Forex News and Events

The long awaited June FOMC meeting will be held on Tuesday and Wednesday, and will be followed by a press conference, held by Fed Chairwoman Janet Yellen, on June 17. Earlier this year, an accelerating US economy - Q4 2014 GDP printed at a solid 2.2%q/q annualised – led market participants to expect a first rate hike in June. Expectations have now shifted toward a September rate hike after a weak Q1 2015. At this week meeting, we anticipate that the Fed will reiterate its confidence in the economy, as strong retail sales and upbeat job report reinforced market’s feeling that the US is on a much firmer footing, and that the winter weakness was indeed temporary. In addition, we expect the Fed will repeat its commitment to start raising rate when it has seen further improvement in the labour market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.

However, we think that the recent lack of USD strength is not only due to the ongoing Greek situation, but also to the lack of persistently strong US data. Indeed, traders want solid evidences that the US is back on track before starting to reload long USD position. The CPI data due on Thursday will be closely monitored, as a surprise on the upside would increase consistently the odds of a September rate hike.

Norges Bank: Rate Cut in Sight

Next Thursday, Norges Bank is likely to cut its main policy rate, currently at 1.25%, by 25bps. A month ago, Norges Bank kept its rates on hold. We assumed that policymakers’ officials were gaining time for gathering more data. Meanwhile, Manufacturing PMI, Industrial production decreased in May. Furthermore, the Q1 GDP growth figure came in at a disappointing 0.2%, while prior GDP growth figure for Q4 2014 was 0.9%. As we expected, the economy is still suffering from low oil prices and the likelihood for a cut rate has increased. Governor Olsen declared that as long as the Brent will stay below $70 a barrel, the Norwegian economy will be at stake. For the time being, the oil surge has been temporary and oil prices remain clearly on the $60-level a barrel, and therefore, we anticipate Norges Bank to lower its rates by 0.25bps, despite inflationary pressures that will add up to the housing price. Indeed, property prices tripled since the mid-1990s. A day before the Central Bank decision, the Norway’s Finance minister will hold a conference on strategy for housing market. The USD/NOK will not rally up after the rates decision as the cut is already priced in.

Russian Central Bank to Cut 100bp

The Russian central bank is meeting today, and we and the market are expecting a 100bp cut to 11.50%. This cut continues the central banks dovish bias, but at a slower pace than recent cuts of 150bp. In May, the CBR was in a panic to stave of unexpected RUB strength, utilizing aggressive rate cuts and heavy daily purchases of USD. But so far in June, the RUB has reversed direction, allowing the CBR to be less concerned with the potential negative effects and even skipping days for FX interventions. The Russian economy remains in a weak state. Growths deceleration appears to have extended into Q2, with very few bright spots ahead. There is growing risk of a deeper recession as consumer demand has withdrawn, illustrated by soft retail sales as wages decay endures. We suspect that the CRB would like to cut rates at a faster rate (to combat weak growth), but is constrained by elevated inflation levels and volatility in RUB. Last year’s collapse of the RUB has made the CBR extremely attentive to actions that could unsettle the markets. We remain bearish on the RUB, as the currency faces significant challenges. Western sanctions, low oil prices, unstable inflation environment and Fed rate hikes (reversing investors’ appetite for Russian investment) will all weigh on the RUB.

