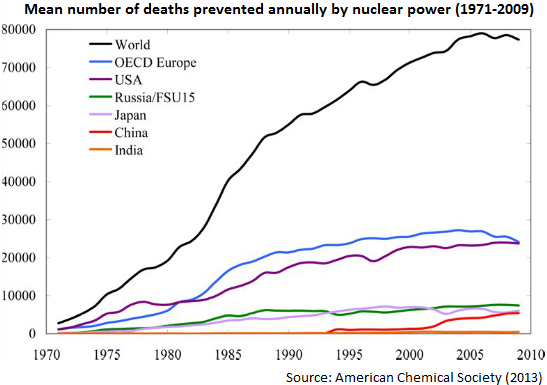

According to a recent publication from the American Chemical Society, a study performed by the NASA Goddard Institute for Space Studies and the Columbia University Earth Institute of New York came to the conclusion that more than 1.8 million human deaths have been prevented by world nuclear power production from 1971-2009.

On average, 76,000 deaths were prevented globally every year from 2000-2009 thanks to using nuclear power. A mean of 117,000 deaths per year were prevented alone in Germany between 1971-2009, yet Germany announced plans to shut down all reactors by 2022. The estimated human deaths caused by nuclear power from 1971-2009 are far lower than the avoided deaths. Globally, some 4,900 such deaths were calculated, or about 370 times lower than the number of avoided deaths. Around 25% of these deaths are due to occupational accidents and about 70% are due to air pollution-related effects.

“In the aftermath of the March 2011 accident at Japan’s Fukushima Daiichi nuclear power plant, the future contribution of nuclear power to the global energy supply has become somewhat uncertain. Because nuclear power is an abundant, low-carbon source of base-load power, it could make a large contribution to mitigation of global climate change and air pollution. Using historical production data, we calculate that global nuclear power has prevented an average of 1.84 million air pollution-related deaths and 64 gigatonnes of CO2-equivalent (GtCo2-eq) greenhouse gas (GHG) emissions that would have resulted from fossil fuel burning. On the basis of global projection data that take into account the effects of the Fukushima accident, we find that nuclear power could additionally prevent an average of 420,000-7.04 million deaths and 80-240 GtCO2-eq emissions due to fossil fuels by midcentury, depending on which fuel it replaces. By contrast, we assess that large-scale expansion of unconstrained natural gas use would not mitigate the climate problem and would cause far more deaths than expansion of nuclear power.“ (Pushker A. Kharecha and James E. Hansen in „Prevented Mortality and Greenhouse Gas Emissions from Historical and Projected Nuclear Power“; American Chemical Society, 2013)

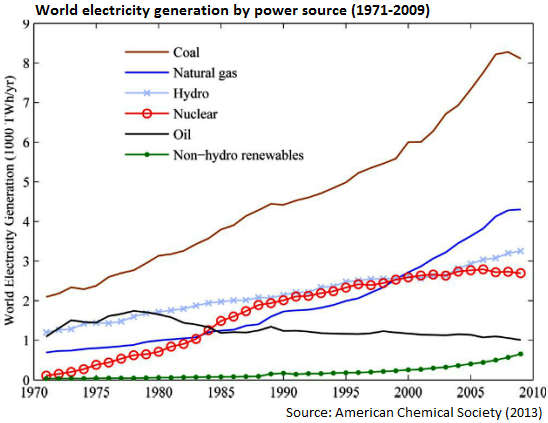

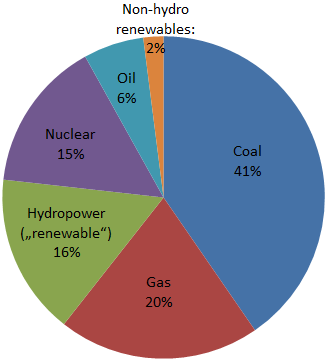

According to the study, the following energy sources provided for world electricity generation in the past decade (2000-2009):

