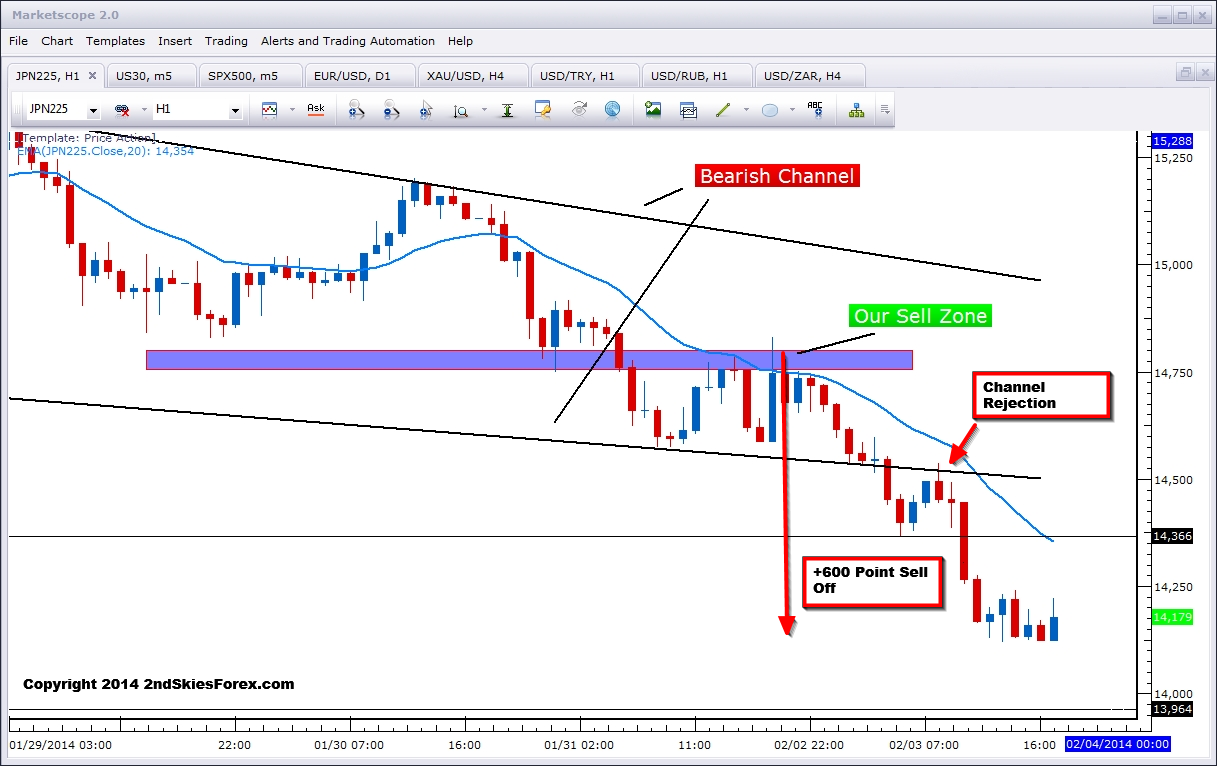

We we’ve been writing about for weeks now here and here, the Nikkei 225 has been offering up a lot of selling signals and opportunities as of late. In our most recent weekly market commentary, we suggested selling in the 14750/775 area targeting 14590 and 13975. The Japanese index has not disappointed, coming right into our 14750/775 selling zone, and then dropped over + 600 points. Anyone using a 85 point stop entering at at the low end around 14750 would have profited now over +600 points and for +7 R as savvy price action traders did.

We remain bearish and will look to sell on rallies. Our first area to get short will be around 14360/80, and will be happy to sell further up around 14475/14500. Downside targets are 14130 and 13990