The return to work of our south of the border neighbours after the long weekend of Thanksgiving will certainly be marked by increased volatility. Indeed, some good news came out of the weekend. In the U.S., the long weekend was very beneficial to the retailers. They have seen the volume of their sales increase by 16% compared to the same period last year. On the European side, the leaders of the euro zone have mentioned wanting to coordinate the fiscal policies of their members. As long as the sovereign debt problem is still in play, the market will remain alert to any update on that front. In terms of economic news, here is what is expected:

Canada

Little news is expected this week in Canada, but each very important. Tuesday, the current account data for the third quarter of 2011 is expected. The last figure was evaluated at -15.3 billion and the consensus is estimated at -11.1 billion. A continued current account deficit would necessarily cause a depreciation of the loonie. Wednesday, we will be able to measure the growth rate of our economy, with the release of the Canadian GDP figures of the third quarter. Friday is the most anticipated day of the week with the release of data on employment. Employment being the engine of our economy, this information is paramount and will give us an indication of the economic health of our country. A creation of 17.5k jobs in November is expected compared to the previous figure of -54k.

United States

We have a very busy schedule on the American side. It starts Tuesday with the consumer confidence index. The last data recorded for this index surprised the whole market falling well short of expectations. This month, analysts expect a level 44.4. The influx of U.S. data continues on Wednesday with ADP statistics. This data tells us the level of jobs created in the private sector. Also on Wednesday, we expect the Beige Book published by the U.S. Federal Reserve. Thursday we have the traditional data on initial jobless claims and the ISM manufacturing. As in Canada, Friday will be the most important day of the week with the release of non-farm payroll data. A creation of 120k jobs in November is expected compared to the previous figure of 80k.

International

We expect a lot of data from the euro zone. It will be interesting to analyze these statistics to have a good overview of the economic situation in the euro area without all their political problems. The inflation figures in Germany and the consumer confidence index in the euro area are expected on Tuesday. Wednesday, it will be to the euro zone to reveal its level of inflation. The German and euro zone unemployment rates will be revealed on Wednesday as well. Saturday, will be the release of the Chinese PMI for the month of November. Have a good week!

The Loonie

“Thanksgiving dinners take eighteen hours to prepare. They are consumed in twelve minutes. Half-times take twelve minutes. This is not a coincidence.

