In December 2015, automakers were still riding high. Auto sales that year were to be another record, both in terms of units as well as dollars. Americans had spent about $437 billion on new vehicles in those twelve months, up from $407 billion the year before. Though there were notable disturbances throughout especially the second half of 2015, that December more economists and therefore carmaker projections were focused on the Federal Reserve.

John Humphrey, Senior VP of the Global Automotive Practice at JD Power, assured his industry audience that the first rate hike in a decade “should have a minimal impact on new-vehicle sales.” Consumer surveys about monetary policy were encouraging for 2016.

There is the risk of a knee-jerk reaction from consumers to big economic news, leading them to delay buying, but the survey suggests it’s a very small proportion of shoppers who are concerned about rates, particularly at this low level. In other words, we’re not expecting much of a negative impact.

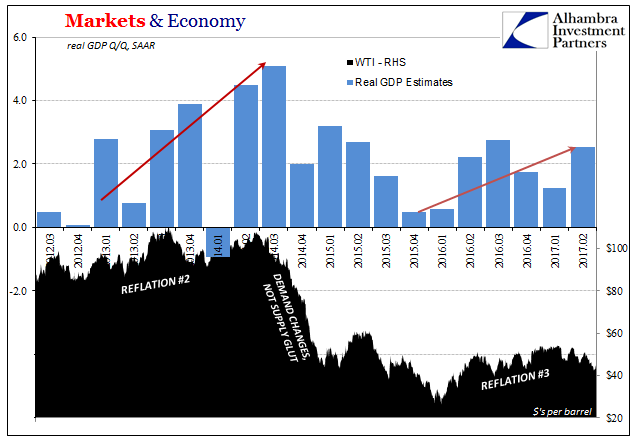

The big economic news in reality had little to do with the Federal Reserve apart from why the central bank hesitated so much in 2015 and again in 2016; and why it doesn’t think it will ever get to normalize monetary policy at all. There was already at that time a sizable downturn, a near-recession even, that economists just missed because the Fed was ready to “raise rates.” Downturn and less “accommodation” just don’t go together in the Economics textbook.

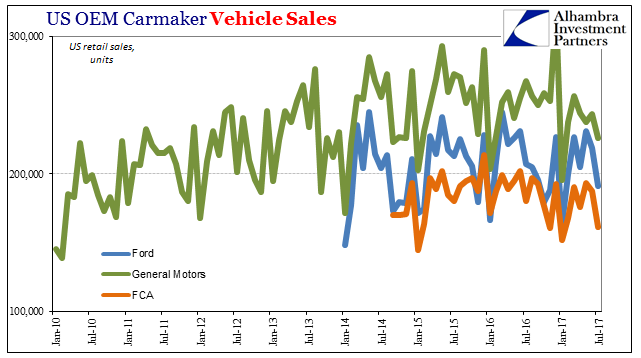

It wasn’t actually a cyclical downturn which for the auto industry has left it in paralysis. A year ago, Ford Motor (NYSE:F) declared, hopefully, that auto sales had plateaued. That was a benign way of describes changing fortunes. The auto sector had been practically the only industry to actually recover from the Great “Recession”, prosper even. Plateau was the nice face to sudden economic uncertainty.

Auto sales have done worse than the plateau overall, and not nearly as bad as full-blown contraction. It seems as if economic cues have all been mixed up; the Fed raises rates but the economy acts more like deceleration than the acceleration that plus the unemployment rate would suggest.

