Johnson & Johnson (N:JNJ) makes all sorts of products for consumers, but one line that stick with me from the 90s is their baby shampoo. They would market it with the slogan “No more tears.” From the promotional picture above, that is still the slogan. Only now it is time to apply it to their stock too.

Johnson & Johnson (JNJ) stock price had a long run higher from June 2012 until topping in November 2014. Since then it pulled back slightly, but could not move away from 100. This is a common phenomenon, stocks or indexes holding for a long time around round numbers. Well it finally did move away, but not how investors had hoped, in August when it fell with the market. If you bought then, congratulations.

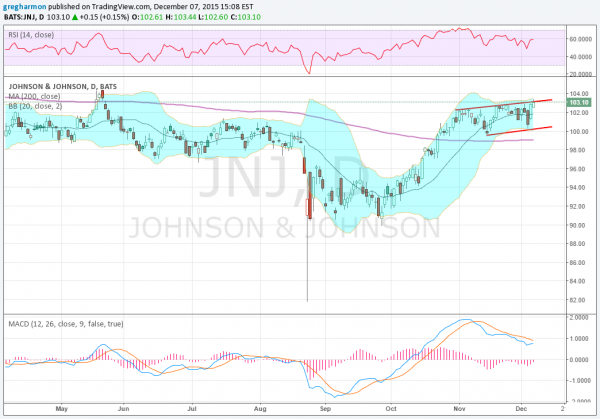

Since the bottom throughout September, it rose back to the 100 level. But it has been stuck there again. Or has it? Looking closely, the stock has formed a rising channel since the beginning of November. A third higher high following a second higher low, defining an uptrend. So what to do?

With the price at the top of the channel, there are two things for a future holder to look for. First, a break above the channel should be bought as it indicates a change of character and a move to the upside out of the long consolidation. Second, a failure to break the channel and move lower is an opportunity for a current investor to sell covered calls, and a future investor to sell Puts on the 100 Strike, at the bottom of the channel, for a potential entry.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog. Please see my Disclaimer page for my full disclaimer.