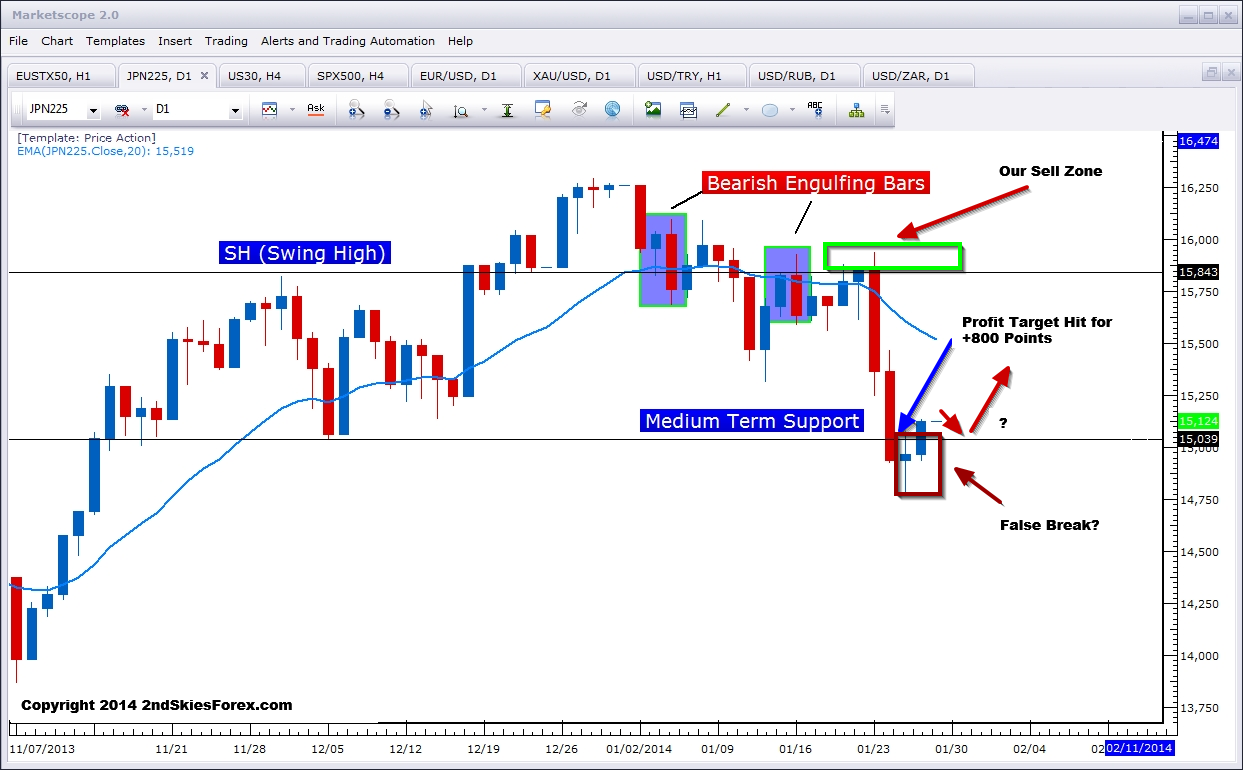

Nikkei 225 – Hits 800 Point Profit Target On Massive Selling

In our Jan 23rd market commentary, we followed up with our short trade on the Nikkei 225 in the 15840-15933 resistance zone. At that time, it was up over +500 points and on its way to its final target of 1505. Lo and behold a day later and the final target was achieved for +800 points and +8R. Congrats to the savvy price action traders who took this short and profited heavily from it.

As of now, the price action closed below the key support level on Friday, forming a doji on Monday testing that same resistance. Today the Japanese index broke above this key level, suggesting now a false break, and likely an overdone move. If this 15040 level holds the downside, we’ll likely see an attack on 15450. At the very least, this should mean a corrective phase for the index, and thus sideways movement for the rest of the week.

Another option to consider that this is a re-distribution phase for the uptrend, suggesting it is over and a likely range-bound to bearish market will ensue. I’ll look to sell any rallies towards 15450 with half sized positions. If that fails then will look to re-sell up around 15840 for a range play and possible bearish turnover.