Positive Q313 results

Nordgold's, (NORD.L) Q313 financial results showed further signs of improvement, 12 November 2013 with overall total cash costs (TCC) falling 6% q-o-q to US$791/oz. This, coupled with an earlier reported increase in production, has helped to offset the lower gold price, supporting quarterly EBITDA at US$108.2m. The company targets further cost reduction to mitigate the impact of the weaker gold price.

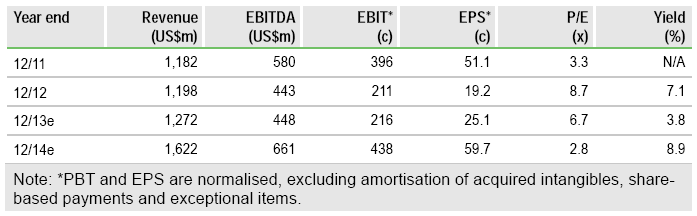

Nordgold’s Q313 EBITDA came in at US$108.2m, a 2% q-on-q increase, supported by lower costs and higher gold output (as previously reported at 245koz). The most notable achievement was the reduction in reported total cash costs (TCC) across all mines except Taparko, leading to a 6% q-o-q drop in total TCC to US$791/oz (a 5% reduction year-on-year). At the mine level, as was expected, Lefa returned to profitability, delivering US$3m in EBITDA at US$1,223/oz TCC. In addition, the company has managed to further reduce its SG&A expense by 31% y-o-y and 20% q-o-q to US$14m. Cash flow generation has also improved, with an estimated quarterly OCF of US$102m (the record level in 2012/13) and FCF (operating cash flow less capex) of US$45m. The company reiterated its FY13 production guidance at the top end of the original range (850koz).

In all, we are positive about Nordgold’s continuing focus on cost reduction, which, coupled with a double-digit increase in production, has so far helped the company to offset a 24% year to date reduction in the gold price. However, this is yet to be properly reflected in the company’s valuation, which continues to be negatively affected by the uncertain gold price outlook.

We plan to update our financial forecasts and valuation for Nordgold shortly.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Nordgol: Positive Q313 Results

Published 11/13/2013, 03:09 AM

Updated 07/09/2023, 06:31 AM

Nordgol: Positive Q313 Results

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.