Last week was relatively calm in North America, but the same cannot be said of Europe. The people of Greece and Spain spent most of last week expressing their discontent with the current situations in their countries and drawing considerable attention to the European Union’s economic problems. Please consult this week’s section on the loonie for a fuller discussion of this subject.

Canada

The week in Canadian news will begin quietly, with the release of the Producer Price Index for August. The market is forecasting a 0.1% decrease in producer prices on the heels of the 0.5% decline posted for July. Then on Thursday the Ivey Purchasing Managers’ Index will be released for September. The market is expecting it to fall, to 60.0 from 62.5 for August. Lastly, the week will close with the release of labour market data. The market is forecasting that the Canadian economy created some 10,000 jobs in September. This compares to 34,500 jobs created in August.

United States

We can expect a similar scenario south of the border, where the main focus this week will also be on the labour market. The week will begin with the release of the ISM Manufacturing Purchasing Managers Index for September. It is expected to be up slightly, to 49.9 compared to 49.6 last time. This will be followed on Wednesday by the ISM Non-Manufacturing Purchasing Managers’ Index, expected at 53.2 compared to 53.7 for August. The ADP Nonfarm Employment Change Report will also be released on Wednesday.

The market expects that the economy added 143,000 jobs in September, compared to 201,000 new jobs in August. This will be followed by the release of data on weekly Initial Jobless Claims, on Thursday. The market is predicting 370,000 claims, compared to 359,000 claims made the week before. Lastly, the week will close with monthly data on NonFarm Payrolls. The market expects the economy to have added 115,000 jobs, compared to 96,000 jobs added in August.

International

Some major international economic news is expected this week. Starting on Tuesday, the Reserve Bank of Australia will announce its key interest rate decision, which is expected to be unchanged at 3.5%. The latest Consumer Price Index for the eurozone will also be released on Tuesday; 2.6% growth is expected.

On Wednesday we will have Retail Sales in the eurozone, expected to be down 1.9%. Lastly, the Bank of England and the Bank of Japan will announce their key interest rate decisions on Thursday. The market expects both rates to be unchanged. Have a good week!

The Loonie

“All things are difficult before they are easy.” – Thomas Fuller

Europe is back in the news since summer vacations ended in early September. As mentioned in our columns over the last few weeks, the European Central Bank has taken several steps in the right direction, in particular by introducing sterilized bond purchases to support countries in difficulty. However, we believe that, despite the recent calm and numerous developments, the European crisis is far from over. This was made clear by the new budget tabled by Spain on Thursday.

The budget includes new austerity measures that are certain to receive mixed reviews from Spanish citizens, who have been protesting in the streets for several days. Government departments will see their budgets cut 8.9% on average in 2013, public sector wages will be frozen for a third consecutive year, and there will be a new 20% tax on lottery winnings. This week we will analyze why over-indebted European governments are forced to take such drastic measures.

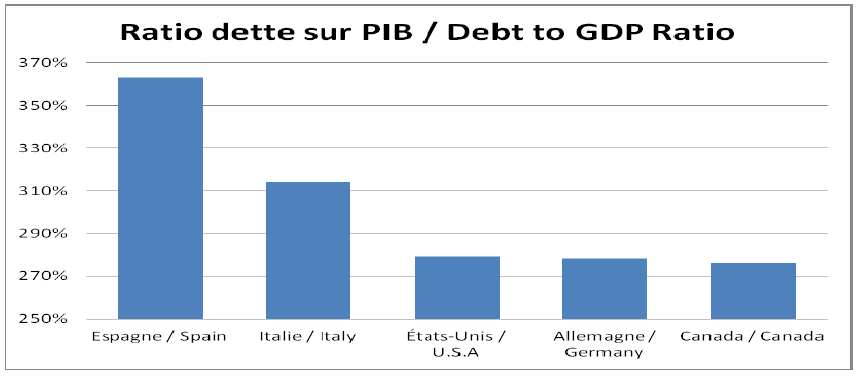

For comparative purposes, the above chart shows the debt/GDP ratios (the debt data includes households, financial institutions, nonfinancial corporations and government debt) of different countries. The differences are striking, and do not bode well for the future. In 2011, Spain’s deficit stood at 8.9% and its leaders hope to reduce this gap to 4.5% in 2013.

With investors demanding interest rates of over 6% on its 10-year bonds, Spain definitely has a long and winding road ahead. As we can see from the graph, the total debt ratio of Spain is already much higher than its peers. This context of uncertainty may counter the unofficial efforts of the Federal Reserve to devaluate the US dollar with its quantitative easing program and bring USD/CAD back to par.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

North American Markets Calm, But Europe In Turmoil

Published 10/03/2012, 03:01 AM

Updated 05/14/2017, 06:45 AM

North American Markets Calm, But Europe In Turmoil

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.