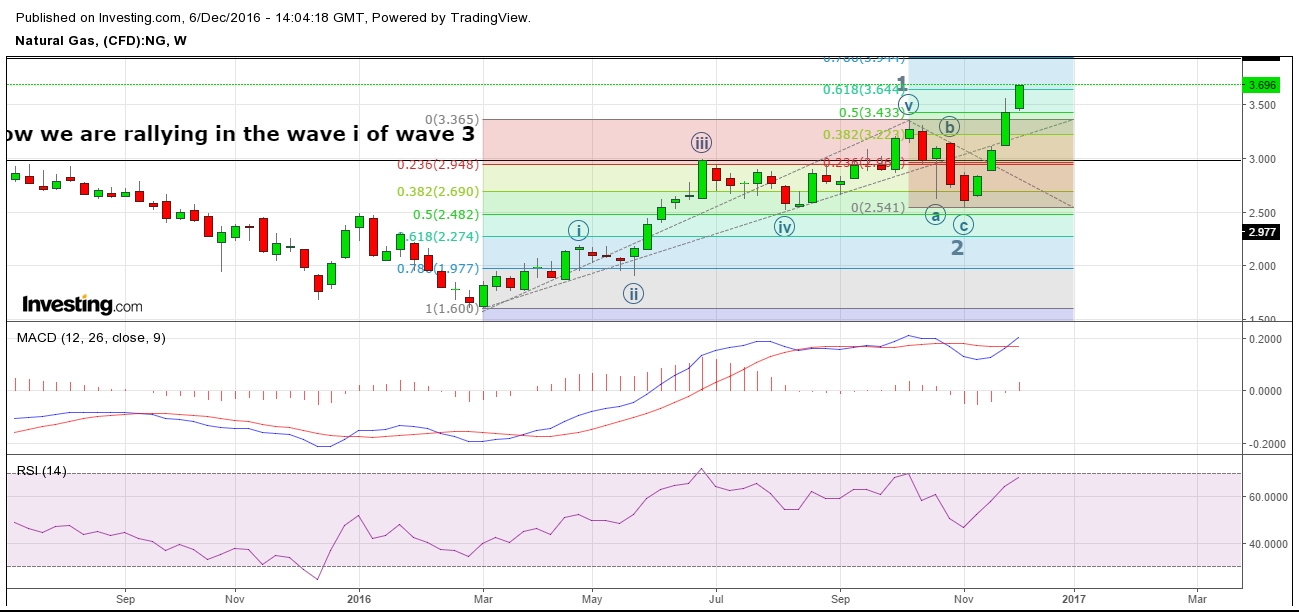

Here is the weekly chart of natural gas. Natural gas has completed its first five wave structure of wave 1 and retraced almost 50% in wave 2. Wave 2 finished exactly at the level of wave (iv) and printed the classical example of Elliot wave pattern. Right now we are in wave (i) of wave 3. Here is the weekly chart with the current count.

Minimum target for wave 3 is 4.326 if it does not extend. In case of extension, the further targets are 4.812/5.065/ and 5.430 in case of 1.618 times extension

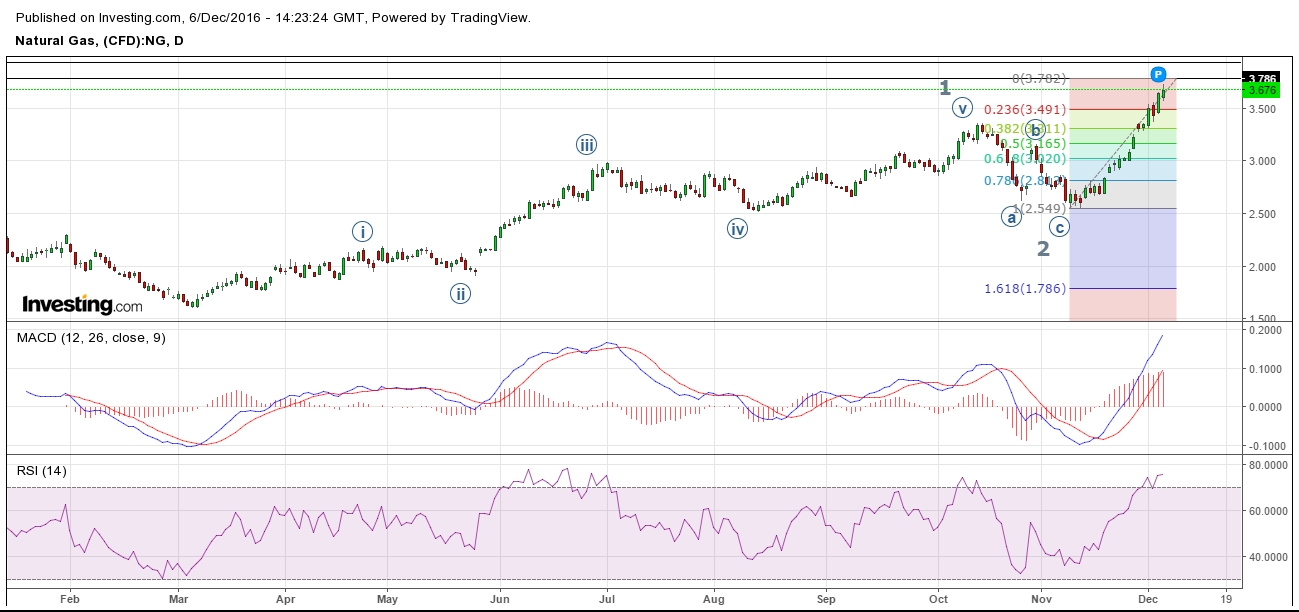

Here is the daily chart, which is showing that the wave (i) of wave 3 might be approaching towards its resistance in the range of 3.782 to 3.934 region. If this band offers good resistance, then we might get correction at least 38.20% of this entire rally and it should get support in the range of 3.365 to 3.308 area. Smaller time frame charts have started to show diversion already, which indicates a minor correction is waiting in the corner for short term traders.

Investors should continue to hold longs and wait till the journey ends. Who knows what the market is going to give you as a reward of holding, like in previous days when it soared to $6.4930.

Resistance: 3.80/4.326

Support: 3.56/3.44

We are in bull camp.