Although it is a Tuesday the market is hunkering down to trade today as if it was the first Friday of the month. That’s because today sees the release of the jobs report delayed by the shutdown and subsequent furlough of US government workers earlier this month. As with all good economic releases there is a broad split between those who think that this will be an important, worthwhile number and those who, well, don’t. We are in the latter camp. The jobs report is always an interesting read in normal times but the enforced suspension and subsequent reset of US economic performance renders this one of lesser use than normal.

I was not particularly strong on US prospects in the run-up to the original publication date and therefore expect today’s figure to be within the recent trend of 160k-175k and we think the 180k consensus view looks heady. Most will be watching the participation rate closely following the 35yr low print it made in August. The unemployment rate is coming lower in the US but simply because people aren’t participating – a jobless recovery in unemployment if you will. Many will simply view the release as a disappointment given it normally means we’re a couple of hours from a weekend. The number is due at 13.30 BST.

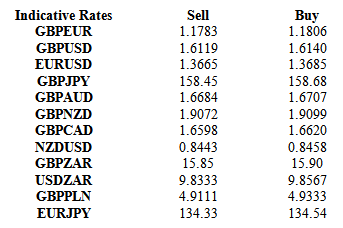

USD has remained offered in the run-up to the number with EURUSD and GBPUSD staying within striking distance of recent highs. The only currency that it has made significant gains against in the past 24hrs has been the yen. Japanese data overnight has cast a shadow over the belief that the Abenomics plan of the current government may not be performing as well as some had expected.

Export growth increased by 11.5% but disappointed heavily against analysts’ expectations of a 15.6% rise. The key to understanding this is that, for all the positivity in the looseness in Japanese monetary policy, the slowing in the rest of the pan-Asian economy is having a more detrimental effect. 2 year targets on 2% CPI look even more pie-in-the-sky.

We also get news from the UK today in the form of public finance data. The hope is that the government’s finances have improved as the run-up in near-term UK data has continued. Doubts are creeping in as to the sustainability of the UK growth picture at the moment. Friday’s GDP data may just be the high-water mark — that place where the wave finally broke and rolled back. The number is due at 09.30.

AUD has been the best performer overnight after BHP Billiton, one of the world’s largest mining operators, raised its production forecast on iron ore. Any scepticism around RBA cuts in a fortnight’s time will keep AUD bid but we must emphasise that the central bank was not happy with AUD strength 2 cents lower than where we are now – they’ll be livid if we see a push to 0.98 in AUDUSD terms.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Non-Farm Tuesday Should Show Little More Than Trend Job Growth

Published 10/22/2013, 06:09 AM

Updated 07/09/2023, 06:31 AM

Non-Farm Tuesday Should Show Little More Than Trend Job Growth

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.