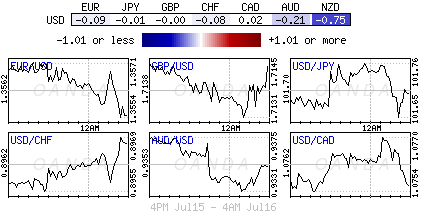

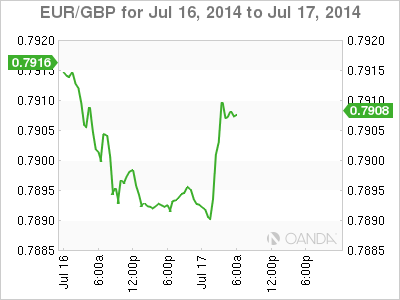

After many months of low FX volatility, one gets the distinct impression that the worst is probably behind us, and that there are a few signs emerging that would suggest that the main forex pairs are on the cusp of a major breakout. Dealers and investors require movement for opportunity and its just itching to happen. The dollar has gained broad support from a positive Fed Beige Book and hawkish members from the FOMC suggesting mid-2015 will see the first Fed hike. The 18-member single currency, the EUR, is under pressure from weaker activity data and asset market underperformance. The unit is currently within striking distance to this year low in January (€1.3473). Any momentum through key support levels for the EUR outright should be capable of dragging both the JPY and GBP higher through significant resistance levels on the cross play.

Russian Sanctions to tie down EU

Both geopolitical and event risk are expected to fan the flames and cause few distinctive market moves. Already investors have been seen dumping Russian assets this morning, rather than risk been caught off side further down the line, following the latest round of EU and US sanctions on the "Motherland" announced overnight. After confirmation that Russia continues to aid separatists in Ukraine earlier this week, US Treasury unveiled a list of targets in a new round of sanctions that included separatist leaders and some large Russian companies. Expect investors to try and get further ahead of the curve by anticipating which companies will be next and what assets will be subject to further sanctions.

What was Russia going to say? Other than the sanctions were "unacceptable and that Russia may retaliate." Despite the USD/RUB falling to a one month low some support for the currency continues to appear. Already this week we have seen the effect of trade between Russia and neighboring Europe come under official pressure. Yesterday, the euro-zone’s May trade surplus with the rest of the world had increased year-over-year (+€15.4B versus +€14.3B or exports +0.6% while imports are at +0.5%). But, Eurostat’s latest trade data also showed the currency bloc’s trade with Russia has fallen sharply in the face of the Ukraine crisis. For January to April, Russian exports are down -13%, year-over-year. The EUR is guilty by associate and only needs a small push before taking on some significantly low levels established already this year.

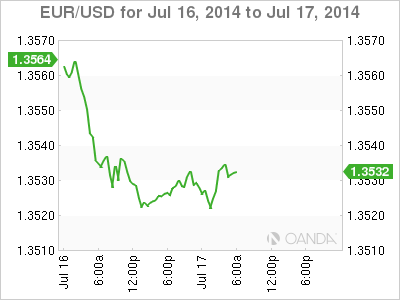

The June lows at €1.3501 are under threat, and many are anticipating a push into five-month lows over the coming sessions. So far, the EUR has matched the overnight Asian base of €1.3521 and remains nearby. The market continues to see some decent bids just under €1.3520 (a two-year trend line on a weekly chart). The market is required to tackle the key support barrier at €1.3500 and June's ECB low at €1.3503 for conviction. Sitting and straddling so close to yearly lows has seen implied vols gain from near/at record lows. The biggest expiries for a New York cut are at €1.3500 (+$699m) and €1.3550 (+$418m). When coming close to expiration expect the market to lean one way or another.

RBA 'jawboning' to commence next week?

