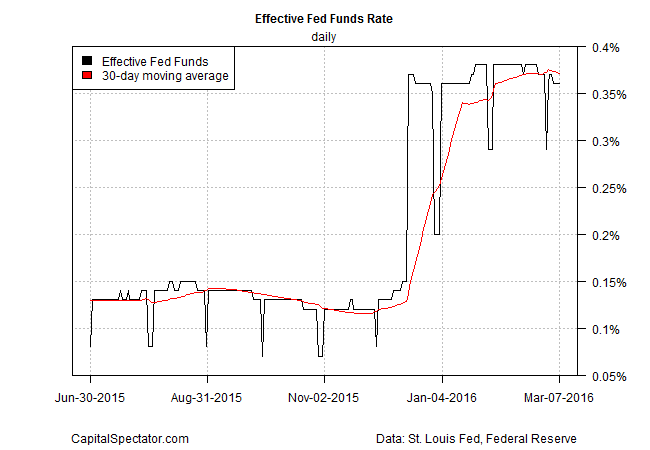

The Federal Reserve will leave interest rates unchanged at the current target range of 0.25% to 0.50% at its policy meeting next week, writes The Wall Street Journal’s John Hilsenrath -- reportedly one of the most “well-connected” journalists on Fed matters. Supporting evidence for anticipating that the central bank to stand pat includes the recent numbers on key Treasury yields, the Effective Fed Funds rate and the market’s inflation expectations.

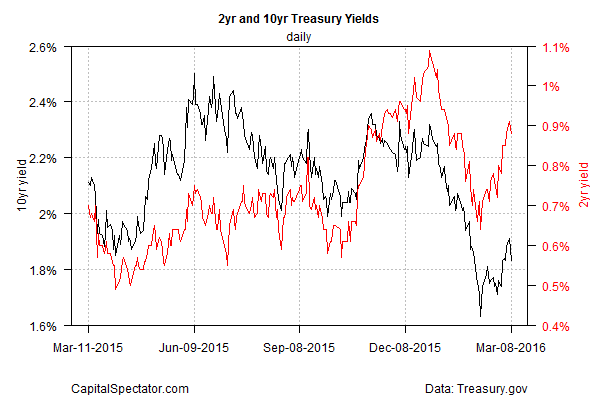

The 2-year yield -- widely seen as the most sensitive spot on the yield curve for rate expectations -- ticked lower yesterday (Mar. 8), dipping to 0.88%, based on daily data from Treasury.gov. Although this yield has bounced higher in recent weeks as US recession fears have faded, the current rate is still well below the 1%-plus levels reached in December, when the Fed increased Fed funds by 25-basis points. The market’s reluctance to challenge December’s highs for the 2-year maturity imply that the crowd isn’t expecting a rate hike at next week’s FOMC announcement (Wednesday, Mar.16).

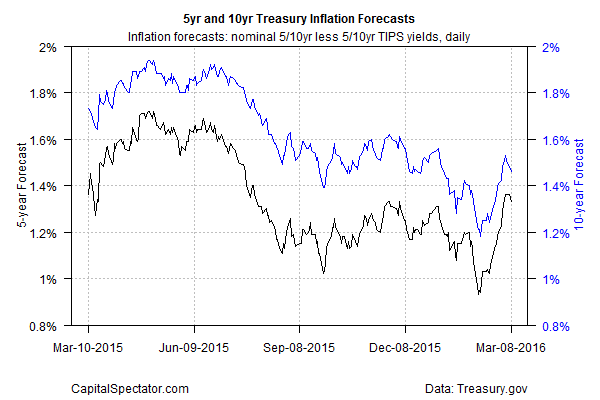

Some analysts say that pressure is building on the Fed to squeeze policy in the wake of firmer inflation data. Earlier this week Fed Vice Chair Stanley Fischer seemed to confirm the hawkish view by noting that “we may well at present be seeing the first stirrings of an increase in the inflation rate -- something that we would like to happen.” Perhaps, but the Treasury market has been inclined to trim its inflation outlook a bit this week.

Meanwhile, the Effective Fed Funds rate (EFF) continues to hold steady in the mid-0.3% range, which is where it’s been for much of the year to date.

Fed watcher Tim Duy, an economics professor at the University of Oregon, thinks that next week’s Fed meeting will focus on refining the central bank’s message rather than changing policy. “At stake is not a decision of rates; they will hold steady,” he wrote on Monday. “At stake is a decision on the balance of risks. Do they want to send a dovish, neutral, or hawkish signal for the April and June meetings? I expect them to default to the neutral/dovish side. I don’t think there is sufficient weight on the hawkish side of the FOMC to drive an aggressive rate signal at this juncture.”

For the moment, the data seems to agree.