Peter Zihlmann summarized well of what Marino G. Pieterse, publisher of The Uraniumletter International and one of the most respected experts on the uranium market, wrote in an article titled “Uranium – Ripe for a Recovery” for the Mining Journal on August 23, 2013:

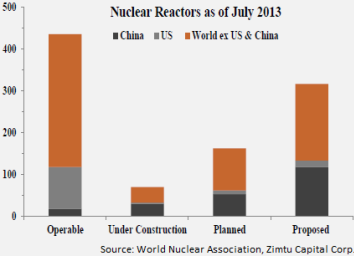

“While France receives 75% of its electricity from nuclear energy, Belgium 51% Sweden 38%, South Korea 30%, the United States 19% and the UK 18%, China receives only 1.9% of its electricity from nuclear, India 2.2%, Brazil 3% and Russia 8%. These countries, focusing on non-greenhouse clean electricity sources, offer a strong growth potential… At this time, China is for more than 70% dependent on coal, it plans to quadruple its nuclear energy output by 2020 and triple or quadruple output again by 2030…China currently produces almost 14 GWe through its 17 reactors, which supply about 2% of the country’s electricity. It expects to produce 58-60 GWe of capacity by 2020 (28 reactors under construction), possibly 200 GWe by 2030 (171 reactors planned or projected) and 400GWe by 2050. China will need more than 27,000 tonnes (60 million pounds) U3O8 per year by 2030 compared to the US using almost 20,000 tonnes (44 million pounds) U3O8 per year to produce 99 GWe from its 100 reactors.“

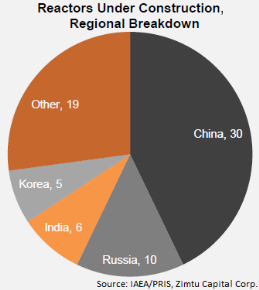

Recently, Canadian analyst Derek Hamill of Zimtu Capital Corp. published a well-established research report on the uranium market analyzing supply and demand by a hair’s breadth with interesting findings. As per Hamill’s calculations, there are only 18 nuclear reactors in operation in China – very few when comparing with the rest of the world respectively with a large upward potential. And indeed, almost half of all reactors which are under construction worldwide at the moment are located in China. These 30 reactors which are set to be connected to the grid require uranium for the long haul from secure sources.

“When you subtract the approximately 70 nuclear power reactors either shut down or in the process of being shut down, mostly in Japan and Europe, there are actually about 370 power-producing nuclear reactors in the world today, consuming approximately 160 million pounds/year (160 Mlb/year) of uranium as U3O8. Another 65 reactors are actually being built today in China, in Russia, the U.A.E., Turkey, Finland, the UK and India. Now add what they say they're planning behind that, and in 40 years there will be another approximately 370 reactors operating worldwide, the same number of reactors as is operating today. Where is that other 160 Mlb of U3O8 going to come from over the next 40 years? It has to come substantially from new mines in the Athabasca Basin in Canada, from Australia, from parts of Africa and from Utah, Colorado, Nevada and Wyoming in the U.S. It's going to come from Mongolia and it's going to come from other mines here and there in the Far East and in Slovakia. Uranium prices right now are definitely in a bottoming process, but as a result, the uranium mining industry has a chance to get its act together and invest in new exploration and production (E&P). We've got time on our side because these new uranium mines, especially in Athabasca, are long-lead items. They're 10 years from concept and exploration through to production… Overall, I see a very good future for uranium, but we've got to use the time to get our act together.“ (Thomas Drolet of Drolet & Associates Energy Services Inc. in a recent interview with The Energy Report)

