The crucial Chinese industrial production data, which might show some decline on the back of weak PMI data is due to be released.

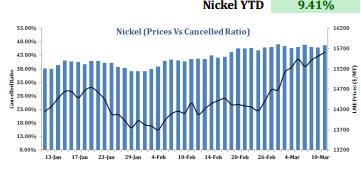

--Nickel prices in yesterday's trading session closed higher, in line with view yesterday as the outperformer compared to its peers, as it is getting continued support due to the supply concerns arising from the ore export ban by Indonesia. By the end of yesterday’s trading session, nickel prices closed higher by 0.6% and 0.9% at $15,650 and Rs.955.30 at LME and MCX platform respectively.

--From the inventory front, though nickel stock piles fell marginally in yesterday’s trading session, the cancelled warrants for the commodity increased by 2% from 123,870 MT to 125,934 MT on a daily basis . We feel that the increase in the cancelled warrants for the commodity might support the commodity to trade higher during the day.

--From the PVOI table, we infer that nickel might continue to trade higher as its prices rose along with a decent increase in its volumes and open interest. The volumes and open interest increased by 8% and 10% in yesterday’s trading session. The crucial Chinese industrial production data, which might show some decline on the back of weak PMI data is due to be released. Overall , we continue to maintain a positive bias on the commodity and suggest buying from the lower levels in spite of the concerns of weak Chinese data due to its own fundamentals.