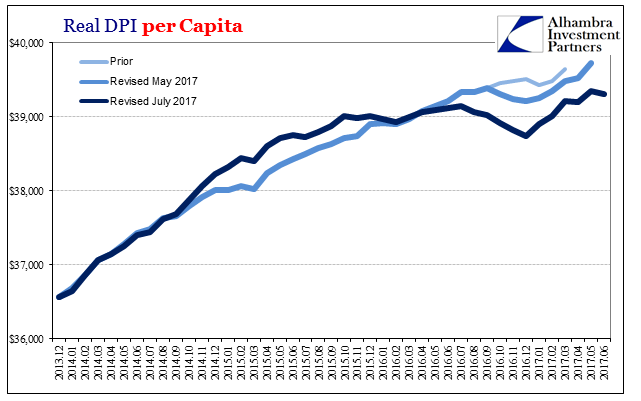

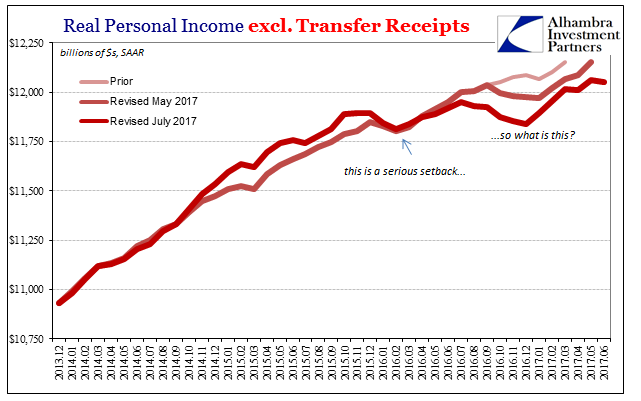

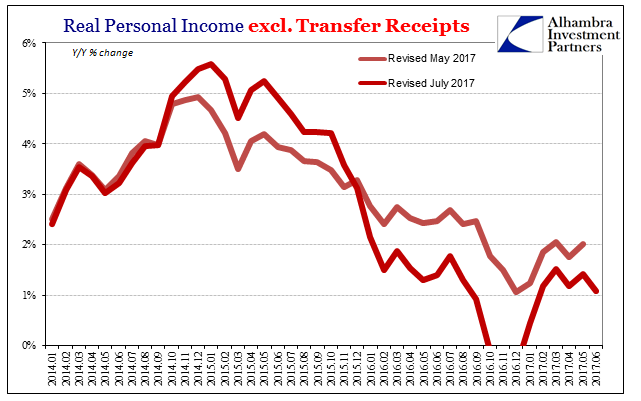

For American consumers, income data is instructive, especially now with the latest benchmark updates. The 2015-16 downturn seriously impacted the labor market, slowing the pace of hiring and labor utilization, affecting income growth. Over the last nearly two years, there (as of these revisions, anyway) has been almost none.

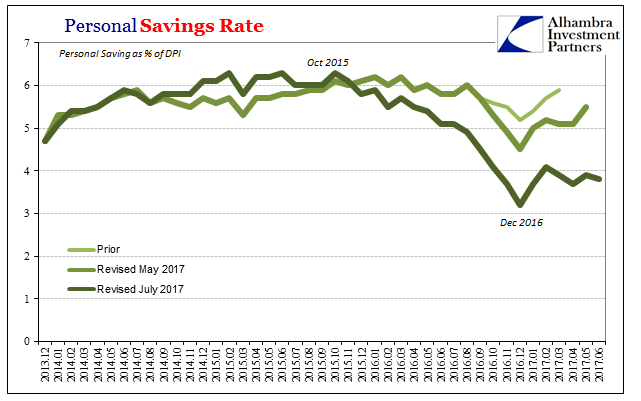

That has left consumers in a precarious position, as shown by the (as of these revisions, anyway) Personal Savings Rate. A lower income trajectory plus the rebound in oil/gasoline meant much less of a discretionary spending margin. Autos and other big ticket items are among the first goods to be reconsidered.

