NDM acquires 100% of Pebble

Northern Dynasty Minerals (NDM) exercised its right to acquire Anglo American’s 50% interest in the Pebble Project on 13 December, increasing its ownership to 100%, and is working on securing a new partner. All Anglo American representatives have resigned from the NDM board. Pebble is the world’s largest undeveloped copper-gold project.

Exercises option to buy out Anglo

On 13 December, Northern Dynasty exercised its option to acquire Anglo American’s 50% interest in the Pebble Project. Anglo had contributed US$556m for the advancement of Pebble through to September 2013 and, although it has not officially been made public, Edison estimates that final expenditure will have been US$560-570m. NDM committed minimal funds to exercise its option to reacquire the 50% interest in Pebble.

New ownership structure sought

NDM is focused on consolidating all of the technical, engineering work and permitting documentation related to Pebble into a data room, with the goal of qualifying and securing a new partner for the project in 2014. We believe there will be material interest in joining the project by major global-mining companies and that it is possible that NDM may be able to sign up a new partner by Q314.

Project may be scaled back

At 30 September 2013 Northern Dynasty had C$22.5m in cash and no debt. We estimate spending by NDM on Pebble will now be C$12-17m in 2014 vs US$70-80m when Anglo was a partner. We estimate it would have cost US$300m to secure environmental permits by 2017 if Anglo were funding the spending. The February 2011 preliminary assessment estimated Pebble’s capital budget at US$6.0bn. Management has indicated it may reduce the scope of the Pebble Project.

Valuation: Resource valuation vs risk profile

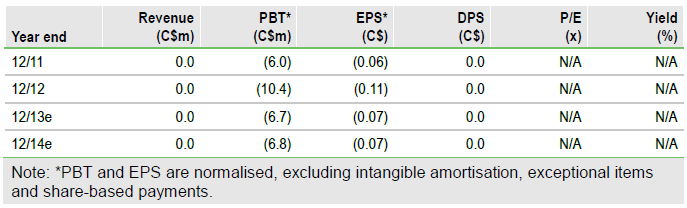

We have not revised our DCF model valuing NDM as the details of development and timing are up in the air. With 100% of the project however, NDM’s resource multiple is currently just 0.17 US cents per lb copper in-situ (US$3.75/t), compared to a global average for explorers of 6.7c/lb (US$147/t). As such, NDM represents a cheap way of buying copper and gold in the ground, although investors need to be aware of the altered risk profile in the light of Anglo’s exit. For now we leave our estimates unchanged pending details on a new partner and a new schedule.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Northern Dynasty Minerals

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.