Rio Tinto may divest 19.1% of NDM

Rio Tinto, (RIO) has announced it is undertaking a strategic review, including the possible divestiture, of its 19.1% shareholding in Northern Dynasty Minerals Ltd., (NDM) common shares. We are surprised by this action, as we believed Rio Tinto might be interested in increasing its holding in Pebble. NDM is working on securing a replacement for Anglo American as a strategic partner for the Pebble project.

Rio Tinto may divest Northern Dynasty stake

On 23 December, Rio Tinto announced that it intends to undertake a strategic review, including possible divestment, of its 19.1% ownership of NDM common shares. As part of the review, Rio Tinto’s management will consider the fit of the Pebble project with the strategy of investing in and operating long-life and expandable assets and with the strategy for its copper business, which is focused on its four producing assets (Kennecott, Utah Copper, Oyu Tolgoi and its interests in Escondida and Grasberg) and two development projects, La Granja in Peru and Resolution in Arizona.

New ownership structure sought for Pebble

NDM is focused on consolidating the relevant information on its Pebble Project into a data room, with the goal of qualifying and securing a new partner for the project in 2014. We believe there will be material interest in joining the project by major global mining companies and that NDM may be able to sign up a new partner by Q314.

Valuation: Resource valuation vs risk profile

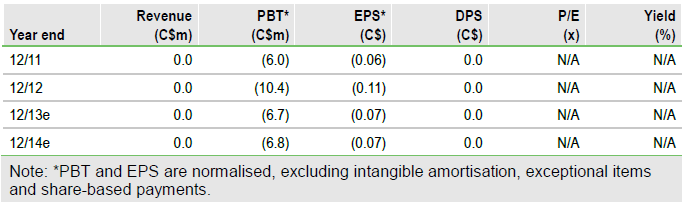

As stated in our update note of 19 December, we have not revised our DCF model valuing NDM, as the details of development and timing are uncertain. However, with 100% of the project, NDM’s resource multiple is currently just 0.17 US cents per lb copper in situ (US$3.75/t), compared to a global average for explorers of 6.7c/lb (US$147/t). As such, NDM represents a cheap way of buying copper and gold in the ground, although investors need to be aware of the altered risk profile in the light of Anglo American’s exit. For now, we leave our estimates unchanged pending details of a new partner and a new schedule.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Northern Dynasty Minerals: New Ownership Structure Sought For Pebble

Published 01/05/2014, 03:10 AM

Updated 07/09/2023, 06:31 AM

Northern Dynasty Minerals: New Ownership Structure Sought For Pebble

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.