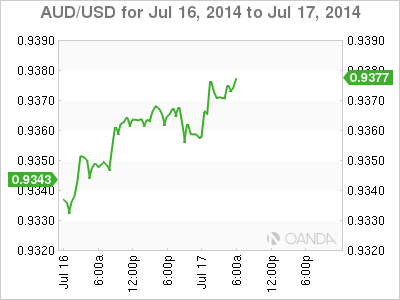

Risk and interest sensitive currencies have again managed to get a leg-up. The AUD continues its slow grind higher, towards the psychological AUD$0.9400 level, after Fed Chair Yellen indicated that she was still sensitive to weakness in the US jobs market and low inflation, indicating that she is in no rush to raise rates. Yesterday's comments on "monetary policy remaining appropriate" and the need to make sure that the "US economy is on the right trajectory before considering raising rates" offset her previous remarks on Tuesday when she highlighted concerns that loose monetary policy was "helping to build imbalances in parts of the US economy."

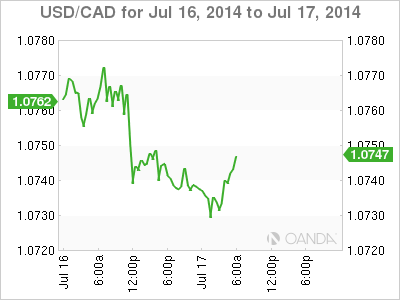

Loonie gets a brief reprieve

Technically, the dollar's bounce has lost some of Tuesday's Fed shine on higher US rates sooner than later. Since yesterday, both the AUD/USD and CAD have managed to climb out of immediate danger, the loonie in particular ($1.0738).

The USD/CAD was weaker, testing the next handle higher ($1.0800), following yesterday's BoC events as investors cut positions established following the weak employment report last week anticipating a dovish tone from Governor Poloz at the BoC's rate meet yesterday. The FX impact of the BoC’s general removal of the “down side risks to inflation remain important” language from the statement was offset by their continued emphasis that higher inflation has been driven by temporary factors, and importantly, the pushing out of their forecast for the output gap to close to mid-2016.

In addition, the importance of a return to export-led growth for Canada in closing the output gap means the BoC is required to keep the CAD weak as a key means of stimulating exports and the broader economy. How is this different from other Central Bankers covert currency manipulation? On balance, the BoC’s continued cautious tone and the clear importance of a weaker CAD in reaching their goal of a return to export- and business investment-led growth means their tone will remain accommodative, supporting higher USD-CAD. Expect investors to better buyers of US dollars outright on dips and be cautious for the CAD being tempted higher on some cross play (EUR/CAD and GBP/CAD).

Local Aussie data has been limited this week. The market's focus is rapidly switching to next week speech from the RBA's Governor. Stevens has been trying to "jawbone" the AUD down of late, but with mixed results. With policy makers pointing again towards a sluggish economy, the fixed income dealers are pricing in a +50% chance of a RBA rate cut by year-end. Look for inflation reports to confirm just that - no inflation worries.

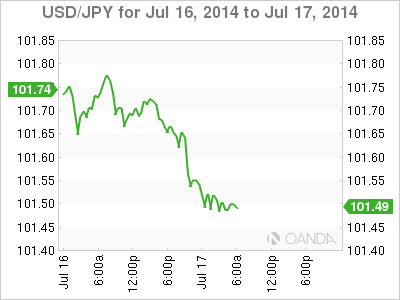

Yen of little interest

Even Yen is on a win, hitting a five-and-a-half month high against the EUR (€137.23) and encroaching on the yearly low at €137.78 set on February 6, 2014. The EUR's woes have been well highlighted (weak German ZEW, Euro economic indicators weaker and financial stability in Portugal), but the Yen has also gotten a boost from the lack of momentum in the benchmark Nikkei Stock Index has been reason enough to want to own the Yen for a bit. However, the fact that USD/JPY did not move much throughout Yellen's more hawkish testimony would suggest that USD/JPY could very well stay within a narrow range for the next several weeks. Let's hope the crosses get to dominate market direction!