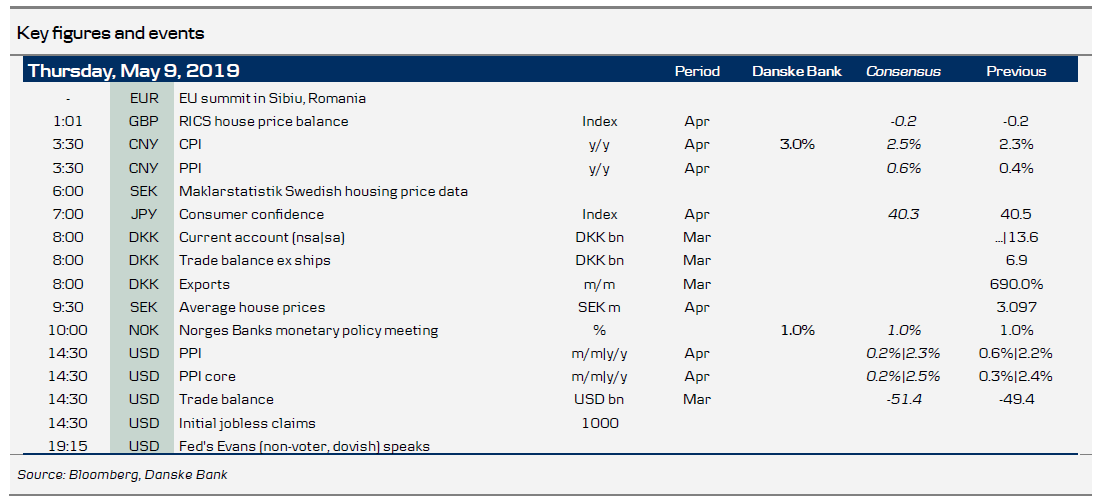

Market movers today

We expect Norges Bank to stay on hold at today's meeting (in line with consensus), as it is one of the interim meetings without a monetary policy report or press conference, just a press release, see page 2 for more details.

In Sweden , Statistics Sweden is publishing average house prices for March at 09:30 CET. Note that Maklarstatistik published housing price data for April earlier this morning.

US-China trade talks continue today, as China's top trade negotiators are in Washington today and tomorrow. While we previously thought there was a high likelihood of concluding the negotiations this week, uncertainty has risen. The two sides are blaming each other for the current deadlock and it is a real risk Trump is going to raise tariff rates tomorrow, as officially notified by the Trump administration. For more see our preview .

In the US , we have a few Fed speeches today including Powell's opening remarks at Fed Community Development Conference. We do not think the Fed is going to change policy signals, as it is firmly on hold for now.

Selected market news

The uncertainty regarding a trade deal between the US and China continues to dominate the global financial markets. Trump declared during the night that China's leaders broke the deal that they are negotiating and stated that there was nothing wrong in taking in USD 100bn in duties.

The Asian equity markets are down this morning, Italy continues to be under pressure with widening spreads to core-EU etc. However, we did see a lower demand at the 10Y US Treasury auction yesterday, as the decline in US Treasury yields has dampened demand at the auction yesterday.

In UK, the talks between the Conservatives and Labour continue and both parties say that progress is being done. However, the markets are not convinced as GBP remains weak. See more below in the FX section.

Scandi markets

In Norway, we expect Norges Bank to stay on hold today. This is an ‘interim’ meeting without a monetary policy report or press conference, just a press release. There is no doubt the underlying trend in core inflation is up. With the output gap increasing, this upward trend will push inflation higher unless the NOK strengthens considerably. This suggests that Norges Bank will have to continue normalising monetary policy and is likely to reiterate the message from March, signalling a rate hike in June.

Fixed income markets

Global fixed income markets continue to trade on US-China trade news and after the recent Trump comments/tweets we expect another day with support for Bunds and a further widening of the Bund-spread.

Today, we have Ireland in the market with a 30Y syndicated deal. We expect Ireland will sell up to EUR3bn at the transaction today. The Irish macroeconomic outlook is still among the strongest in Euroland despite Brexit uncertainty. Given the strong demand seen at the ultra-long syndicated deals so far in 2019, such as Belgium, Italy, France and Spain (15Y), we expect strong demand at the auction. Ireland has already fulfilled some 35% of its funding for 2019. If it sells EUR3bn at the auction, this percentage would rise to more than 50%. For more including expected pricing see this research note.

Spain will also be in the market with regular taps in 5y, 10y and 30y benchmark bonds. Spain will sell between EUR 3 bn and EUR 4bn in nominals and another EUR 0.5bn in the 15y linker. Spain has done remarkably well during the recent risk-off jitters including the repricing of Italy. It underlines the sound fundamentals of Spain and we expect good demand today. Spain remains our favourite pick in periphery and we remain long 5Y Spain vs France.

We have published a new edition of Reading the Markets Denmark. This time we take a closer look at the large increase in prepayments in the callable mortgage bond market that will result in larger supply than expected. We expect a daily issuance of DKK1bn in callables until July 1. However, we expect continued healthy demand for primarily the 1.5'50 (/1.5'50io) series, which offer attractive carry and limited negative convexity. Also, the weighting of, not least, 1.5'50 in a number of indices is set to increase going forward. All in all, we continue to have a positive view on 1.5'50. High-coupon callables still look far too expensive, see Reading the Markets Denmark, 8 May 2019.

FX markets

Markets continue to move in a broad based risk-off, and FX-vol, VIX, industrial metals, USD/JPY, EUR/NOK, NZD and AUD are running with a unity correlation driven by the trade uncertainty. There are some indications that a trade deal between the US and China could indeed be struck this week or next week, but further downside risk remains our core scenario.

If we are right in our call on Norges Bank (see above) it should be perceived as moderately hawkish given current market pricing. That said, the potential for a re-pricing in today’s session remains limited due to the lack of a press conference and the fact that a June hike (our call) ultimately depends on the coming month’s data releases and the US-China trade negotiations. As a result, the global environment remains in the NOK driver’s seat also today.

GBP has been weakening as markets once again have shifted to doubt if Labour and the Tories really can converge on a compromise. We see that outcome as currently being of low probability and expect range trading to continue until politics get settled in a more tangible way.