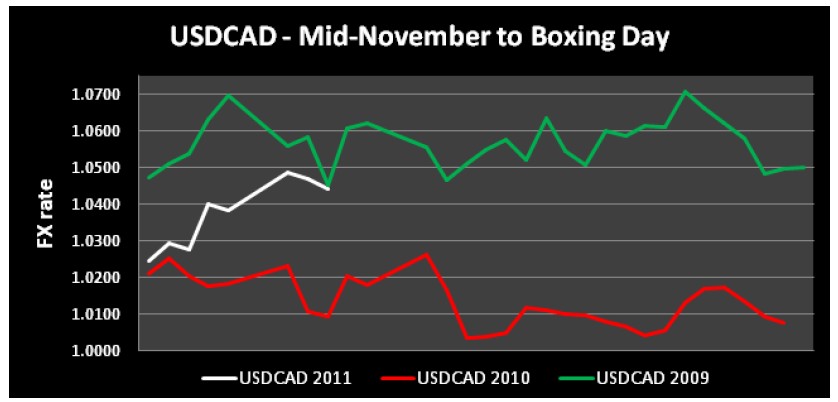

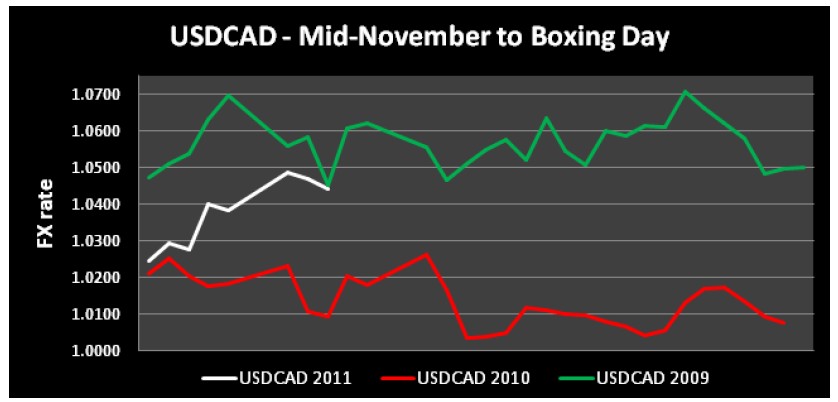

Of course Erma is talking about the American Thanksgiving and American football. Last Thursday was Thanksgiving Day, followed by the famous Black Friday which officially launches the Holiday shopping period. Many surveys show that Canadians this year will spend slightly more than the previous year during this period, to reach on average $640 per person. Amid this uncertain economic environment, we can say that this is quite good news. But will Canadians drive across the border to go shopping this year with a loonie that is weaker than the USD? In terms of foreign exchange impact, with accumulated data from the last years from American Black Friday to Canadian Boxing Day, there is not much trend. In 2009, the Loonie was diving towards parity after having failed to break 1.30 after three attempts. In 2010, the Loonie was again slowly going back towards parity after a much stable year. Now in 2011, the US dollar is just taking its role of a safe-haven currency and appreciating against the CAD. There is definitely some interesting volatility that’s showing how feverish markets are right now. The VIX index is reflecting this as it has increased by more than 30% since October 31st and this only proves a point that fear is very high among market participants.

Be careful with volatile markets. The irrational side of you that is whispering within cannot take over your common sense and have you take a decision in panic regarding your foreign exchange needs. Take some time to really analyse your needs with our help, as you would take some time to enjoy a great meal that was cooked/baked over a few hours. If the risk is short-term, the hedging should reflect this. Be alert and make sure you speak with your trader to find out more about what we can offer. Happy Holiday shopping!

Last Week at a Glance

Canada – In September, retail sales increased 1.0% after rising 0.6% in August. Sales were up in 9 of 11 retail industries. Motor vehicle and parts dealers saw sales spring 2.8% after registering a 1.2% gain in August. Excluding this subsector, retail sales advanced 0.5% with the strongest push coming from sporting goods, hobby, book and music stores (+1.7%) and from electronics and appliance stores (+1.2%). The month’s worst performers were furniture and home furnishings stores (-0.5%) and health and personal care stores (-0.4%). On a regional basis, all provinces rolled forward. Leading the lot were Nova Scotia (+2.4%) and Newfoundland and Labrador (+2.1%), with British Columbia (0.2%) and Manitoba (+0.6%) bringing up the rear. Volume retail sales grew 0.6% on the month after swelling 0.3% in August. The month’s performance, the best in 10 months, easily topped consensus expectations. Moreover, gains were broad based and all provinces were in positive territory. It is true that 61% of the gains in September came from a sharp increase in sales at motor vehicle and parts dealers and that some people could view this negatively. However, to our eyes, the fact that sales of motor vehicles, the ultimate discretionary item, reached a new high in the present cycle and are now almost back to their pre-recession peak suggests Canadian consumers are in fine form. With September's strong input, retail volumes progressed 1.9% annualized on the quarter, outpacing Q2 in this regard, which heralds a healthy contribution from consumption spending to GDP in Q3. Still in September, wholesale trade came in below expectations, climbing only 0.3% (consensus was calling for +0.7%). Agricultural supplies and food, beverages and tobacco products provided most of the thrust, but many other subsectors recorded decreases, including machinery and equipment, and personal and household goods. In real terms, wholesale trade was down 0.5% on the month.

The Province of Ontario published its Economic Outlook and fiscal review. Here are the highlights:

• For 2011-12 the Ontario government now expects a deficit of $16 billion, $0.3 billion less than budgeted last March.

•Revenues are projected to fall $443 million short of the 2011 budget forecast. Excluding a loan repayment from Chrysler Canada and other first-quarter changes, the shortfall would have been $778 million.

•The 2011 Budget plan included a $700-million reserve for 2011-12. The reserve has been reduced by $500 million to counter the impact of slower economic growth on fiscal performance.

•Program spending is consistent with the 2011 budget. Debt service is expected to cost $193 million less than budgeted.

•Deficit projections for the next two fiscal years are unchanged from the March budget. The effect of lower revenues and higher program spending is offset by a decrease in debt service cost.

•Real GDP growth is now projected at 1.8% in both 2011 and 2012, down from 2.4% and 2.7 % in the 2011 budget. The projection for 2013 is 2.5% and for 2014 it is 2.6%.

•The borrowing requirement is projected at $35 billion in 2011-12, $37.2 billion in 2012-13 and $40.0 billion in 2013-14. As of November 15th, 70% of the required 2011-12 borrowing had been completed.

