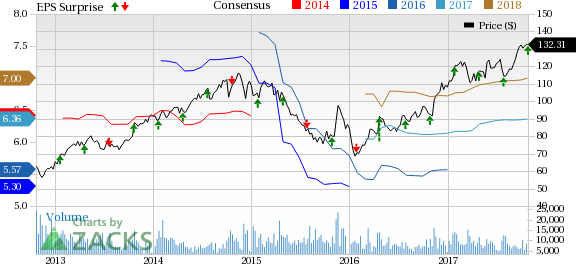

Leading U.S. railroad operator Norfolk Southern Corp. (NYSE:NSC) reported third-quarter 2017 earnings of $1.75 per share, surpassing the Zacks Consensus Estimate of $1.64. The bottom line also expanded 12.9% on a year-over-year basis. Results were aided by higher revenues.

Railway operating revenues in third-quarter 2017 came in at $2,670 million, above the Zacks Consensus Estimate of $2,630.3 million. The bottom line also improved 5.8% on a year-over-year basis. Overall volumes grew 4% on the back of impressive performances at key segments like coal and intermodal.

Income from railway operations climbed 11% year over year to $911 million. Operating expenses increased 3% year over year to $1,759 million. Markedly, Norfolk Southern revealed that operating ratio (operating expenses as a percentage of revenues) in the reported quarter improved to 65.9% from 67.5% in the third quarter of 2016. Operating ratio came in at 67.4% on a year-to-date basis.

Segmental Revenues

On a year-over-year basis, coal revenues surged 13.1% to $449 million.

Merchandise revenues increased 3.1% year over year to $1,600 million.

Intermodal revenues rose 8% year over year to $621 million.

Liquidity

This Zacks Rank #3 (Hold) exited the third quarter with cash and cash equivalents of $724 million compared with $956 million at the end of 2016. The company had long-term debt of $9,280 million compared with $9,562 million at the end of 2016. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

Investors interested in the broader Transportation sector are keenly awaiting third-quarter earnings reports from key players like American Airlines Group, Inc. (NASDAQ:AAL) , Southwest Airlines Co. (NYSE:LUV) and Union Pacific Corp. (NYSE:UNP) . All are scheduled to report their respective earnings numbers on Oct 26.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Southwest Airlines Company (LUV): Free Stock Analysis Report

American Airlines Group, Inc. (AAL): Free Stock Analysis Report

Union Pacific Corporation (UNP): Free Stock Analysis Report

Norfolk Souther Corporation (NSC): Free Stock Analysis Report

Original post

Zacks Investment Research