The January low in the Crude Oil market was broken yesterday, when the black gold tumbled to a six and a half year low. With the bearish trend dominating, the commodity’s rout is likely to continue as it enters a liquidity zone.

The breach of the low formed back at the beginning of 2015 was only a matter of time as the bearish trend dominated proceedings. The push came in the New York session when the American Petroleum Institute released their inventories figures. The result saw a draw of 847,000 barrels from the stockpile, but this was short of the 1.8m barrels the market was expecting.

China's economic trouble is also having a big impact on the price of Oil. China has twice devalued its currency in the last two days and many traders are taking that as a sign that things must be worse than expected if the PBOC is willing to take such drastic action. The result was the market scrambling to safe haven assets and Oil is certainly not one of them.

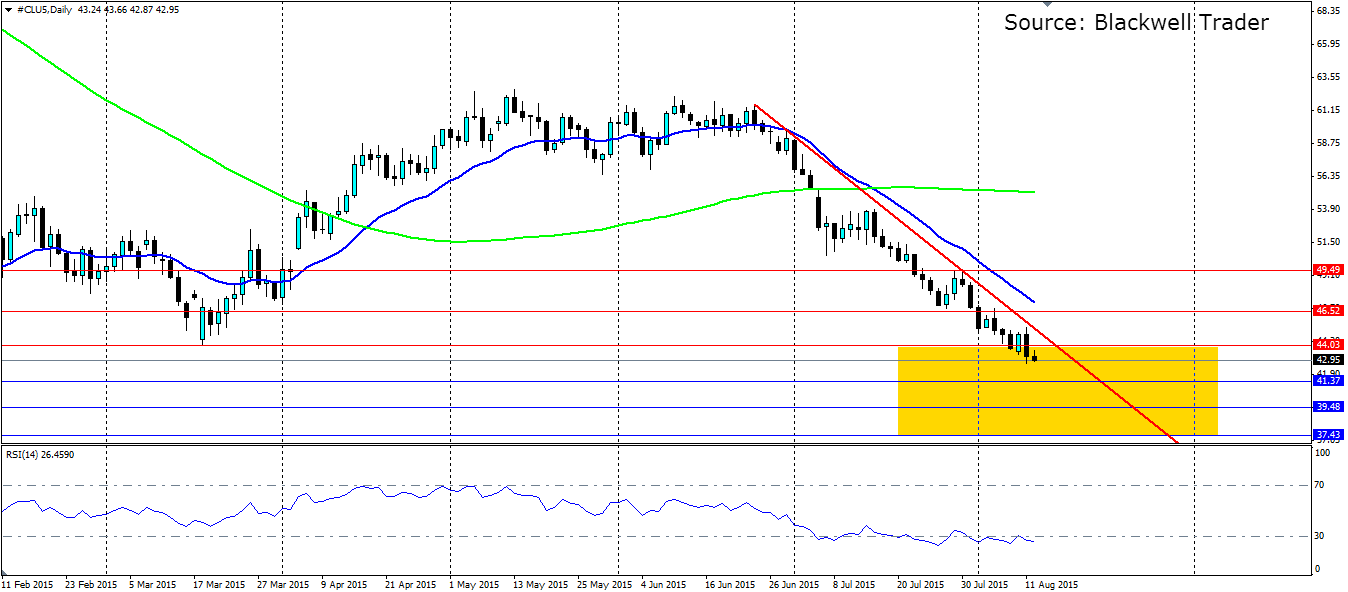

From here, Oil is entering into a liquidity zone that will see a lot of choppy price action. Between the resistance at $44.03 a barrel and the support at $37.43, price saw plenty of swings and rejections when it was last in this region, back in 2009. This will be an area to watch as volatility is likely to increase and some sharp falls can be expected.

It is possible that the liquidity zone could be where the market finds a bottom as it did previously, but price action would need to signal that first, and at this stage the bear trend is in control and likely to remain there. The RSI is well into oversold territory showing that bearish momentum is solid and relentless. Only if RSI swings back into neutral territory and stays there can we think about an end to the trend. However, for now, look for tests off the trend line as entry points move lower.

Look for support to be found at 41.37, 39.48 and 37.43 with the latter looking the strongest as the other two are within the liquidity zone and will act more as sticking points for price. Resistance is found at 44.03, 46.52 and 49.49.