At a glance - Resilient, up to a point

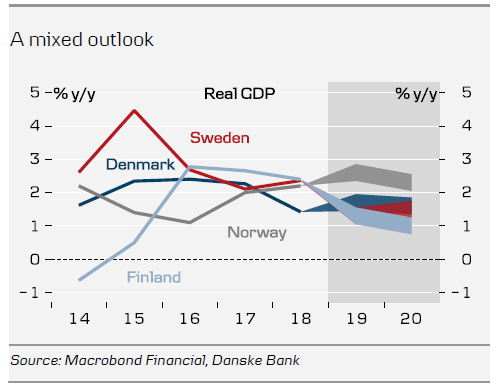

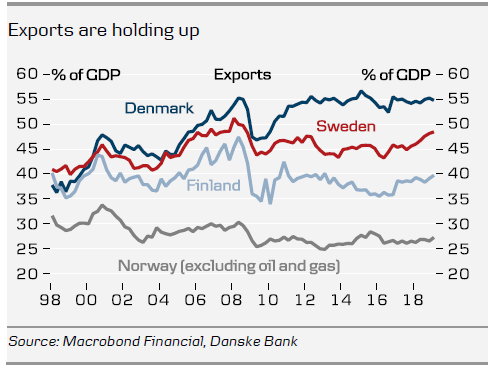

The global and especially the European economies have weakened since the middle of 2018, with serious headwinds for German manufacturing and lots of political uncertainty over a trade war, Brexit and the ongoing budget crisis in Italy. So far, the Nordic economies have been remarkably resilient, with continued decent GDP growth and quite strong export performances. The reasons are many: pharma and windmills in Denmark, exports of services in Sweden, demand from global oil investments in Norway and a major ship delivery from Finland, among others. However, this illustrates that the Nordic countries have entered the current period of slower global growth from a starting point of strong competitiveness.

Nevertheless, the Nordic countries are small open economies and very dependent on global developments. We expect lower global growth to become visible in Nordic data as well, but of course mitigated or aggravated by domestic developments. In Sweden, good GDP data currently cover over weak underlying domestic demand growth, not least from the housing market. However, oil investments strongly support the growth outlook in Norway, even if there is less growth in the global economy. Norway is one of the few countries in the world where interest rates are heading up, as growth and inflation actually warrant monetary tightening. We do not see the case for this in Sweden.

Political risks on top of economic ones

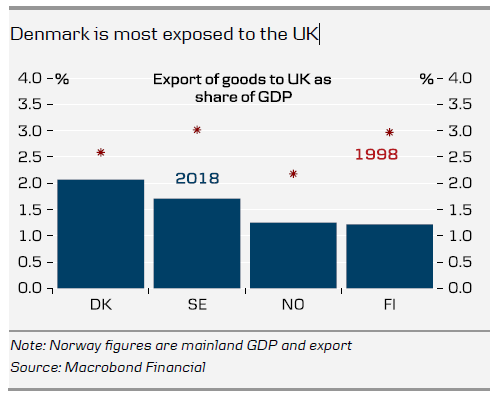

Trade war tensions are mostly between China and the US, with limited direct effect on the Nordics, although sectors such as Danish shipping are clearly affected and lower global growth matters for all. If the US starts to target Europe, Nordic producers would also be affected, for instance as suppliers to the European car industry. A disorderly Brexit would create problems closer to home and affect many Nordic companies directly. If it triggers a short-term recession or at least a slowdown in the UK, this would be felt in the rest of Europe. In terms of direct effects, Nordic exporters would be likely to face tariffs on some of their UK exports and all Nordic countries have a surplus against the UK in goods (but a deficit in services). Norway has the most exports but 80% of this is oil and gas, which face only 2.5% tariffs under rules and on which the UK government intends to impose no tariffs in the event of a no-deal Brexit. Denmark's substantial food exports would have to deal with more significant tariffs and would also face increased competition from non-EU producers. However, the total value of agricultural exports to the UK is only 0.5% of Danish GDP. The UK is not as important as it once was to the Nordics and we do not expect a major economic impact beyond the immediate effect.

