With 314 first-quarter earnings releases already published, we have sufficient data to begin to draw some intelligent conclusions about the U.S. earnings season, which, by any measure, is the most important driver of global equity markets. Today, we will analyse net income figures and will follow up tomorrow with an analysis of revenue and then cash flow on Thursday.

Non-financial profits declines year-over-year, defensive sectors are the bright spot

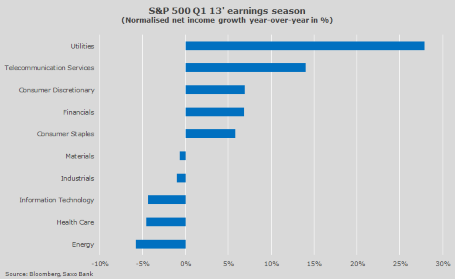

The U.S. earnings season has so far been similar to its predecessors with a high earnings surprise ratio of approximately 75 percent. If we look at aggregate normalised net income, S&P 500 companies are showing a 0.8 percent growth year-on-year in the aggregate figures. Exclude financials, and the growth rate drops becomes a 0.6 percent contraction, highlighting the impact from better-than-expected earning releases from financials. The figures can still change, but the profit decline in non-financial companies is not looking good.

The chart below shows the aggregate change in normalised net income for the ten sectors. Many financial commentators have said that the fact that this year's rally has been driven by defensive sectors is a sign of weakness. However, as the chart shows, it is the defensive sectors that have improved their profits relatively the most. The two best sectors have been utilities and telecommunication services, with the former up almost 28 percent year-over-year.

The law of small numbers play into top 10 on profit growth

Among individual companies, small companies with low net income figures are dominating the top 10 table on profit growth. This is not a surprise given the law of small numbers, meaning that smaller companies can more easily double net income than Google or Apple.

The most interesting observation is the huge improvement in net income among home builders such as Lennar Corporation (LEN:NYSE) and D.R. Horton (DHI:NYSE) highlighting the improvements in the U.S. housing market. Another interesting company is Cabot Oil & Gas (COG:NYSE), which is an independent oil and gas company that focuses primarily on the Marcellus shale gas fields. Cabot's impressive growth in net income was driven partly by a 37 percent growth in revenue, but also increased production efficiency and economies of scale effects from its increasing production.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Non-Financial Profits Down, Defensives Up

Published 04/30/2013, 06:22 AM

Updated 03/19/2019, 04:00 AM

Non-Financial Profits Down, Defensives Up

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.