•Debt resulting from accumulated deficits is estimated at 25.2% of GDP at the end of the current fiscal year and is projected to peak at 27.7% in 2014-15.

According to the Institut de la statistique du Québec, in August, real GDP at basic prices contracted 0.6% in the province (Canada +0.3%) after expanding 0.4% in July. Some 60% of the decline was due to a 2.3% drop in manufacturing output. Pulling back on the month were 13 of 20 industry groups accounting for 51% of production. With reports in for two months of Q3, GDP is on track for a quarterly expansion of 0.7% annualized.

United States – The BEA revised Q3 GDP growth down from 2.5% to 2.0% on its second estimate. Most of the adjustment was due to a $14-billion downward revision in inventories, which trimmed 1.55 percentage points off growth. State and local governments once more provided a small measure of drag. By contrast, personal consumption and fixed investments added 1.63% and 1.45%, respectively. Once again, net exports contributed positively to the cause (0.49%). In October, existing-home sales shot up 1.4% to the rate of 4.97 million units. This came as a surprise as pending home sales, which had fallen over the previous three months, suggested the movement would have been in the opposite direction. Distressed transactions were down from their level a year earlier but still accounted for 28% of sales. October durable goods orders fell 0.7%, reflecting a significant drop in the aircraft industry. Excluding transportation, orders rose 0.7%. Still, orders sagged in numerous categories as evidenced by the 1.8% decline in new orders for non-defence capital goods excluding aircraft. Moreover the September gain, originally estimated at 2.4%, was revised down to just 0.9%. Despite growing at a slower pace, core goods orders were nonetheless up 4% on an annualized basis. In October, personal income rose 0.4% while consumption expenditures increased 0.1%. The personal consumption expenditure (PCE) price index slipped 0.1% from the month before. Lower energy prices contributed to the drop, the first in the index since June. Excluding food and energy, the index was up 0.1% on the month and 1.7% on the year. The Congressional Joint Select Committee on Deficit Reduction failed to reach an agreement on how to cut $1.2 trillion from the federal deficit from 2013 to 2021. However, there is still time left to do so (including a presidential election) before automatic spending cuts kick in across the board as stipulated under the Budget Control Act passed this summer.

S&P 500: The target at 1,156 mentioned in our Snapshot of November 7th and 14th has been reached on Friday (1,158). For now, no sign of change in the trend lower despite possible rebounds.

USDCAD: The “Head and Shoulder” (see chart below) underlined several time in the past weeks is now activated and the target sits at 1.0640. A pull back towards the Neck Line (green line) at 1.0264 would represent opportunities for buyers. However, a breach of this level would send a negative signal to sellers who should leave stop loss orders around 1.0250-1.0225

