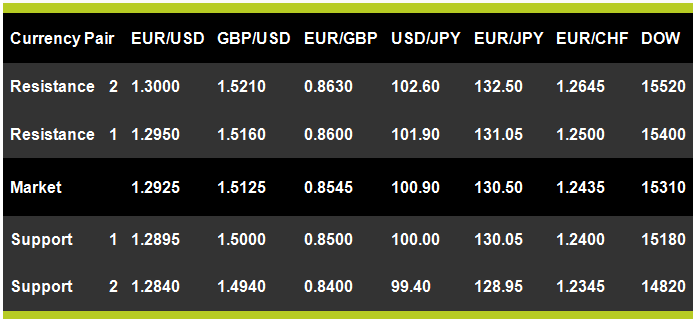

The week is kicking off with some fresh Yen buying. It seems that the Japanese currency is currently correcting some of the huge losses it has experienced over the past months. The USD/JPY is currently trading at 100.90, 0.40% down for the day. Other Yen crosses are experiencing similar behavior. The BoJ meeting minutes indicated that some members are worried that the 2% inflation target might be very hard to accomplish within the set two year timeframe. The Nikkei is recording losses of 3.1% . The EUR/USD is trading in a tight range for now, between 1.2915 and 1.2945. The pair could continue sideways as the U.K. and U.S. markets are closed and there are no major data releases due today.

Trade Idea

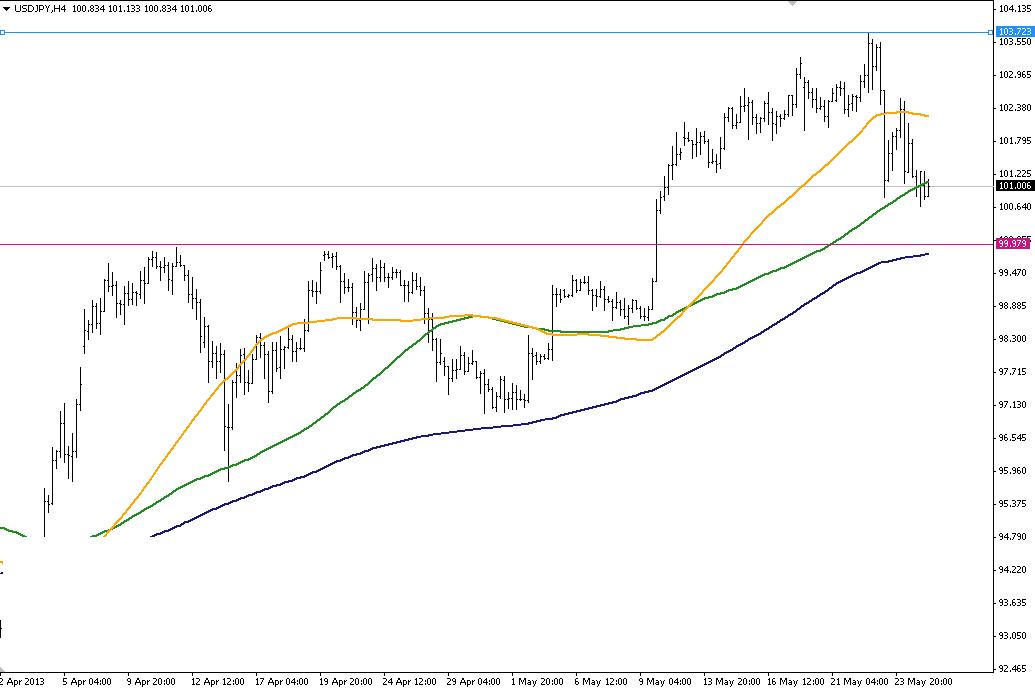

USDJPY 4H Chart:

The pair seems to be losing some momentum recently and a retracement back to 100 area is possible. This should provide a good opportunity for fresh longs targeting higher. If 100 level however is penetrated then this might signal further downside risk. USD/JPY H4" title="USD/JPY H4" width="1324" height="665">

USD/JPY H4" title="USD/JPY H4" width="1324" height="665">

Disclaimer • Risk Warning

This document should not be relied upon as being an impartial or objective assessment of the subject matter and is not deemed to be “investment research” as defined by the applicable law. This document has been issued by TFI FX only for information purposes and should not be construed in any circumstances as an offer to sell or solicitation of any offer to buy any financial instrument, nor shall it, or the fact of its distribution, form the basis of, or be relied upon in connection with, any contract relating to such action.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Nikkei Lower, JPY Higher

Published 05/27/2013, 02:50 AM

Updated 04/25/2018, 04:40 AM

Nikkei Lower, JPY Higher

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.