Silver - Challenging the Support at 15.82

Today's Key Issues Country / GMT Apr Trade Balance NSA, exp 22.5B, last 23.4B EUR / 09:00 Norway's Finance Minister Presents Housing Market Strategy NOK / 10:30 Central Bank Weekly Economists Survey BRL / 11:25 Bank of Italy Deputy Director General Speaks on Derivatives EUR / 12:00 Apr Manufacturing Sales MoM, exp -0.50%, last 2.90% CAD / 12:30 Jun Empire Manufacturing, exp 6, last 3.09 USD / 12:30 May Existing Home Sales MoM, last 2.30% CAD / 13:00 ECB President Mario Draghi Speaks at EU Parliament in Brussels EUR / 13:00 May Industrial Production MoM, exp 0.20%, last -0.30% USD / 13:15 May Capacity Utilization, exp 78.30%, last 78.20% USD / 13:15 May Manufacturing (SIC) Production, exp 0.30%, last 0.00% USD / 13:15 ECB Publishes Weekly QE Details EUR / 13:45 Jun 12 Bloomberg Nanos Confidence, last 56.3 CAD / 14:00 Jun NAHB Housing Market Index, exp 56, last 54 USD / 14:00 ECB's Coene Speaks on EU Investment Plan in Brussels EUR / 16:00 Jun 14 Trade Balance Weekly, last $1976M BRL / 18:00 Apr Net Long-term TIC Flows, last $17.6B USD / 20:00 Apr Total Net TIC Flows, last -$100.9B USD / 20:00 RBA's Debelle Gives Speech in Sydney AUD / 21:55 May Formal Job Creation Total, exp -50000, last -97828 BRL / 22:00 May Tax Collections, exp 94396M, last 109241M BRL / 22:00 Apr Service Production MoM SA, last -0.10% SEK / 22:00 Apr Service Production YoY WDA, last 2.90% SEK / 22:00 May Exports YoY, last -14.00% INR / 22:00 May Imports YoY, last -7.50% INR / 22:00 ABPO May Cardboard Sales BRL / 22:00 May Foreign Direct Investment YoY CNY, exp 8.00%, last 10.50% CNY / 22:00 May Trade Balance, exp -$11000.0M, last -$10992.3M INR / 22:00

The Risk Today

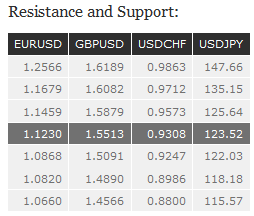

EUR/USD EUR/USD is now moving sideways. Hourly resistance is given at 1.1346 (10/06/2015 high). Hourly support can be found at 1.1182 (11/06/2015 low). A break of key support at 1.0868 (28/05/2015 low) will provide downside momentum to the pair. In the longer term, the symmetrical triangle from 2010-2014 favors further weakness towards parity. As a result, we view the recent sideways moves as a pause in an underlying declining trend. Key supports can be found at 1.0504 (21/03/2003 low) and 1.0000 (psychological support). Break to the upside would suggest a test of resistance at 1.1534 (03/02/2015 reaction high).

GBP/USD GBP/USD has broken the hourly resistance at 1.5554 (10/06/2015 high) and is now back below this level. Hourly support is given at 1.5369 (10/06/2015 low). Key resistance lies at 1.5815 (14/05/2015 high). The short-term technical structure suggests an upside momentum. In the longer term, the technical structure looks like a recovery bottom whose maximum upside potential is given by the strong resistance at 1.6189 (Fibo 61% entrancement).

USD/JPY USD/JPY is still trading slightly below its 13- year highest level below 124.00. We remain bullish for the pair as we stay largely above the 200-dma. However, the pair is gaining bearish momentum on the short term. Hourly support is given at 122.46 (10/06/2015 low). Key resistance lies at 135.15 (14-year high). A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 118.18 (16/02/2015 low).

USD/CHF USD/CHF is decreasing. Hourly support is given at 0.9234 (10/06/2015 low). Hourly resistance can be found at 0.9408 (11/06/2015 high). Stronger resistance can be found at 0.9573 (29/05/2015 high) and stronger support lies at 0.9072 (07/05/2015 low). In the short-term, the pair is setting lower highs, and therefore, we remain bearish over the next few weeks. In the long-term, there is no sign to suggest the end of the current downtrend after failure to break above 0.9448 and reinstate bullish trend. As a result, the current weakness is seen as a counter-trend move. Key support can be found 0.8986 (30/01/2015 low).