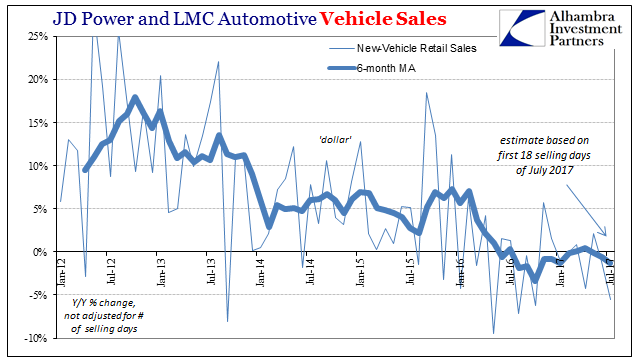

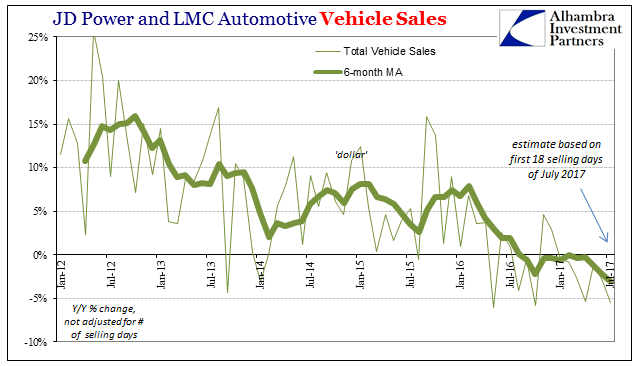

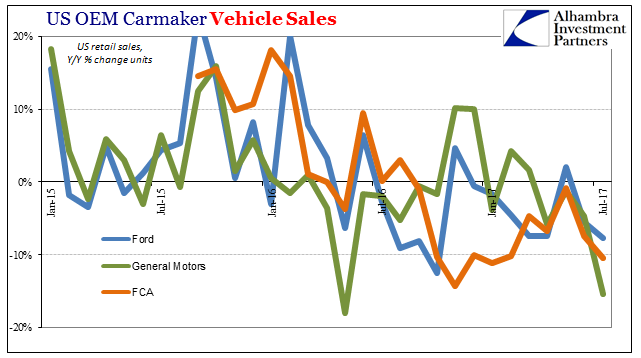

July 2017 auto sales were downright awful across-the-board: GM sales -15.5%; Ford -7.4%; FCA -11%; Hyundai -27.9%; Kia -5.9%; Mercedes-Benz -9.8%; Nissan -3.2%; Honda -1.2%. The only major manufacturer producing sales gains was Toyota (+3.6%).

The press releases were flooded with mentions of “tough comparisons” to July 2016 and last year sales in general, but this slowdown is much more than mere base effects. Car sales have been decimated in the past few years, leaving producers reliant on light truck sales to maintain minimal momentum. In July, however, even truck sales were off: pickups -1.1%; midsize SUV’s -4.5; large SUV’s -14.9%; luxury SUV’s -6.4%. Sales of crossovers, the largest segment of light-duty trucks and one of the main engines for any growth, only managed +1.8% year-over-year last month.

These results occurred despite record vehicle incentives and extremely loose financing terms and fluid options. From JD Power on July 27:

Manufacturers typically reduce incentive spending following the July 4 holiday, but this year elevated inventory levels, coupled with the sales slowdown, have compelled them to maintain aggressive discounts throughout July.

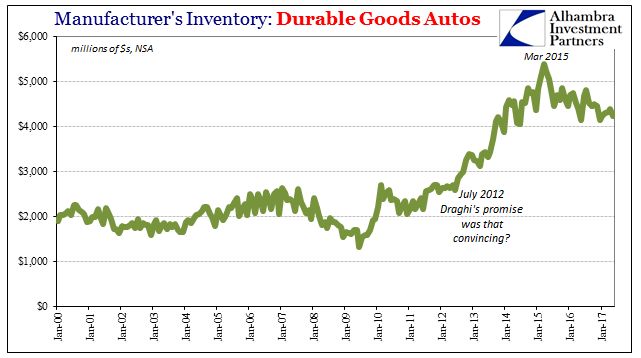

According to Census Bureau estimates, manufacturers in the United States still hold massive inventory in addition to large volumes of unsold (and heavily discounted) product on dealer lots. They appeared increasingly happy to do so starting in July 2012 (Draghi’s promise was that convincing?) but only so long as the economic climate appeared to be heading in the right direction. Manufacturer inventory of autos peaked, unsurprisingly, in March 2015 when oil prices had crashed and the issuance of the Fed’s first “lower for longer” statement pushing off rate hikes further into the future.

It’s a long way down to normalizing inventory, meaning it’s an even more painful journey in terms of production. Because this is all taking place outside of traditional views on cyclicality, the auto sector has now joined the wider macro economy in paralysis. Despite all the imbalances throughout the supply chain and the lingering negative factors associated with them, automakers have so far refuse to take bigger steps to rectify their positions. The only reason that seems to be the case is, as noted yesterday, economists remain sure that the big economic bump is just over the horizon.

The difference in 2017 for the auto sector is that manufacturers are leaning against the mainstream view, especially about what rate hikes really mean and why they are taking place. For the macro economy, it’s just one more economic drag keeping the altitude of “reflation” even lower than the last time.