Nordson Corporation (NASDAQ:NDSN) reported flat bottom-line results for first-quarter fiscal 2018 (ended Jan 31, 2018).

Adjusted earnings in the quarter came in at $1.35 per share, in line with the Zacks Consensus Estimate. On a year-over-year basis, the company’s earnings surged 57% from the year-ago tally of 86 cents.

Revenues Increase From Volume Growth & Forex and Buyout Gains

In the reported quarter, Nordson’s net sales came in at $550.4 million, increasing 35.1% year over year. This improvement was driven by 30.4% gain from organic volume growth, benefits from acquired assets and 4.7% positive impact of currency translation.

Also, the top line surpassed the Zacks Consensus Estimate of $538.1 million by 2.3%.

At the quarter end, backlog was $405 million, up 24% year over year.

On a regional basis, revenues, sourced from the United States, increased 32.1% year over year to $165.8 million. Revenues generated from operations in Japan surged 172.4% to $65.9 million, while that from the American operations grew 14.1% to $34.3 million. Sales in Europe improved 19.1% to $141.9 million and that in the Asia Pacific expanded 31.3% to $142.5 million.

The company reports its top-line results under three segments, namely Adhesive Dispensing Systems, Advanced Technology Systems and Industrial Coating Systems. A brief discussion on the segmental performance in the fiscal firstquarter is provided below:

Adhesive Dispensing Systems segment’s revenues totaled $220.9 million, increasing 6.3% year over year. Results were driven by 0.6% organic growth and 5.7% forex gains.

Advanced Technology Systems revenues were $271.7 million, up 86.9% year over year on the back of 83.3% organic volume growth and 3.6% gains from favorable foreign currency movements. Product demand was strong in the medical and electronics end markets.

Revenues generated from Industrial coating systems grew 6.6% to $57.9 million.

Margin Improves Despite Higher Costs & Expenses

In the quarter, Nordson’s cost of sales increased 36.8% year over year to $249.4 million. It represented 45.3% of net sales versus 44.7% reported in the year-ago quarter. Selling and administrative expenses, as a percentage of net sales, were 33.3% compared with 36.6% in the year-ago quarter.

Adjusted earnings before interest, tax, depreciation and amortization (EBITDA) in the quarter were $141.9 million, increasing 50.3% year over year. Operating profits grew 55.1% year over year, while the margin came in at 21.4% versus 18.6% in the year-ago quarter.

Balance Sheet & Cash Flow

Exiting the fiscal first quarter, Nordson had cash and marketable securities of $132.8 million, up from $90.4 million recorded the previous-quarter end. The company’s long-term debt was $1,258.8 million, marginally above $1,256.4 million exiting the previous quarter.

In the fiscal first quarter, the company’s net cash flow from operating activities totaled $109.3 million, up 34.7% year over year. Capital spent on the addition of property, plant and equipment grew 65.5% to $16.7 million. During the quarter, the company paid dividends of approximately $17.3 million to its shareholders.

Outlook

For second-quarter fiscal 2018, Nordson anticipates sales to increase in the range of 9-13% year over year. Organic volume growth is predicted to range from 3% fall to 1% growth. Acquisition gains will likely add 7% sales growth, while foreign currency movements will benefit by 5%. Operating margin will likely be 22%. EBITDA is expected to be within $143-$154 million. The tax rate is estimated to be 25%.

GAAP earnings are expected in the range of $1.33-$1.47 per share, including 8 cents of expenses related to acquisition intangible asset amortization.

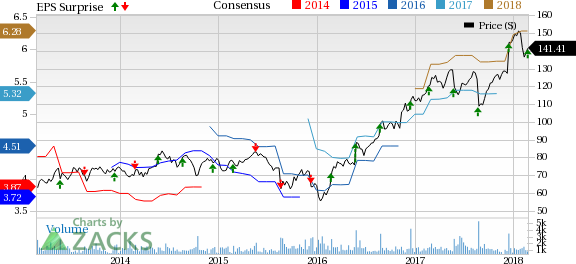

Nordson Corporation Price, Consensus and EPS Surprise

Roper Technologies, Inc. (ROP): Free Stock Analysis Report

Dover Corporation (DOV): Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT): Free Stock Analysis Report

Nordson Corporation (NDSN): Free Stock Analysis Report

Original post

Zacks Investment Research