Resistances

1.0417

1.0400

1.0372

1.0320

Supports

1.0300

1.0294 1.0264

1.0228

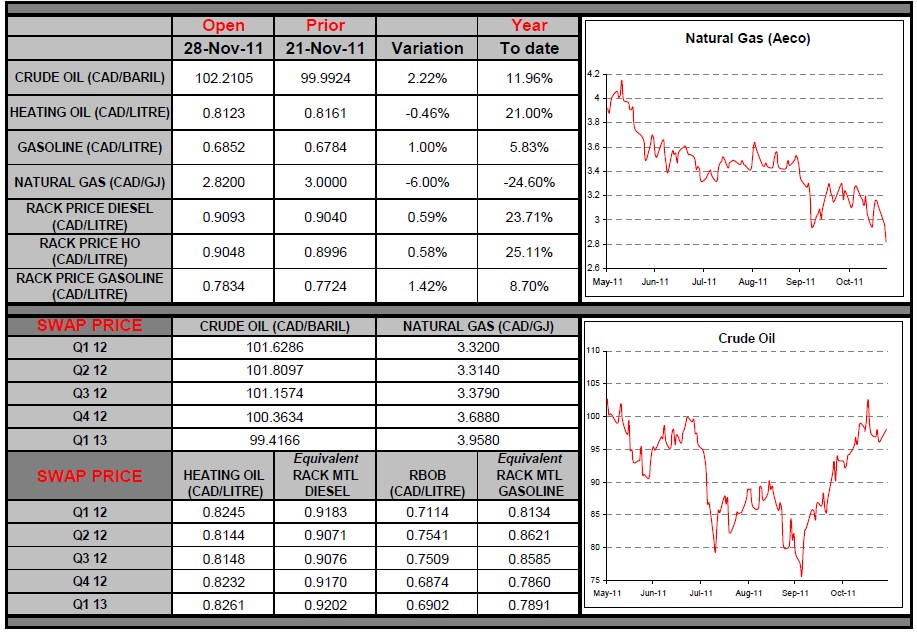

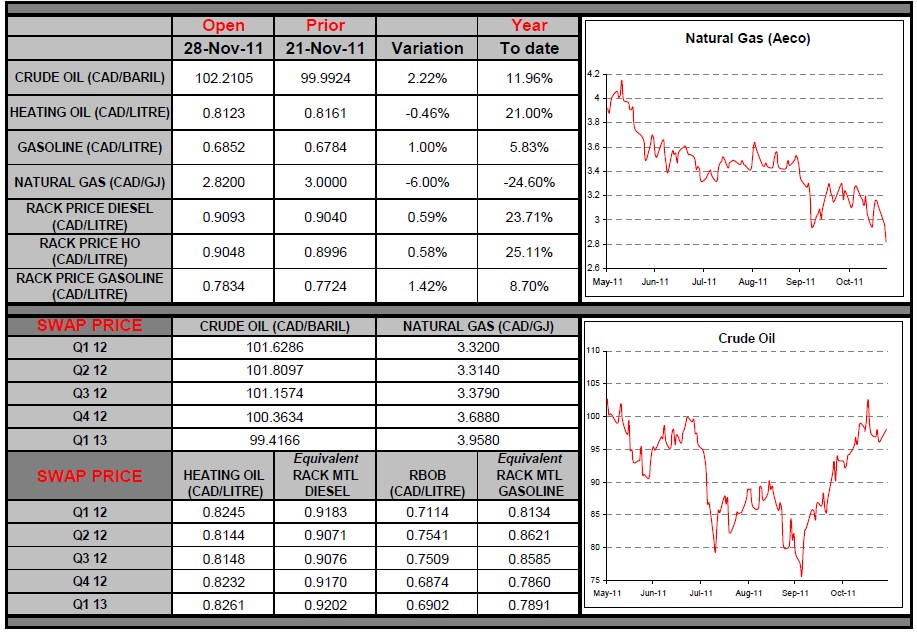

Commodities

Last week was difficult for energy prices with declines of about 2% for WTI, Brent and diesel. These declines are due to the crisis in Europe and disappointing economic data from China. The impact of the failure of MF Global should also not be underestimated. The financial institution was a major player in the field of commodities and its collapse would have resulted in the liquidation of a large number of positions. Despite this, the publication of inventories of petroleum products from the International Energy Agency (IEA) was positive for prices. The inventories of these products have fallen sharply and are below the average of the last five years for the first time in nearly a year. By the time winter sets in, this could help support the price of crude oil and diesel and thus to counterbalance the economic fears in Europe. Tensions across the Middle East could also bring a lot of volatility in 2012. Have a great week!

