One must wonder how Vietnam, a country where gold investing between 2011-2012 accounted for over 3% of GDP, has handled the global dash for gold in recent weeks.

The country’s central bank and citizens hold more gold per capita than India and China, and they have been unable to benefit as well as their neighbours from the low gold prices. Whilst gold shortages induced premiums to be charged in both India and China, they were not to the extent seen in Vietnam.

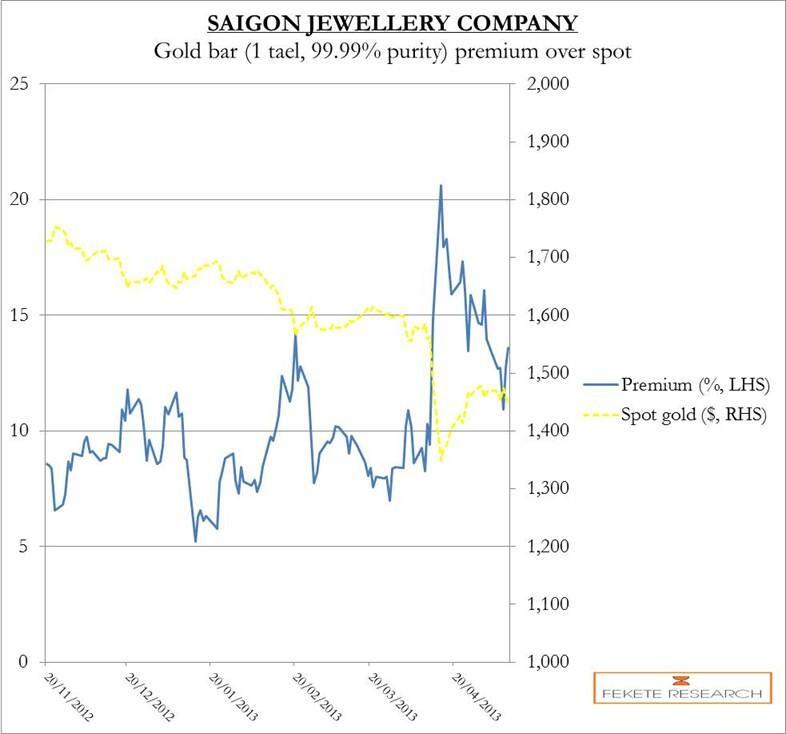

Here, the gold market is heavily regulated and the central bank has been unable to keep up with gold demand. As a result premiums on gold have reached as high as 20% above the global spot price.

Premiums long existed prior to the gold price drop last month. This is mainly down to a newly regulated gold market which is unable to meet demand. This was clearer than ever last month when premiums of 20% above spot gold prices were common in Vietnam, significantly higher than the average 7-11% seen in earlier months.

We have written in the past of the Vietnamese government’s attempts to control gold in order to ‘stabilize’ the market and prevent manipulation.

Prior to last year, gold traded freely in the country and was seen as one of the three currencies which could be used, alongside the dollar and the dong.

Controlling the domestic gold supply, and therefore demand, is an attempt to reduce the domestic transactions involving gold and its role as safe-haven.

GFMS believes gold demand will be down by approximately a quarter this year, compared to last year’s purchases, as people struggle to get hold of the yellow metal thanks to government supply controls.

Since last year a series of measures have come into play which has seen the government take total control of the gold market and as a result, a widening gap between domestic and international gold prices.

Given Vietnam’s Central Bank (SBV) does not yet have an established infrastructure to manage supply of gold, how have they managed since the gold price fell across the world, in all currencies?

Vietnamese citizens purportedly blame the government and SBV for these high premiums and short supply. Despite importing 95% of its gold in 2011, the country has not officially imported any gold since then, according to GFMS.

However, smuggling is purported to be rife.

Government manipulation to stop market manipulation?

“The primary goal of the State Bank of Vietnam is to control the domestic gold market to stop price manipulation,” State Bank of Vietnam governor Nguyen Van Binh

Since July 2012, the government has had responsibility for the production of gold and Saigon Jewellery Company (SJC) is the national brand. When SJC was announced that it was going under government control and would be the sole supplier, citizens expressed concerns that the gold market would now be controlled like a currency.

