It would be possible to make another easing move at some point, which would re-center inflation expectations at 2 percent…That might be a great thing to do while the economy is running well. – St. Louis Fed President James Bullard (2019 voter)

There is the distinct risk that inflation expectations are too low and will be slow to recover to levels that are consistent with our symmetric 2 percent goal.– Chicago Fed President Charles Evans (2019 voter)

If the incoming data were to show a persistent shortfall in inflation below our 2 percent objective…then these are developments that the [Federal Open Market Committee] would take into account in assessing the appropriate stance for monetary policy. – Fed Vice Chairman Richard Clarida (permanent voter)

When it comes to the current global trading environment, a few things are clear:

- Traders are hyper focused on the Federal Reserve’s monetary policy stance…

- … and the Fed is hyper focused on inflation in determining policy, as the above quotes show.

Logically, it follows that any data around inflation will be critically important for global markets. And when it comes to inflation data, one of the best leading indicators is employee wages.

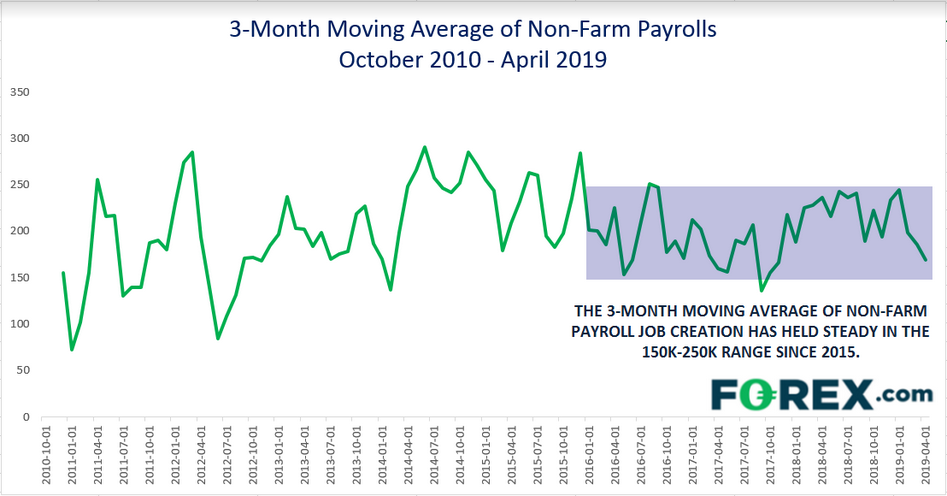

While traders love to watch the month-to-month fluctuations in the aggregate number of jobs created, most of those fluctuations are mere noise. As the chart below shows, the 3-month moving average of U.S. job creation has been remarkably steady in the 150k-250k range since 2015!

Source: BLS, FOREX.com

With that in mind, see the key numbers we’ll be watching in tomorrow’s NFP release below: