In a sign that the recent stimulatory policy has failed, the Central Bank of Nigeria (CBN) has cut their benchmark interest rates by over 200 basis points. However, the rate cut could just be the tip of the ice berg as the Nigerian economy faces a self-imposed, diminished growth environment.

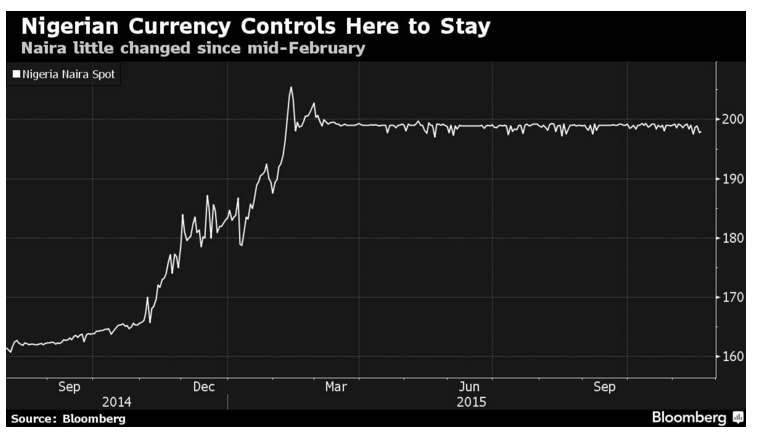

It is largely no surprise that the central bank has been forced into action given the recent schizophrenic fiscal policy, including capital controls, undertaken by the national government. February saw the scraping of the bi-weekly currency auction and a subsequent peg being applied at 198 between the naira and dollar. This action was followed closely by the CBN taking up arms to defend any devaluation of the naira through the introduction of foreign exchange capital controls.

Subsequently, the reduction of interest rates by over 200 basis points to 11.00% demonstrates a central bank that has largely lost control over monetary policy. The concept of stimulating economic activity and growth through a decrease in rates typically only works if you allow capital to flow freely throughout the economy. Adding additional bottle necks, in the form of foreign exchange capital controls, acts only as a disincentive to foreign investment in the region, and is unsustainable in the long run.

In addition, the joint failure of both government and central banking policy hides a deeper underlying problem, a lack of fiscal discipline. The Nigerian government has a problem not only with their external debt load but also with internal expenditure. As their foreign currency reserves dwindle, so too does their ability to raise additional funds on international debt markets at reasonable yields. The simple truth is that the current state of the Nigerian economy is such that government expenditure cannot be maintained at the current level.

In the short run, lower interest rates may assist the government in borrowing to fund an expanding budget but it fails to address systemic failures in the Nigerian economy. Moving forward, Nigeria requires a stable economy based upon incentives for entrepreneurs who drive economic activity rather than central planning and continued government meddling in the economy. Without some radical changes, the debt load will continue to increase to unsustainable levels, whilst economic growth will remain elusive.