State Bank of Vietnam governor Nguyen Van Binh, believes that if the Dong is not interconnected to the international currency market (it does not float on the foreign exchange market) then why should gold be affected by external markets.

The SBV’s concerns over the gold market come down to the 100 tonnes p.a. that was being imported, affecting the value of the dong against the dollar. “In the past, each year the country had to spend some US$4.4 billion worth of foreign currencies, mostly the greenback, to import about 100 tons of gold bars,” the central bank said.

Part of the management policies designed to regulate the gold market were to ‘stabilize the market’ which, according to Governor Binh does not mean that the gap between local and world gold price should be narrowed. But he does expect to see this happen in the mid to long-term.

Deadline for gold

In an unexpected move the SBV, in January, announced banks must return all gold deposits, which have been loaned out, to depositors by 30 June.

Banks had previously encouraged gold deposits, and paid good interest on them, however in 2011 a government-selected group of banks were allowed to speculate with 40% of the gold held on deposit. At the time dong deposit rates were at record highs of 18% and lending rates were 26% whilst interbank rates were as high as 30%. However, for gold on deposit interest rates were 3% p.a. Therefore these selected banks sold the gold on deposit in order to earn higher interest rates.

Last year they began to lower interest rates in order to reduce the attraction of storing gold in a bank.

Following January’s ruling, banks now need to return an estimated 20 tons of gold to depositors by the end of June. There is now a scramble to get the gold back and large bids are appearing in the domestic market – hence a higher price.

Gold Auctions

Towards the end of January 2013, the SBV announced it would be running a series of gold auctions in order to reduce market volatility and attempt to ‘stabilize the gold market’ where there has been an increasing problem with supply.

Auctioned gold is being sold to satisfy commercial bank demand as they are looking to buy more gold in order to be able to fulfil requirements to gold depositors by 30 June.

In 13 auctions local commercial banks have bought over 13.7 tons offered by SBV.

This high demand from local banks, means ‘the price gap between local and international gold bullion is inevitable’ said the SBV this week.

The SBV no longer grants licences to commercial entities looking to either import or produce gold bars. The purpose of the bank’s recent auctions was to allow these same entities access to the market. The bank argues that the amount of gold sold to the market, through these auctions has reduced pressure on supply and therefore prevented the domestic price from climbing further.

Gold goes underground

Last year over 2,000 smaller gold shops in Hoi Chi Minh City were closing or facing closure due to these tightened regulations which state they must close due to their low levels of registered capital.

Last year we explained how the closure of smaller gold traders and producers will no doubt pre-empt an increase in counterfeit gold bars, something which will increase if the rumours of government plans to eventually ban all gold production are to be believed.

Black markets allow counterfeit and sub-standard goods to circulate far more easily. As we explained previously, over 10,000 companies are expected to be driven ‘underground’ as a result of these new regulations demonstrating there is still high demand for gold bars in the country.

This black market will be further encouraged as premiums on gold taels increase further over the spot price. Reports of gold smuggling continue to circulate, with many speculating that this will continue as long as the price disparity continues. The VDN has suffered in recent weeks as speculation that illegal gold imports will continue to rise has put downward pressure on the currency, as it is sold for USD in order to buy gold illegally.

Whilst inflation is no longer increasing at the rate it once was, it is still growing and therefore devaluing the currency. The country experienced its lowest growth last year, but inflation continued to increase. Whilst it has slowed down compared to 2011, inflation still pushed on.

Restricting the gold market was intended to change the perspectives of gold’s use. But as long as citizens continue to receive less for the local currency they will seek out something of more secure value.

In a country where Thiers’ Law is demonstrated daily, where citizens chose sound money (gold) over bad (local currency), there will continue to be a desire to own gold. Given that the central bank has ruled gold dealing is illegal for any bank or business without the necessary license, they themselves do not have the adequate infrastructure lined up to organise imports and production, therefore demand for black market gold will continue premiums or no premium.

Disclaimer: Information published here is provided to aid your thinking and investment decisions, not lead them. You should independently decide the best place for your money, and any investment decision you make is done so at your own risk. Data included here within may already be out of date.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

No Cheap Gold In Vietnam

Published 05/12/2013, 03:28 AM

Updated 05/14/2017, 06:45 AM

No Cheap Gold In Vietnam

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.