Market movers today

Markets will continue to digest the outcome of yesterday's UK parliament vote on extending Art.50. Unless a deal is reached at the EU summit on 21-22 March, calls by UK politicians for a longer rather than short extension are likely to grow louder.

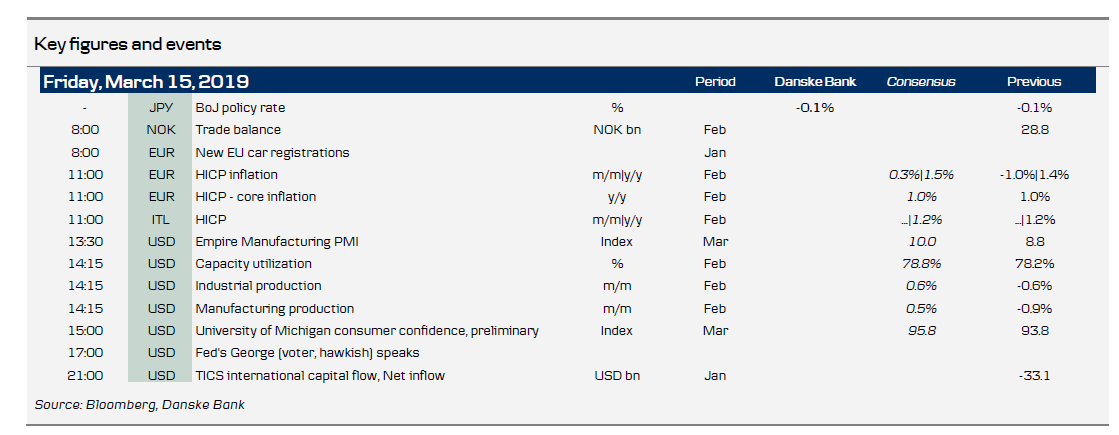

In the euro area, we get the final February HICP figures. The preliminary print showed headline inflation increasing to 1.5% y/y from 1.4% y/y in January, while core inflation disappointed at 1.0% y/y from 1.1% y/y in January. We are particularly interested in the drivers of this fall in core inflation, since the continued absence of transmission from wages to consumer prices is becoming an increasing worry for the ECB.

The day also brings data on new EU car registrations for February. Developments in the auto sector remain in focus with production hampered by new emission test standards in autumn and we look for a continuation of the recent months' rebound.

In the US, industrial production is expected to edge higher in February, while the Empire index will give us some hints on how the manufacturing sector fared in March, after some signs of weakness in recent months. Finally, consumer sentiment from the University of Michigan is expected to continue its recovery in March after the dip during the government shutdown, boding well for consumer spending.

There is a string of possible rating reviews. Moody's could update Italy's rating. S&P has Finland, Austria and Portugal up for review. Fitch has Norway up for review.

Selected market news

After another dramatic night in the House of Commons, a majority voted to postpone Brexit. If the House of Commons votes to pass May's deal next week, it would be only a short extension, otherwise a long extension may be in the cards. Remember that the EU27 has to grant the extension unanimously, so the response by the EU leaders will be interesting. The EU summit takes place on Thursday-Friday next week.

There was no change from the Bank of Japan this morning. Its QQE was maintained with yield curve control and its forward guidance was unchanged at the meeting which ended this morning in a 7-2 vote. It was one of the small meetings, so no new projections were given for growth and inflation. The BoJ changed its assessment of Japan's economy somewhat. It now recognises that "exports and production have been affected by the slowdown in overseas economies". It kept the sentence that "Japan's economy is expanding moderately" unchanged, though, which highlights that the BoJ expects the global slowdown to be temporary and the recent weak Japanese export figures to bounce back once a trade agreement has been reached between the US and China. Hence, the BoJ is still in a wait-and-see mode.

Scandi markets

No major economic events today in the Scandinavian countries.

Fixed income markets

There is a string of possible rating reviews today. Moody’s could update Italy’s rating. S&P has Finland, Austria and Portugal up for review. Fitch has Norway up for review. Moody’s has Italy on a stable outlook and we expect that both the rating and outlook to remain unchanged. Finland and Austria are on a stable outlook, but we expect they will go to a positive outlook. Portugal is on a positive outlook and is likely to be upgraded.

An upgrade of Portugal by S&P would confirm the positive sentiment surrounding Portugal, which has taken 10Y yields to the lowest absolute level since 2015. The long end of France finally received some support yesterday after the 10-30Y slope of the yield curve was under pressure. The Italian government bond market also performed yesterday, with decent spread tightening of some 5-6bp in the 10Y segment to the core-EU.

The Bund spread is trading in the lower part of the expected trading range for 2019, which is 50bp to 60bp. Hence, we see value in buying the Bund spreads at these levels.

FX markets

Yesterday proved a fairly quiet day in FX markets with the GBP little changed upon the third day of Brexit votes in the House of Commons. EUR/USD erased part of recent gains, settling around 1.13 in a session that saw the traditional G10 carry currencies in the likes of AUD and NZD gain ground. This also went for the scandies, as both the SEK and NOK found further moderate support from improved risk appetite and diminished risk of a WTOstyle Brexit. EUR/NOK has continuously tested territory below the 9.70 threshold but so far the cross has not managed to stay below amid profit taking, returning the cross to the 9.70s. We still expect the cross to move lower over the coming months and with less than 1W to the Norges Bank rate hike, we think increased focus will turn to the unique and shielded macro case playing out in Norway. From a positioning perspective, we also note that the weekly flow data from Norges Bank suggests that long NOK positioning is not as crowded as market perception seems to imply, see chart. For more information see FX Strategy – Sell 2M EUR/NOK risk reversal, 12 March.