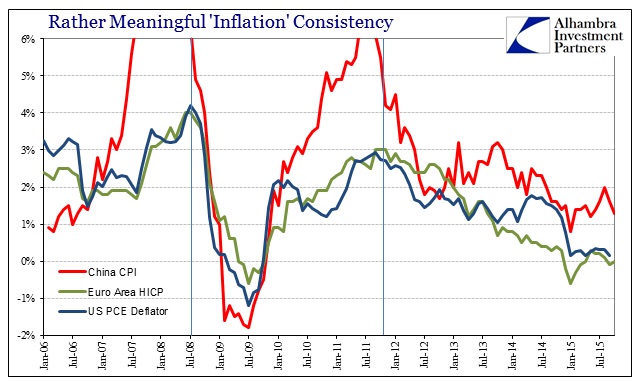

By all count of orthodox economics, the harmonization of “inflation” rates across the US, Europe, and China should not happen. While the former two might be more forgiving given close economic ties, the assumed vast differences with the Chinese economic framework (particularly PBOC operations) should prevent what can only be observed as a highly contagious global environment.

With China’s CPI lower yet again, the third lowest annual rate in October of this cycle, it so closely matches the US and Europe despite those geographical distances and even the different suite of calculation attempts that I have presented above for each (PCE Deflator for the US; China’s CPI; Europe’s Harmonized Index of Consumer Prices). The sum total of that is as the renewed conflagration in global money markets: the bastardized reserve currency system that operates as a “dollar” but is nothing like one (and certainly not truly American).

As PBOC governor Zhou Xiaochuan pointed out all the way back in early 2009, there is a curious lack of appreciation for how the global financial system actually operates. This is no trivial distinction:

It is the paramount issue which no central banker or economist seems to fully comprehend. What replaced Bretton Woods? Invariably the answer is the dollar, or even the petro-dollar. Neither is correct as Zhou makes plain in his written thoughts on the matter, “The acceptance of credit-based national currencies as major international reserve currencies, as is the case in the current system, is a rare special case in history.” The key words to all of this are “credit-based.” There is a world of difference between an assumed petrodollar function and “credit-based” wholesale finance globally, a fact that seems to escape all these central bankers but which they are receiving, a second time, an abject lesson through continued failure.

Unfortunately, that “lesson” is both ongoing and still, by blind ideology and dedication to the fantasy of control, not being received. Stimulus just isn’t in this context, as central banks are a sideshow to bank balance sheet factors that are, obviously, presenting the global economy a more sideways, precarious view. To which “our” own Federal Reserve remains comfortably mystified and stumped:

“I see this as more of a warning, a red flag that there’s something going on here that isn’t in the models, that we maybe don’t understand as well as we think, and we should dig down deep deeper and try to figure this out better,” he [SF Fed President John Williams] said during a panel discussion at the Brookings Institute in Washington.

It’s truly sad that the Fed started to do so all the way back in 1979; and we, globally, are continuing to pay the high cost of monetary and economic dogma over everything.