A slew of retailers are slated to report earnings this week, with department store Nordstrom, Inc. (NYSE:JWN) on deck to report after the close tomorrow. Ahead of the event, Barron's called JWN stock a "bargain," but it looks like recent options buyers are expecting more downside for the beat-up shares.

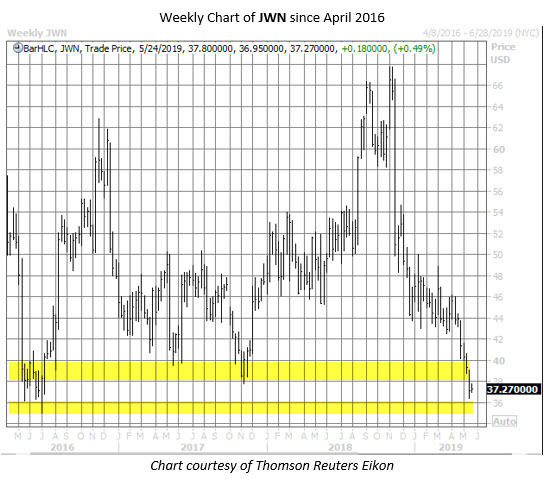

Nordstrom stock was last seen 0.5% higher at $37.27. The security touched a nearly three-year low of $36.37 last Friday, May 17, and has already lost more than 9% so far in May -- pacing for its worst month since December's 11.8% slide, and a steeper loss than the equity typically averages in May. Further, JWN shares barreled right through the $38-$40 region, which contained pullbacks in 2017. The $36 region could emerge as a potential foothold, though, as this is home to JWN's 2016 lows. Meanwhile, the $34 area is roughly half of Nordstrom stock's November 2018 high.

It's no surprise, then, to find that JWN's 14-day Relative Strength Index (RSI) stood at an oversold 27 coming into today. Nevertheless, options buyers have been betting on more downside for the shares. On the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), traders have bought to open more than four Nordstrom puts for every call in the past two weeks. The 10-day put/call volume ratio of 4.04 is in the 90th percentile of its annual range, pointing to a much healthier-than-usual appetite for bearish options bets ahead of earnings.

Echoing that, JWN has already seen roughly 14,000 puts change hands today -- six times its average intraday volume, and about four times the number of calls traded so far. It looks like some traders are buying to open the June 40 put, expecting the retail stock to extend its journey south of $40 through the next few weeks.

On the flip side, it looks like one investor may have sold to open a block of July 30 puts -- the most active option so far today. By doing so, the speculator expects JWN shares to remain north of $30 through the close on Friday, July 19, when the options expire. In this best-case scenario, the options will expire worthless, allowing the seller to retain the entire net credit received at the initiation.

Outside of the options pits, short sellers have been upping the bearish ante. Short interest grew nearly 7% in the past two reporting periods and now accounts for nearly 21% of Nordstrom's total available float. At the stock's average pace of trading, it would take nearly eight sessions to repurchase these pessimistic positions.

In the same bearish vein, only two of 15 analysts consider JWN stock a "buy" or better. However, the average 12-month price target of $46.94 represents a premium of more than 25% to the security's current perch. Should the retailer disappoint in the earnings spotlight tomorrow night, a round of price-target cuts could exacerbate selling pressure on the shares.