Independent oil and natural gas exploration and production company, Noble Energy, Inc. (NYSE:NBL) has inked a deal to divest 3% of the working interest in the Tamar field, offshore Israel, to Harel Group, a leading insurance provider and pension manager in the country, and Israel Infrastructure Fund (“IIF”), the nation’s largest infrastructure private equity fund.

Details of the Deal

The transaction is estimated to cost $369 million and is expected to close in the third quarter of 2016, subject to customary terms and conditions. Per the deal, Harel and IIF have the option to purchase an additional 1% working interest from Noble Energy at the same valuation.

Rationale Behind the Deal

Noble Energy’s management has been focused on restructuring the company’s operations to serve the changing landscape of the domestic and international oil and natural gas space.

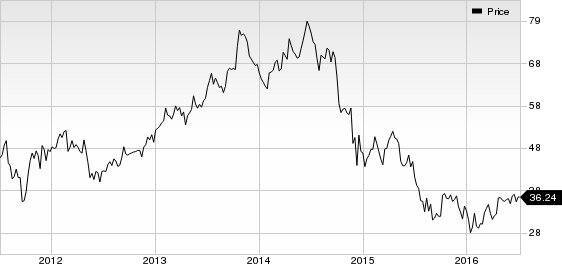

NOBLE ENERGY Price

Proceeds generated by the latest sale are expected to improve the company’s liquidity in the near term and allow it to pursue growth projects in Israel which include capital investments in the Leviathan project.

Noble Energy’s Operation in Israel

Israel is presently witnessing growing preference for natural gas over coal for electricity generation. Sales volume of natural gas in the first quarter of 2016 soared 10% year over year in the country. This trend is expected to continue throughout 2016.

Noble Energy finally received regulatory approval from the Israeli government to develop a fixed platform for the Leviathan field offshore Israel. The company believes that the Leviathan field will act a second source of gas supply for meeting the rising demand for this fossil fuel in Israel. (Read more: Noble Gets Regulatory Nod to Build Leviathan Platform)

Moreover, to cater to the growing demand for natural gas in Israel, Noble Energy, along with its partners, is planning to drill an additional development well at the Tamar field. Drilling is anticipated to commence in the fourth quarter of 2016.

Noble Energy plans to sell another 7–8% working interest over the next three years, which will leave it with a 25% stake and operatorship, thereby allowing the company to comply with Israel’s approved natural gas regulatory framework.

Long-Term Plans

Noble Energy’s focus on new discovery and asset diversification are expected to drive its performance. The company manages a diversified portfolio of domestic and international assets that offer high-return opportunities.

Meanwhile, oil prices have recently started to move up and it is expected to improve further in the second half of 2016. Companies like Noble Energy stand to benefit immensely from the ongoing recovery in oil prices as oil is an integral component of their total production mix.

Noble Energy currently carries a Zacks Rank #2 (Buy).

Other Stocks to Consider

Some other favorably placed stocks in the same space include Murphy Oil Corporation (NYSE:MUR) , World Point Terminals, LP (NYSE:WPT) , Halcón Resources Corporation (NYSE:HK) , each sporting a Zacks Rank #1 (Strong Buy).

NOBLE ENERGY (NBL): Free Stock Analysis Report

HALCON RESOURCS (HK): Free Stock Analysis Report

MURPHY OIL (MUR): Free Stock Analysis Report

WORLD POINT TER (WPT): Free Stock Analysis Report

Original post

Zacks Investment Research