Independent oil and natural gas exploration and production company, Noble Energy, Inc. (NYSE:NBL) announced an increase in its sales volume projections for the second quarter 2016. The company now expects sales volumes to be approximately 425 thousand oil equivalents per day (Mboe/d), up 3.7% from its previous guidance of 405–415 Mboe/d.

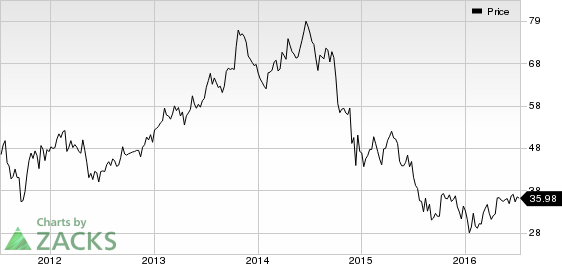

However, despite the positive news, shares of Noble Energy were down marginally due to broader market fundamentals and closed at $35.98 on Jul 8, 2016.

Reason behind the Increase

The company has raised its sales volume guidance mainly due to a consistently strong operating performance, along with significant contributions from the new wells in Eagle Ford shale, Texas.

NOBLE ENERGY Price

In addition, natural gas sales volumes in Israel could be higher than the company’s expectations as the country has recently been witnessing growing preference for natural gas over coal for electricity generation. A warmer-than-expected summer may provide tailwinds as well.

Capital Program to Boost Production

Management has set a capital expenditure budget of $1.5 billion for 2016, with two-thirds of the total being allocated as investments in onshore U.S. unconventional development. The remaining one-third is meant for offshore development and exploration activities. Apart from capitalizing on modern practices to enhance productivity and efficiency, Noble Energy is also planning to drill a higher number of wells this year. All these factors should drive significant volume growth.

Guidance Increased by Others

To accelerate upstream activities, Devon Energy Corporation (NYSE:DVN) has raised its 2016 capital expenditure guidance by $200 million to the range of $1.1 billion to $1.3 billion. Backed by the continuous outperformance of its core assets, the company also raised its 2016 total production expectation by 7 Mboe/d to the range of 540–560 Mboe/d.

Another company in the U.S. oil exploration and production space, WPX Energy, Inc. (NYSE:WPX) , recently raised its 2016 oil production expectations by 5% to the range of 39,000–41,000 barrels of oil per day, up from the earlier expectation of 37,000–39,000 barrels per day.

Bottom Line

Noble energy is currently focused on areas with higher oil content, with a special emphasis on its existing operations in Wells Ranch and East Pony in the DJ Basin.

Meanwhile, oil prices have recently started inching up – a trend that is anticipated to continue in the second half of the year. Companies like Noble Energy stand to benefit immensely from the ongoing recovery in oil prices as oil is an integral component of their total production mix.

Noble Energy currently carries a Zacks Rank #2 (Buy).

A Key Pick in the Sector

Another favorably placed stock in the same space is Stone Energy Corporation (NYSE:SGY) , sporting a Zacks Rank #1 (Strong Buy).

DEVON ENERGY (DVN): Free Stock Analysis Report

NOBLE ENERGY (NBL): Free Stock Analysis Report

STONE ENERGY CP (SGY): Free Stock Analysis Report

WPX ENERGY INC (WPX): Free Stock Analysis Report

Original post