Forex News and Events

Skandies extend losses as the NOK continues suffering from weakening oil prices and the SEK sees its inflation decelerating to -0.4% y/y. The soft fundamentals in the Euro-zone keep the pressures heavy on Riksbank, traders already bet for a dovish rate action in the coming months. In China, the better credit growth in September pushes Yuan higher vs. USD. The improvement in foreign direct investments and shipments to US gave some hope, while global growth concerns keep the risk appetite limited across the board.

Zoom into Skandies

USD/NOK rallied to 6.6505 for the first time since mid-2010. The first-line resistance stands at 6.7281 (June 2010 high) and the ultra-bullish technicals suggest the test of this resistance. Norway’s trade surplus retreated from 22.4 to 21.6 billion NOK in September, fueling fears that the weak energy prices may further hit the country’s trade balance. Should the crude weaken below $80, the selling pressures on oil exporters’ currencies should push USD/NOK toward the 2008 resistance of 7.30s.

The Swedish Krona has hard time consolidating gains against USD this week. Despite significant attempts for correction, bids were strong at 7.1071/91 amid the CPI y/y decelerated at the faster-than-expected pace of -0.4% in year to September (vs. -0.1% y/y & -0.2% last). Given the gloomy macro data from the Euro-zone and ultra-lose ECB policy, the Riksbank may be obliged to react with a rate action in the foreseeable future. Markets bet for a repo rate cut from 0.25% to 0.20% in the coming three months. The 3-month forward rate contracts are priced in at record lows (0.339-0.350%), below 4.75% last seen on 2009-2010, confirming the market expectations of a lower future interest rate. EUR/SEK made a big step from bottom to top on July-Oct descending band (9.05/9.22). Given the dovish Riksbank expectations, the bias remains on the upside as 200-dma support holds (9.05).

NOK/SEK tests the 200-dma for the first time since April 2nd on aggressive NOK sell-off. The 3-month cross currency basis reveals increasing preference in favor of SEK. Next target is placed at 1.0843 (Fib 50% on Feb-Sep rise).

Yuan strengthens on supportive credit growth

The PBoC’s 500 billion Yuan booster to country’s 5 big state-owned banks combined to 14-day repo rate cut in September may explain the increase in new Yuan loans from 702.5 to 857.2 billion Yuan, alongside with some end-quarter support perhaps. The PBoC Governor Zhou Xiaochuan said the monetary policy will remain prudent to ensure reasonable growth in credit. The soft inflation dynamics in China gives flexibility for more monetary stimulus.

USD/CNY weakens in the extension of descending channel building since August. The slope of Yuan appreciation is moderate given expectations for more PBoC action. Yet the prospects for sharper growth in FDI and exports keep the Yuan demand tight today. Released today, Ministry of Commerce report showed 1.9% increase in FDI in year to September (vs. -14.0% expected & last) and meaningful increase in Chinese shipments to US last month. Option barriers are building at 6.1275+ (Aug-Sep support).

Today's Key Issues (time in GMT)

2014-10-16T10:30:00 CAD Aug Int'l Securities Transactions, exp 7.00B, last 5.30B

2014-10-16T10:30:00 USD Oct 11th Initial Jobless Claims, exp 290K, last 287K

2014-10-16T10:30:00 USD Oct 4th Continuing Claims, exp 2380K, last 2381K

2014-10-16T10:30:00 CAD Aug Manufacturing Sales MoM, exp -2.00%, last 2.50%

2014-10-16T11:15:00 USD Sep Industrial Production MoM, exp 0.40%, last -0.10%

2014-10-16T11:15:00 USD Sep Capacity Utilization, exp 79.00%, last 78.80%

2014-10-16T11:15:00 USD Sep Manufacturing (SIC) Production, exp 0.30%, last -0.40%

2014-10-16T12:00:00 USD Oct Philadelphia Fed Business Outlook, exp 19.7, last 22.5

2014-10-16T12:00:00 USD Oct NAHB Housing Market Index, exp 59, last 59

2014-10-16T18:00:00 USD Aug Net Long-term TIC Flows, last -$18.6B

2014-10-16T18:00:00 USD Aug Total Net TIC Flows, last $57.7B

The Risk Today

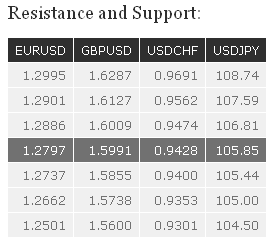

EUR/USD has broken to the upside out of its short-term symmetrical triangle. However, given the resistances at 1.2901 (see also the rising channel) and 1.2995, we do not see a significant upside potential. An hourly support can be found at 1.2737 (intraday low). Another support lies at 1.2625 (15/10/2014 low). In the longer term, EUR/USD is in a downtrend since May 2014. The break of the strong support area between 1.2755 (09/07/2013 low) and 1.2662 (13/11/2012 low) has opened the way for a decline towards the strong support at 1.2043 (24/07/2012 low). As a result, the recent strength in EUR/USD is seen as a countertrend move. A key resistance stands at 1.2995 (16/09/2014 high).

GBP/USD saw some buying interest near the key support at 1.5855. However, the current failure to hold above the hourly resistance at 1.6009 (10/10/2014 low) suggests persistent selling pressures. Another resistance can be found at 1.6127 (13/10/2014 high). In the longer term, the collapse in prices after having reached 4-year highs has created a strong resistance at 1.7192, which is unlikely to be broken in the coming months. Despite the recent short-term bearish momentum, we favour a temporary rebound near the support at 1.5855 (12/11/2013 low). A key resistance lies at 1.6525.

USDJPY USD/JPY has broken the support at 106.81. Given the key support at 105.44 (02/01/2014 high, see also the 50% retracement), a short-term consolidation phase is likely. An hourly resistance lies at 106.81 (16/09/2014 low), while a key resistance stands at 107.59. A long-term bullish bias is favoured as long as the key support 100.76 (04/02/2014 low) holds. Despite the recent decline near the major resistance at 110.66 (15/08/2008 high), a gradual move higher is eventually favoured. Another resistance can be found at 114.66 (27/12/2007 high). A key support lies at 105.44 (02/01/2014 high).

USD/CHF weakened sharply yesterday, breaking the supports at 0.9469 and 0.9433. However, the sharp decline to 0.9368 is likely overdone in the short-term, especially as no significant bearish reversal can be seen. Hourly resistances can be found at 0.9474 (intraday high) and 0.9562. From a longer term perspective, the technical structure favours a full retracement of the large corrective phase that started in July 2012. As a result, the recent weakness is seen as a countertrend move. A key support can be found at 0.9301 (16/09/2014 low). A resistance now lies at 0.9691 (06/10/2014 high).