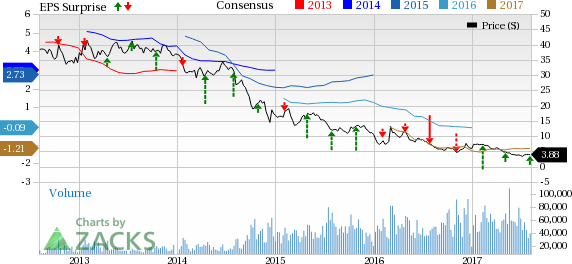

Leading contract drilling company Noble Corporation (NYSE:NE) reported second-quarter 2017 loss of 32 cents per share, narrower than the Zacks Consensus Estimate of a loss of 33 cents. The reported figure compared unfavorably with the year-ago quarter’s earnings of 1 cent per share. Lower rig utilization and lower average dayrates contributed to the decline.

Total revenue in the quarter declined to $278.1 million from $894.8 million in the last-year comparable quarter. Contract Drilling Services contributed $271.5 million to total revenue, down 69% year over year.

Second-Quarter Operating Highlights

Net loss from continuing operations was $96.2 million, which compared unfavorably with a net income of $345.4 million in the second quarter of 2016. Total rig utilization remained unchanged at 65%. The average dayrate declined to $164,475 from $509,145 in the year-ago quarter.

The average dayrate for Drillships of $309,313 was also lower than $1,134,011 a year ago. Average capacity utilization decreased to 52% from 86% in the year-ago quarter.

The average dayrate for the company's jackups was $121,284 compared with $136,041 in the prior-year quarter. Average capacity utilization increased to 93% from the year-ago level of 83%.

The average dayrate for the company's semisubmersibles was $126,106 compared with $290,106 in the prior-year quarter. Average capacity utilization increased to 17% from the year-ago level of 16%.

As of Jun 30, 51% of the company's available rig operating days were committed for 2017, including 32% of floating rig days and 69% of jackup rig days. For 2018, an estimated 37% of available rig operating days are committed, consisting of 29% and 46% floating and jackup rig days, respectively. As of Jun 30, overall total backlog was approximately $3.2 billion.

Financials

At the end of the reported quarter, the company had a cash balance of $603 million and long-term debt of $3,793.9 million, with debt-to-capitalization ratio of 38.5%.

Zacks Rank

Noble currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the same space include Global Partners LP (NYSE:GLP) , Braskem S.A. (NYSE:BAK) and TransCanada Corp. (TO:TRP) . All of these stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Global Partners delivered a positive earnings surprise of 1200.00% in the preceding quarter. The company beat estimates in three of the trailing four quarters with an average positive earnings surprise of 415.30%.

Braskem delivered a positive earnings surprise of 107.79% in the quarter ending September 2016.

TransCanada delivered a positive earnings surprise of 12.00% in the preceding quarter. It surpassed estimates in two of the trailing four quarters with an average positive earnings surprise of 4.06%.

"5 Trades Could Profit ""Big-League"" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

Global Partners LP (GLP): Free Stock Analysis Report

Braskem S.A. (BAK): Free Stock Analysis Report

Noble Corporation (NE): Free Stock Analysis Report

TransCanada Corporation (TRP): Free Stock Analysis Report

Original post

Zacks Investment Research