U.S. markets moved higher from session lows close in the green yesterday. The S&P 500 has hit a fresh high above 1,750. A much weaker than expected non-farm payrolls report (NFP) boosted sentiment the Federal Reserve will delay tapering back it asset purchase program.

The NFP report showed that U.S. employers added a tepid 148K jobs in September. We had expected a print of 180K new jobs. The Unemployment rate dropped to 7.2 percent. This is its lowest level since November of 2008.

The NFP was delayed since October 4, more than two weeks, thanks to the recent budget shutdown of the U.S. Government. We are now anticipating the Fed will delay pairing back its $85 billion a month bond buying program until sometime in 2014.

STOCKS

The S&P 500 was up 10 points to close above the 1,750 level for the first time at 1,754.67. The DJIA was up 75.46 points to close at 15,547.66. The Nasdaq Composite rose 9.52 points to end at 3,929.57. This is a new 13 year high for the tech heavy index.

Asian markets lost all early gains to move firmly lower. Would seem we have some profit taking occurring as investors want to lock in this week’s strong gains.

The Nikkei has fallen below 14,700. The Shanghai Composite has hit a one week low and is at 2,184.87. The Kospi, in South Korea, hit a two year high then fell back to 2,043.34. The S&P/ASX, in Australia, is holding on to its five year high. The Australian benchmark is bucking the trend and is higher at 5,374.80.

European markets were mostly higher, yesterday, on Fed hopes of delaying its asset purchase reduction. The French CAC finished flat on the day.

CURRENCIES

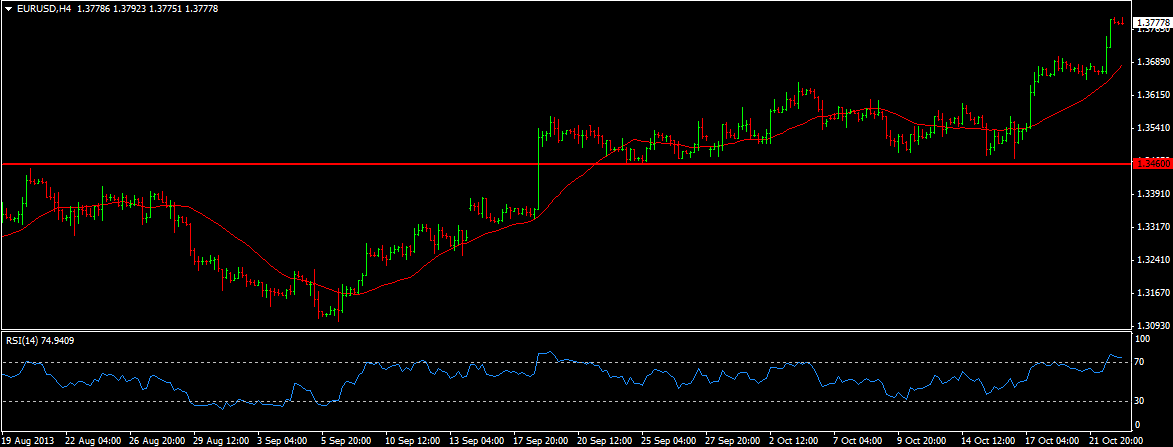

EUR/USD (1.3775) soared after the tepid NFP. We are aiming for 1.3900 at this point while above 1.3710. See below chart.

The U.S. dollar Index (79.187) continue to show weakness, especially after the NFP. We are targeting 78.89 at this point. We need to close above the key 80.00 level to relieve downward pressure.

The USD/JPY (97.424) has weakened from 98.47. Overall we are stuck in a sideways pattern from 97.00 towards 99.49/50 for the time being.

COMMODITIES

WTI Crude (97.87) has been falling as crude inventories in the U.S. are rising. WTI Brent (1009.82) is consolidating for the last few trading session.

Copper (3.3065) is back above 3.30 and saw a high at 3.355 yesterday. We are bullish for 3.400 if we see a break above the 3.376.

TODAY’S OUTLOOK

We continue to get a plethora of data out of the U.S. today. Mortgage applications, import/export prices (delayed from September), FHFA home prices and oil inventories.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

NFP Is Weak. No Tapering In Sight?

Published 10/23/2013, 06:02 AM

Updated 05/14/2017, 06:45 AM

NFP Is Weak. No Tapering In Sight?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.