Fixed Income

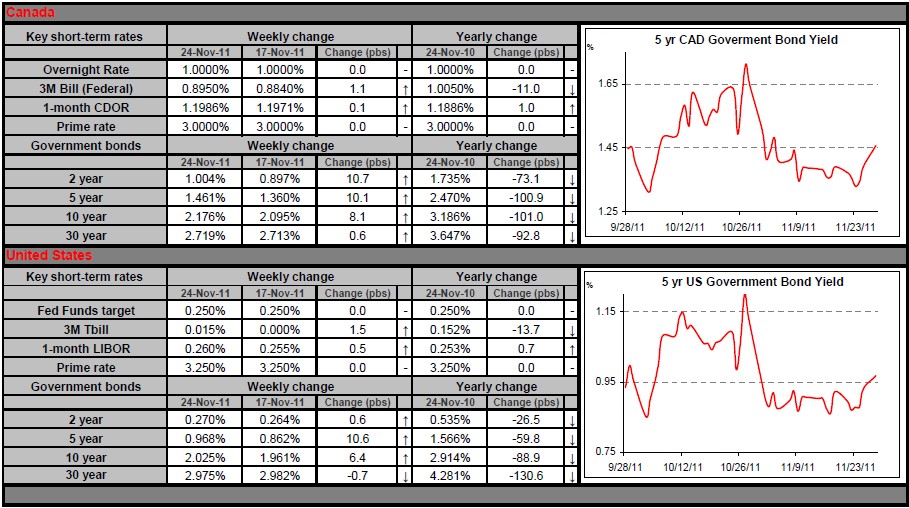

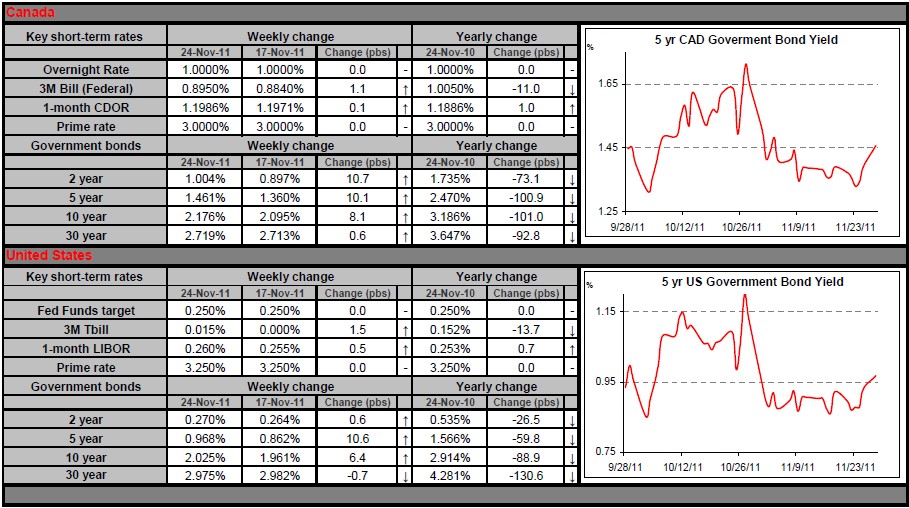

We went through another rough week in global financial markets, keeping the pressure on long term Canadian rates.

Bond yields sank early last week, amid concerns the U.S. government will be forced to submit up to $1.2 trillion in automatic spending cuts.

On Wednesday, Bank of Canada’s Governor Mark Carney emphasised on its flexible approach, through which the Canadian Central Bank could tolerate inflation being temporarily higher than its 2% threshold.

Also on Wednesday, Germany failed to get bids for 35 percent of the 10-year bonds offered by the government, propelling borrowing costs higher everywhere in Europe on concern the region’s debt crisis will drive away investors demand for European paper. The market was also very nervous on Friday after credit rating agencies downgraded Belgium, Hungary and Portugal.

Investors will be focused on the European political scene this week, as many are nervous about the future of the Union. On the economic front, the Canadian GDP will be released on Wednesday and employment numbers will be published on Friday in both Canada and the US.

Canada

Little news is expected this week in Canada, but each very important. Tuesday, the current account data for the third quarter of 2011 is expected. The last figure was evaluated at -15.3 billion and the consensus is estimated at -11.1 billion. A continued current account deficit would necessarily cause a depreciation of the loonie. Wednesday, we will be able to measure the growth rate of our economy, with the release of the Canadian GDP figures of the third quarter. Friday is the most anticipated day of the week with the release of data on employment. Employment being the engine of our economy, this information is paramount and will give us an indication of the economic health of our country. A creation of 17.5k jobs in November is expected compared to the previous figure of -54k.

United States

We have a very busy schedule on the American side. It starts Tuesday with the consumer confidence index. The last data recorded for this index surprised the whole market falling well short of expectations. This month, analysts expect a level 44.4. The influx of U.S. data continues on Wednesday with ADP statistics. This data tells us the level of jobs created in the private sector. Also on Wednesday, we expect the Beige Book published by the U.S. Federal Reserve. Thursday we have the traditional data on initial jobless claims and the ISM manufacturing. As in Canada, Friday will be the most important day of the week with the release of non-farm payroll data. A creation of 120k jobs in November is expected compared to the previous figure of 80k.

International

We expect a lot of data from the euro zone. It will be interesting to analyze these statistics to have a good overview of the economic situation in the euro area without all their political problems. The inflation figures in Germany and the consumer confidence index in the euro area are expected on Tuesday. Wednesday, it will be to the euro zone to reveal its level of inflation. The German and euro zone unemployment rates will be revealed on Wednesday as well. Saturday, will be the release of the Chinese PMI for the month of November. Have a good week!