Denmark

While we wait for the slowdown

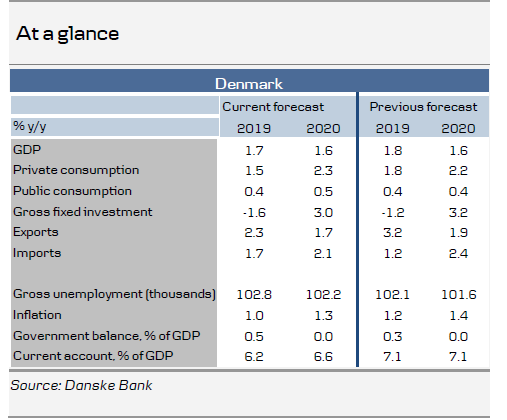

- The slowdown in Europe has still not spread to Denmark or Danish exports but, in our view, it is likely that it will.

- Denmark’s economy is well prepared if the slowdown becomes serious, as it has remained well balanced throughout this upswing.

- House prices are rising, supported by even lower interest rates and this in turn is fuelling private consumption but private consumption is not yet outpacing income growth.

- Inflation is lower than in other parts of Europe, though a hike in cigarette prices could send inflation noticeably higher.

- Interest rates seem set to hover around current levels for quite some time yet.

Global signs of weakness have not yet hit Denmark

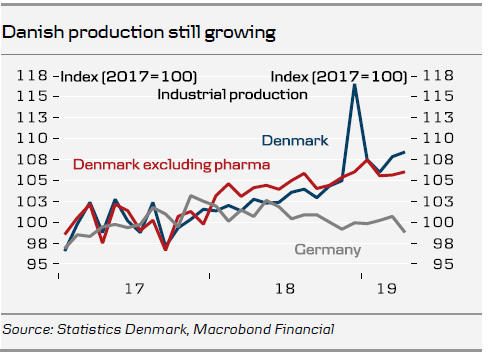

We have been seeing clear signs of a slowdown in key global growth indicators since mid-2018, especially in the industrial sector – not least in Germany, Denmark’s most important trading partner. However, the trend remains difficult to discern in Denmark, where production, exports and employment remain buoyant and GDP growth has not slowed. This is in no small part due to the pharmaceutical industry, where production continues to increase and there is a tendency to be less sensitive to the global economic cycle. The windmill industry too is expanding, while the car industry, for example, which has been a serious drag in Germany, plays a minor role in Denmark.

Divergence in growth between Denmark and Germany, or indeed Sweden – Denmark’s second most important trading partner – is not unusual. However, there is normally a fairly close correlation between the business cycle in Europe as a whole and Denmark and, given the slightly weaker global growth picture, some slowing in Denmark is likely in coming months. There is also a clear risk of a more serious slowdown or even a new crisis in the global economy in coming years. This would also affect Denmark, although Denmark’s economy is well prepared to deal with any crisis, as no great imbalances have accumulated during this upswing. For example, there has been no surge in house prices or credit growth and competitiveness has not deteriorated.

Outlook is for unchanged interest rates

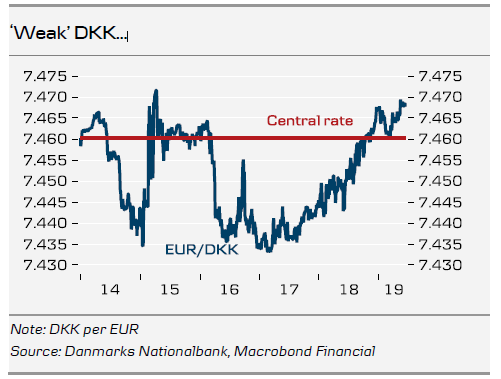

We are not expecting any change in interest rates from the European Central Bank (ECB) or Danmarks Nationalbank in the coming year. While it is true that the DKK is trading slightly weak to the EUR, this has been insufficient to trigger intervention by Danmarks Nationalbank since December and January; even then, it was very limited. A potential unilateral Danish rate hike would require much more pressure on the DKK and where that pressure might come from is difficult to see, given Denmark’s large current account surplus and generally stable economy.

To read the entire report Please click on the pdf File Below..