Equities

The Nikkei tumbled 1.2% to 10039 after the Bank of Japan announced its third round of stimulus in four months. The central bank added 10 trillion yen to its asset buying program, pushing the total allocation up to 101 trillion yen. Investors had hoped for a larger stimulus push. Around the region, the Kospi, Shanghai Composite, and ASX 200 all ticked up ,3%.

European markets ended little changed as fiscal cliff negotiations stalled. The FTSE slipped 3 points to 5985, while the DAX and CAC40 rose fractionally.

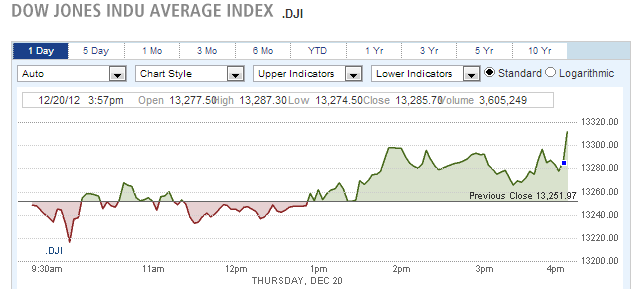

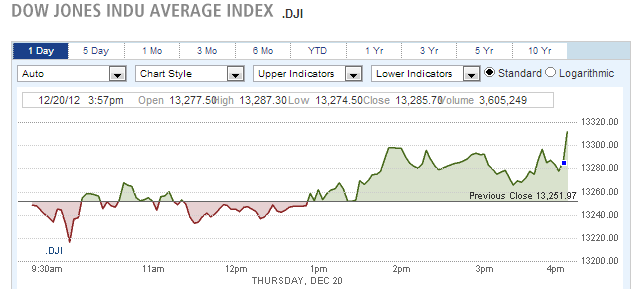

US stocks posted moderate gains, led higher by banks. The Dow advanced 60 points to 13312, and the Nasdaq edged up .2% to 3050

The Intercontinental Exchange agreed to purchase NYSE Euronext for $8.2 billion, pushing NYSE Euronext shares up 34% to 32.35.

Currencies

The Euro climbed .3% to 1.3246, but settled well off its midday high of 1.3293. The Swiss Franc advanced .4% to .9114, while the yen dropped .3% to 84.35.

Economic Outlook

Existing home sales rose to 5.04M from 4.76M, beating estimates for a rise to 4.88M. Additionally, the Philly Fed manufacturing index surged to 8.1 from last month’s -10.7 reading.

The Nikkei tumbled 1.2% to 10039 after the Bank of Japan announced its third round of stimulus in four months. The central bank added 10 trillion yen to its asset buying program, pushing the total allocation up to 101 trillion yen. Investors had hoped for a larger stimulus push. Around the region, the Kospi, Shanghai Composite, and ASX 200 all ticked up ,3%.

European markets ended little changed as fiscal cliff negotiations stalled. The FTSE slipped 3 points to 5985, while the DAX and CAC40 rose fractionally.

US stocks posted moderate gains, led higher by banks. The Dow advanced 60 points to 13312, and the Nasdaq edged up .2% to 3050

The Intercontinental Exchange agreed to purchase NYSE Euronext for $8.2 billion, pushing NYSE Euronext shares up 34% to 32.35.

Currencies

The Euro climbed .3% to 1.3246, but settled well off its midday high of 1.3293. The Swiss Franc advanced .4% to .9114, while the yen dropped .3% to 84.35.

Economic Outlook

Existing home sales rose to 5.04M from 4.76M, beating estimates for a rise to 4.88M. Additionally, the Philly Fed manufacturing index surged to 8.1 from last month’s -10.7 reading.