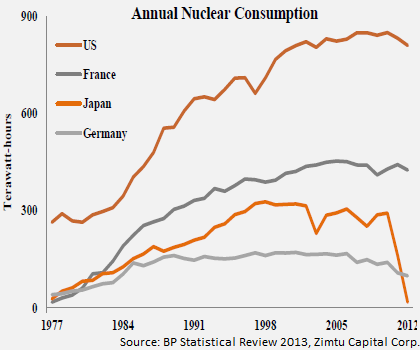

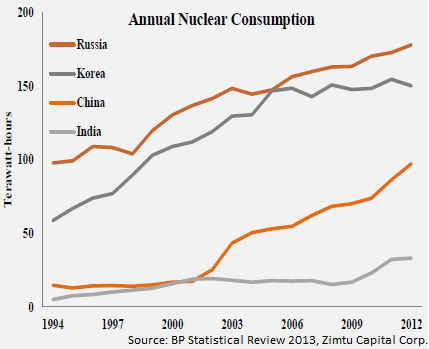

While demand in Japan has crashed to almost zero after the Fukushima incident, other countries like USA, France and Germany only marginally consumed less. Meanwhile, demand from countries like Russia, China and India upswings unperturbedly:

“The planned commercial nuclear expansion in Asia, especially China, is the major growth driver of uranium demand.“ (Derek Hamill in "Canadian Uranium Exploration“)

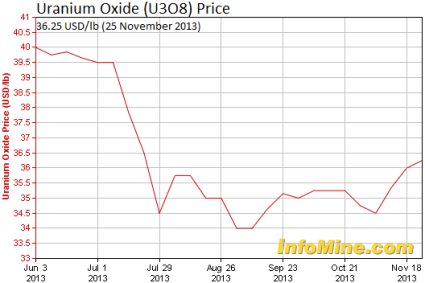

Of all metals, uranium enjoys the best price outlook, not only in the mid- to long-term but also in the short-term as the latest price breakout demonstrates:

In our last article "Athabasca Basin – The Place To Be For The Upcoming Uranium Boom“ it is marked out why we are so bullish for uranium prices and why the Athabasca Basin is not only attractive to senior mining companies but also to investors. In a Special Report of The Uraniumletter International, Marino Pieterse gave some valuable insights about the companies active in the Athabasca Basin:

“Besides the three producing companies (i.e. Cameco, Areva and Denison Mines), there are only three exploration/development companies with a mature market capitalization (i.e. Fission Uranium, Alpha Mineralsand UEX), of which Fission and Alpha have announced an amalgamation of their PLS discovery. These two companies have a present combined market capitalization of Cdn$ 300 million, of which at least 90% applies to the PLS project in which only Cdn$ 9 million has been spent on exploration to date. The potential of the PLS discovery as a stand alone project is estimated at a minimum of 50 million pounds of U3O8 which is comparable with Rio Tinto’s Roughrider Project (formerly owned by Hathor Exploration). This project was discovered in February 2008 and has a resource of 57 million pounds of U3O8 from ores grading 4.7% of U3O8. Rio Tinto’s acquisition of Hathor Exploration was completed on January 12, 2012 for a total cost of Cdn$ 654 million at $ 4.70 per share, representing a premium of 53%, compared to a first bid by Cameco of Cdn$ 578 million at Cdn$ 3.75 per share. As such, Hathor Exploration was valued at a market capitalization of Cdn$ 307 million before the bidding war between Cameco and Rio Tinto commenced. At the time that the acquisition of Hathor Exploration was completed, the U3O8 spot price and long-term price were US$ 43 and US$ 62, respectively, compared to current prices of US$ 35 and US$ 50, respectively. Based on Rio Tinto’s Roughrider Advanced Exploration Technical Proposal for the period 2014-2018, it is expected that there will not be a decision made to develop a production mine before 2019. This means that despite a prospective outlook to develop the PS discovery as a production mine, this will take at least five years. With Fission Uranium and Alpha Minerals at approximately Cdn$ 346 million, already valued at a similar level as Hathor Exploration before its takeover by Rio Tinto, this means that Fission Uranium and Alpha Minerals are strongly overvalued. Consequently, I particularly advise shareholders of Alpha Minerals to sell their shares before the meeting of shareholders on November 28, 2013 to approve the amalgamation with Fission Uranium. As an alternative, besides producing companies Cameco and Denison Mines expected to benefit from an expected improving uranium investment sentiment (see my article published in the Mining Journal of August 23, 2013), I prefer to look at some of the small capitalised junior companies with prospective assets […] and being able to get access to funding and thereby offering a speculative high investment leverage potential.“

