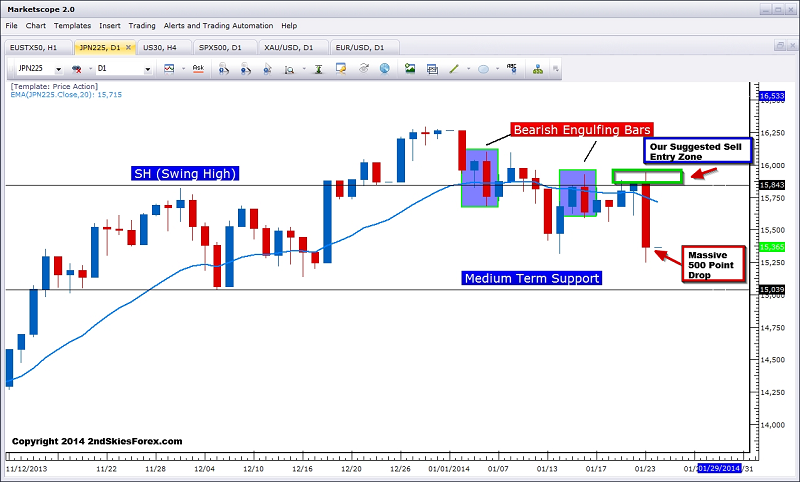

Nikkei 225 – Our Recommended Short Plays Out Heavy

In our latest weekly market commentary, we suggested going short between 15840 and 15933 as the trend was showing signs of breaking down and offering a great sell opportunity. Today we reached a high of 15945 (only 8 points above our entry zone high) before selling off 700 points from high to low. The Japanese index closed down about 500 points from the open.

Had you sold on the open, or even at our lowest entry point, you’d have profited about 500 points and +5R on the day as many savvy price action traders did.

NOTE: If you were selling on the low of the prior engulfing bar, you would have entered almost 300 points below ours, showing you the inefficiency of the traditional engulfing bar entry espoused by others.

We expect more downside, so traders not already short can look for corrective pullbacks between 15680 and 15775. Downside targets for us are now 15050 if you haven’t taken profit off the board already.