The Bureau of Labor Statistics reports inflation in the U.S. economy increased by 0.2% in March, after increasing by 0.1% in each of February and January. In total, prices have increased by 0.4% in the first three months of the year. (Source: Bureau of Labor Statistics, May 12, 2014.) If we extrapolate these “official” numbers for the entire year, inflation will come in at roughly 1.6% in all of 2014.

Dear reader, ask yourself this question: “Do the items I buy on a regular basis seem to only cost 1.6% more than they did 12 months ago?” Of course not; that’s because the “official” government inflation figures are outright misleading.

The reality is that early economic indicators are flashing warning signs about inflation.

A little background…

The direction of the prices of commodities used as raw materials that go toward the making of a final product is an indicator of where general prices are headed. For example, wheat is used to make bread, so the price direction of wheat (going up or down) is important. Oil is another example. Oil is needed to make gas, so if oil prices are rising, it’s safe to say that gas prices will go up.

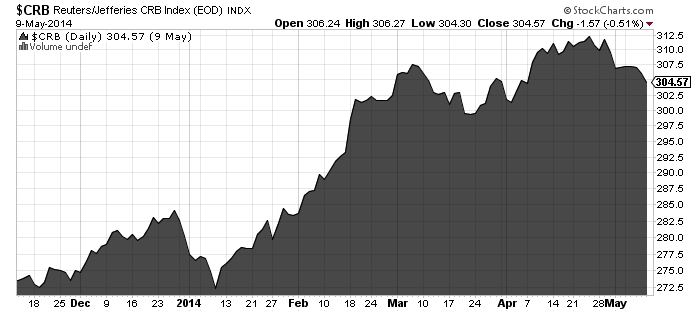

With that said, look at the chart below of the Reuters/Jefferies CRB Index, an index that tracks the prices of commodities that affect our daily life, like wheat, corn, oats, and live cattle. It also tracks the price of heating oil, gasoline, and basic metals.

Since the beginning of the year, this index has increased about 10%.

In the long-term, this jump in commodity prices isn’t going to sit well with consumers, because if commodity prices continue to rise, the products we buy will increase in price, resulting in higher inflation.

But let’s not forget that the government’s “official” inflation numbers exclude food and energy prices. How convenient.

No matter how the government tries to hide the real situation with inflation in the U.S. economy, the truth will eventually come out in sharply rising prices. My readers should prepare for that.

Disclaimer: Dear Reader: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and analysis. The opinions in this e-newsletter are just that, opinions of the authors. Information contained herein, while believed to be correct, is not guaranteed as accurate. Warning: Investing often involves high risks and you can lose a lot of money. Please do not invest with money you cannot afford to lose.