The Loonie

“Thanksgiving dinners take eighteen hours to prepare. They are consumed in twelve minutes. Half-times take twelve minutes. This is not a coincidence.

Of course Erma is talking about the American Thanksgiving and American football. Last Thursday was Thanksgiving Day, followed by the famous Black Friday which officially launches the Holiday shopping period. Many surveys show that Canadians this year will spend slightly more than the previous year during this period, to reach on average $640 per person. Amid this uncertain economic environment, we can say that this is quite good news. But will Canadians drive across the border to go shopping this year with a loonie that is weaker than the USD? In terms of foreign exchange impact, with accumulated data from the last years from American Black Friday to Canadian Boxing Day, there is not much trend. In 2009, the Loonie was diving towards parity after having failed to break 1.30 after three attempts. In 2010, the Loonie was again slowly going back towards parity after a much stable year. Now in 2011, the US dollar is just taking its role of a safe-haven currency and appreciating against the CAD. There is definitely some interesting volatility that’s showing how feverish markets are right now. The VIX index is reflecting this as it has increased by more than 30% since October 31st and this only proves a point that fear is very high among market participants.

Be careful with volatile markets. The irrational side of you that is whispering within cannot take over your common sense and have you take a decision in panic regarding your foreign exchange needs. Take some time to really analyse your needs with our help, as you would take some time to enjoy a great meal that was cooked/baked over a few hours. If the risk is short-term, the hedging should reflect this. Be alert and make sure you speak with your trader to find out more about what we can offer. Happy Holiday shopping!

Last Week at a Glance

Canada – In September, retail sales increased 1.0% after rising 0.6% in August. Sales were up in 9 of 11 retail industries. Motor vehicle and parts dealers saw sales spring 2.8% after registering a 1.2% gain in August. Excluding this subsector, retail sales advanced 0.5% with the strongest push coming from sporting goods, hobby, book and music stores (+1.7%) and from electronics and appliance stores (+1.2%). The month’s worst performers were furniture and home furnishings stores (-0.5%) and health and personal care stores (-0.4%). On a regional basis, all provinces rolled forward. Leading the lot were Nova Scotia (+2.4%) and Newfoundland and Labrador (+2.1%), with British Columbia (0.2%) and Manitoba (+0.6%) bringing up the rear. Volume retail sales grew 0.6% on the month after swelling 0.3% in August. The month’s performance, the best in 10 months, easily topped consensus expectations. Moreover, gains were broad based and all provinces were in positive territory. It is true that 61% of the gains in September came from a sharp increase in sales at motor vehicle and parts dealers and that some people could view this negatively. However, to our eyes, the fact that sales of motor vehicles, the ultimate discretionary item, reached a new high in the present cycle and are now almost back to their pre-recession peak suggests Canadian consumers are in fine form. With September's strong input, retail volumes progressed 1.9% annualized on the quarter, outpacing Q2 in this regard, which heralds a healthy contribution from consumption spending to GDP in Q3. Still in September, wholesale trade came in below expectations, climbing only 0.3% (consensus was calling for +0.7%). Agricultural supplies and food, beverages and tobacco products provided most of the thrust, but many other subsectors recorded decreases, including machinery and equipment, and personal and household goods. In real terms, wholesale trade was down 0.5% on the month.

The Province of Ontario published its Economic Outlook and fiscal review. Here are the highlights:

• For 2011-12 the Ontario government now expects a deficit of $16 billion, $0.3 billion less than budgeted last March.

•Revenues are projected to fall $443 million short of the 2011 budget forecast. Excluding a loan repayment from Chrysler Canada and other first-quarter changes, the shortfall would have been $778 million.

•The 2011 Budget plan included a $700-million reserve for 2011-12. The reserve has been reduced by $500 million to counter the impact of slower economic growth on fiscal performance.

•Program spending is consistent with the 2011 budget. Debt service is expected to cost $193 million less than budgeted.

•Deficit projections for the next two fiscal years are unchanged from the March budget. The effect of lower revenues and higher program spending is offset by a decrease in debt service cost.

•Real GDP growth is now projected at 1.8% in both 2011 and 2012, down from 2.4% and 2.7 % in the 2011 budget. The projection for 2013 is 2.5% and for 2014 it is 2.6%.

•The borrowing requirement is projected at $35 billion in 2011-12, $37.2 billion in 2012-13 and $40.0 billion in 2013-14. As of November 15th, 70% of the required 2011-12 borrowing had been completed.

