Nordstrom, Inc. (NYSE:JWN) will release its second-quarter earnings report after the closing bell later today. Wall Street has shown mixed reactions to retail earnings so far, with Walmart (NYSE:WMT) rallying after the company's results this morning, and J C Penney (NYSE:JCP) plunging. Ahead of Nordstrom's turn, JWN options traders are coming out in droves, with an emphasis on puts.

In today's trading, over 2,350 puts have changed hands already, four times the average intraday volume and pacing for the 97th percentile of its annual range. Pre-earnings options traders are initiating new positions at the August 45 put, though it looks like they might be selling the contracts -- likely betting on a volatility crush after tonight's scheduled event. Implied volatility at this strike has surged nearly 43% from last night's close.

More broadly, options traders have been buying to open puts over calls at an accelerated clip in the past 10 days, albeit amid low absolute volume. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), JWN sports a 10-day put/call volume ratio of 1.39, which ranks in the 77th percentile of its annual range.

Last quarter, Nordstrom shares fell nearly 11% the day after earnings, but have settled higher the next day in six of the past eight quarters. Nordstrom stock has averaged a post-earnings move of 5.8% over this two-year time frame, regardless of direction. Going by implied earnings deviation data, the options market is pricing in an 9.3% swing for tomorrow's trading.

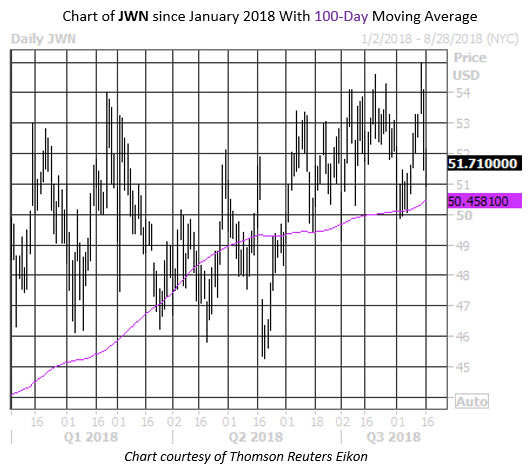

At last check, JWN stock is down 0.3% to trade at $51.71. Nordstrom stock nabbed an annual high of $54.97 on Tuesday, adding to its 9% tally for 2018. Since June, the shares have relied on support from their 100-day moving average, a level that coincides with the round $50 mark.