$12.91 per share (based on a 0.3% copper equivalent cut-off grade).

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Northern Dynasty Minerals: World Class Copper, Gold Project

Published 07/11/2013, 07:49 AM

Updated 07/09/2023, 06:31 AM

Northern Dynasty Minerals: World Class Copper, Gold Project

World-class low-cost copper-gold project

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.