•Debt resulting from accumulated deficits is estimated at 25.2% of GDP at the end of the current fiscal year and is projected to peak at 27.7% in 2014-15.

According to the Institut de la statistique du Québec, in August, real GDP at basic prices contracted 0.6% in the province (Canada +0.3%) after expanding 0.4% in July. Some 60% of the decline was due to a 2.3% drop in manufacturing output. Pulling back on the month were 13 of 20 industry groups accounting for 51% of production. With reports in for two months of Q3, GDP is on track for a quarterly expansion of 0.7% annualized.

United States – The BEA revised Q3 GDP growth down from 2.5% to 2.0% on its second estimate. Most of the adjustment was due to a $14-billion downward revision in inventories, which trimmed 1.55 percentage points off growth. State and local governments once more provided a small measure of drag. By contrast, personal consumption and fixed investments added 1.63% and 1.45%, respectively. Once again, net exports contributed positively to the cause (0.49%). In October, existing-home sales shot up 1.4% to the rate of 4.97 million units. This came as a surprise as pending home sales, which had fallen over the previous three months, suggested the movement would have been in the opposite direction. Distressed transactions were down from their level a year earlier but still accounted for 28% of sales. October durable goods orders fell 0.7%, reflecting a significant drop in the aircraft industry. Excluding transportation, orders rose 0.7%. Still, orders sagged in numerous categories as evidenced by the 1.8% decline in new orders for non-defence capital goods excluding aircraft. Moreover the September gain, originally estimated at 2.4%, was revised down to just 0.9%. Despite growing at a slower pace, core goods orders were nonetheless up 4% on an annualized basis. In October, personal income rose 0.4% while consumption expenditures increased 0.1%. The personal consumption expenditure (PCE) price index slipped 0.1% from the month before. Lower energy prices contributed to the drop, the first in the index since June. Excluding food and energy, the index was up 0.1% on the month and 1.7% on the year. The Congressional Joint Select Committee on Deficit Reduction failed to reach an agreement on how to cut $1.2 trillion from the federal deficit from 2013 to 2021. However, there is still time left to do so (including a presidential election) before automatic spending cuts kick in across the board as stipulated under the Budget Control Act passed this summer.

S&P 500: The target at 1,156 mentioned in our Snapshot of November 7th and 14th has been reached on Friday (1,158). For now, no sign of change in the trend lower despite possible rebounds.

USDCAD: The “Head and Shoulder” (see chart below) underlined several time in the past weeks is now activated and the target sits at 1.0640. A pull back towards the Neck Line (green line) at 1.0264 would represent opportunities for buyers. However, a breach of this level would send a negative signal to sellers who should leave stop loss orders around 1.0250-1.0225

Resistances

1.0417

1.0400

1.0372

1.0320

Supports

1.0300

1.0294 1.0264

1.0228

Commodities

Last week was difficult for energy prices with declines of about 2% for WTI, Brent and diesel. These declines are due to the crisis in Europe and disappointing economic data from China. The impact of the failure of MF Global should also not be underestimated. The financial institution was a major player in the field of commodities and its collapse would have resulted in the liquidation of a large number of positions. Despite this, the publication of inventories of petroleum products from the International Energy Agency (IEA) was positive for prices. The inventories of these products have fallen sharply and are below the average of the last five years for the first time in nearly a year. By the time winter sets in, this could help support the price of crude oil and diesel and thus to counterbalance the economic fears in Europe. Tensions across the Middle East could also bring a lot of volatility in 2012. Have a great week!

Fixed Income

We went through another rough week in global financial markets, keeping the pressure on long term Canadian rates.

Bond yields sank early last week, amid concerns the U.S. government will be forced to submit up to $1.2 trillion in automatic spending cuts.

On Wednesday, Bank of Canada’s Governor Mark Carney emphasised on its flexible approach, through which the Canadian Central Bank could tolerate inflation being temporarily higher than its 2% threshold.

Also on Wednesday, Germany failed to get bids for 35 percent of the 10-year bonds offered by the government, propelling borrowing costs higher everywhere in Europe on concern the region’s debt crisis will drive away investors demand for European paper. The market was also very nervous on Friday after credit rating agencies downgraded Belgium, Hungary and Portugal.

Investors will be focused on the European political scene this week, as many are nervous about the future of the Union. On the economic front, the Canadian GDP will be released on Wednesday and employment numbers will be published on Friday in both Canada and the US.