Thomas Drolet in an interview with The Energy Report on December 3, 2013:

“I think we're going to have more investment in Canada, more mines being developed, especially in the Athabasca area. That investment will inevitably lead to quicker production from Athabasca and other Canadian uranium sources that are dotted across the country. I think it will eventually lead to lower prices and more Canadian uranium on the world markets. It's a long-overdue step… Lakeland Resources Inc. is a very well managed company backed by solid investor groups. The company has what looks like a series of very good properties up on the north rim of the basin that have been explored before. Lakeland may have a very good resource to operate… But surely the Lakelands of this world will come up as they make real progress. I believe value will be driven, as always, by real results… Zimtu [Capital Corp. holds a large stake in Lakeland and other junior mining companies] has an interesting business model in that it has a collection of companies that it has taken various positions in and nurtured, when required, with good people and marketing savvy. Zimtu scours various countries for investments and nurtures a stable of companies. I think the Zimtus of this world are a good thing for juniors to have backing them at early stages.“

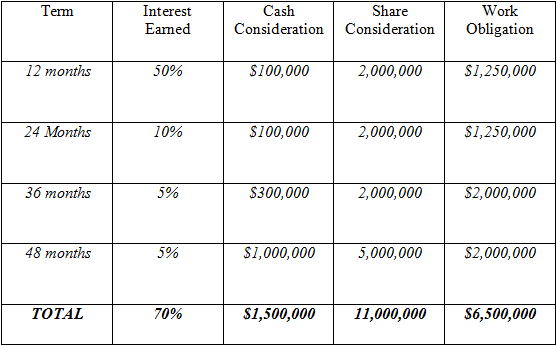

With a minimum of $1.2 million work program in 2014, Lakeland Resources Inc. will have one of the largest drill programs in the Athabasca Basin in the upcoming year funded by their new partner Declan Resources Inc., which is committed to spend a total of $6.5 million over the next 48 months:

In addition, Declan will grant Lakeland a 2% Net Smelter Royalty on commencement of commercial production; 1% of which can be purchased by Declan for $1 million. After Declan has earned its 70% interest, Lakeland’s 30% interest in the property will be carried until Declan completes an initial NI43-101-compliant resource estimate for the property.

This latest partnership in the Athabasca Basin has increased chances of discovery without equity dilution. The Declan team proved expertise in discovering deposits, such as the Rainy River deposit in Ontario with resources of +8 million ounces of gold which was recently acquired by New Gold Inc. in a deal valued at $310 million. Lakeland and Declan will have more news to report shortly on corporate developments as well as the results of the fieldwork that has been completed at their Gibbon’s property in the northern part of the basin: RadonEx, boulders and ground resistivity surveys. Lakeland is backed by renowned Dahrouge Geological Consulting Ltd. which company was instrumental in staking and developing the Roughrider deposit in the eastern part of the basin. Jody Dahrouge was also part of the team that identified and staked both Patterson Lake North and South deposits in the southern part of the basin. On October 23, it was announced that John Gingerich, a prominent professional geoscientist, took a seat in the Advisory Board of Lakeland. He worked for Eldorado Nuclear (now Cameco) spending most of his time between Fond du Lac and Stony Rapids covering the ground that is now held by Lakeland.

DISCLAIMER

The author holds shares of Denison Mines Corp. and Lakeland Resources Inc. and may sell those any time without notice, whereas neither Rockstone Research Ltd. nor the author was remunerated by these companies to produce or publish this content. Please read the full disclaimer at www.rockstone-research.com as none of this content is to be construed as an “investment advice”.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

No Dead-Cat Bounce: A Warning On Uranium

Published 12/04/2013, 02:09 PM

Updated 07/09/2023, 06:31 AM

No Dead-Cat Bounce: A Warning On Uranium

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.