Although yesterday’s Quarterly Inflation Report from the Bank of England was one of the more “by the numbers” releases, questions fielded afterwards by Mervyn King added some colour to the way that the MPC is thinking about how it deals with the economic turmoil the UK economy finds itself in.

Growth was downgraded as expected to basically flat through 2012 with a strong bounce back seen in 2013. This is the same bounce back that has been forecast in 2009, 2010, 2011 and 2012 so you’ll forgive me if I don’t get too excited about it. King asked for “patience” as it seemed from other points made by the Governor that the Bank was running out of options.

Good news did come in the form that inflation is forecast to dip over the same period. This will obviously help lower the disparity between wage growth and price increases which is the number one cause of low consumer confidence and aggregate demand. The lower inflation is also of course due to the lack of demand as well which will lead to calls to help demand via additional stimulus.

The biggest surprise in announcement terms was Mervyn King’s assessment that a cut in interest rates was unlikely. He stated that the cut “would damage some financial institutions” and “we discussed it but we decided that it would be more counterproductive than beneficial”. This saw a big pop higher in sterling as a fair few people had started to price in a 25bps cut at some point in the future.

We had argued that any rate cut in the short term would not lead to an increase in spending and would more than likely lead to consumers paying down debt and saving more for a rainy day. So despite the likelihood that we are likely to see more QE from the Bank, sterling rose on the day; these markets are becoming increasingly annoying.

The overarching problem however remains Europe. In response to criticism about the predictive and prognosticative powers of the MPC, the governor fought back that with the European situation as it is at the moment, that making predictions on anything is very inexact science. On this he is right; until the problems across the channel are sorted, the issues here will remain with us.

Elsewhere German industrial production matched our expectations by falling by close to 1% in the previous month and confirming that GBPEUR should remain relatively well bid in the short term.

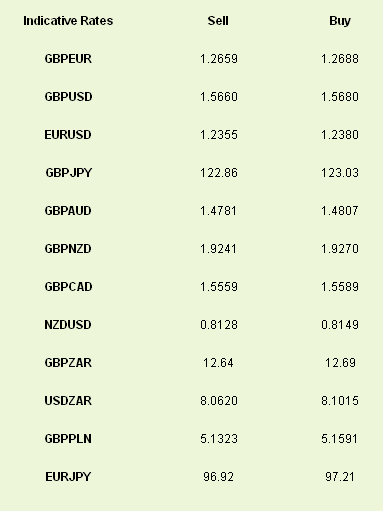

Chinese data overnight was mixed with inflation falling, much for the same reasons as it is here, while retail sales fell by more than expected. This fits in with our model for the Chinese economy, in that the overall data picture is likely to remain poor through Q3, although we have probably found a bottom as far as economic output is concerned. That being said, we do expect further moves to loosen monetary policy in the near term via either interest rate cuts or movements in the Reserve Requirement Ratio. atest exchange rates at time of writing

atest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

No Rate Cut Signal Sends GBP Higher Amid Macro Gloom

Published 08/09/2012, 06:06 AM

Updated 07/09/2023, 06:31 AM

No Rate Cut Signal Sends GBP Higher Amid Macro Gloom

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.