Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

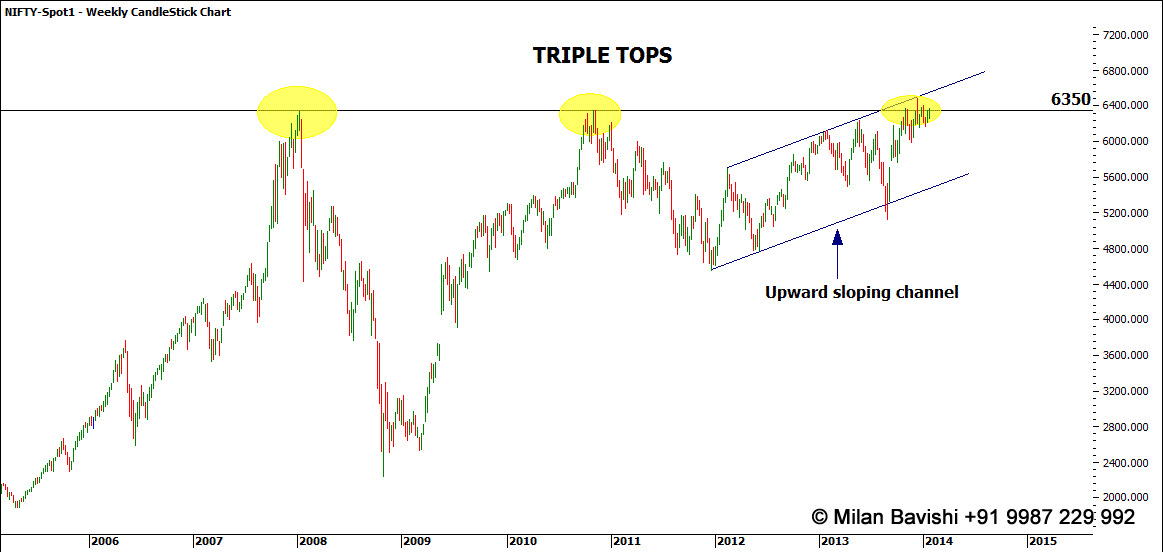

The Indian benchmark index, Nifty (futures) is trading in an upward sloping channel for the past 2 years. Currently, several technical patterns have developed which indicate that the index could a see correction of over 10% in the coming weeks.

Technical patterns observed in Nifty futures:

1. Nifty futures are trading at the higher end of the channel, so the probability of correction is higher.

2. At this higher end, around 6350 level, the index has made triple tops. The tops were made in 2008, 2010 and 2013.

3. In the last two months, the index has made bearish engulfing patterns, twice on the weekly charts.

So even though the momentum indicators are not in the overbought zone, the above mentioned patterns can have bearish implications on the index.

Apart from the above, USD/INR has started showing upward movement. In the past it is observed that a rise in USD/INR has proved bearish for Indian equity markets. Further, Nymex crude oil has reached near $100/barrel. The rise in US dollar rates coupled with rise in crude oil prices can negatively impact India’s Current Account situation. If that happens, expect flight of liquidity out of risky asset such as equity.

Over the next couple months there would also be alot of uncertainty due to general elections in May 2014. Remember, stock markets don’t like uncertainty!

Technically, if Nifty corrects, it could find supports at 6040 (mid-point) of the channel or at 5700 which is the lower edge of the channel. While the probability of upward breakout seems low, only a decisive break above 6500 would mean the start of a fresh bull run.