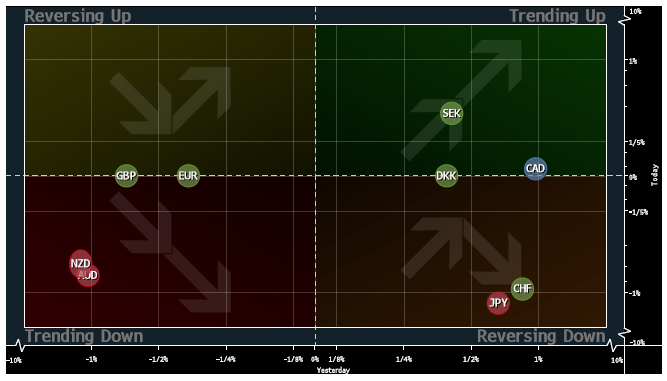

Currencies

07:00 GMT

- EUR/USD - the pair has broken the rising channel towards the downside on a 30 minute time frame. The RSI is showing that the bias could be towards the upside.

- USD/JPY - the price action fell from its resistance level on a 30 minute time frame. This resistance level was given in our analysis on 20th of May. The price has bounced back up from its support zone

- GBP/USD - the price has broken the bearish channel to the downside on a 30 minute time frame. The RSI suggests bias could be towards the upside in the short term.

- Asian Markets plunged by logging the worst day of the year. The Nikkei 225 was the worst performer and closed with a loss of 7.3%

- European stocks are mirroring Asian markets with strong losses. The FTSE MIB is leading the losses and it is down by almost -1.91%.

- U.S. Indices closed sharply lower yesterday on Bernanke's Testimony. The NASDAQ was the worst performer, closing with a loss of -1.12%

- European Leaders finally have put more pressure to fight youth unemployment by announcing a 6 billion-euro package, Bloomberg reported

- The Chinese economic data showed that the country’s manufacturing is contracting in May which is for the first time in seven months.

- Most economists are forecasting that People bank of China could raise the interest rate rather than cutting them, Bloomberg reported

- Stops are your biggest friends so embrace them

- Gold sustained a highly volatile session yesterday after breaking the $1400 mark, albeit very briefly. The price action could be more biased towards the upside.

- Oil fell from its resistance level which we provided in our analysis, and the price is taking a breather near its support zone which was also provided in yesterday's analysis.

- VIX - Volatility index increased by 3.37% yesterday.

07:00 GMT

EUR - French Flash Manufacturing PMI

07:30 GMT

EUR – German Flash Manufacturing PMI

08:30 GMT

GBP - Second Estimate GDP q/q

12:30 GMT

USD - Unemployment Claims

14:00 GMT

USD - New Home Sales

20:30 GMT

EUR - ECB President Draghi Speaks

14:00 GMT

NZD - Trade Balance

Trend

DISCLOSURE & DISCLAIMER:

The above is for informational purposes only and NOT to be construed as specific trading advice. responsibility for trade decisions is solely with the reader.

by Naeem Aslam