Investing.com’s stocks of the week

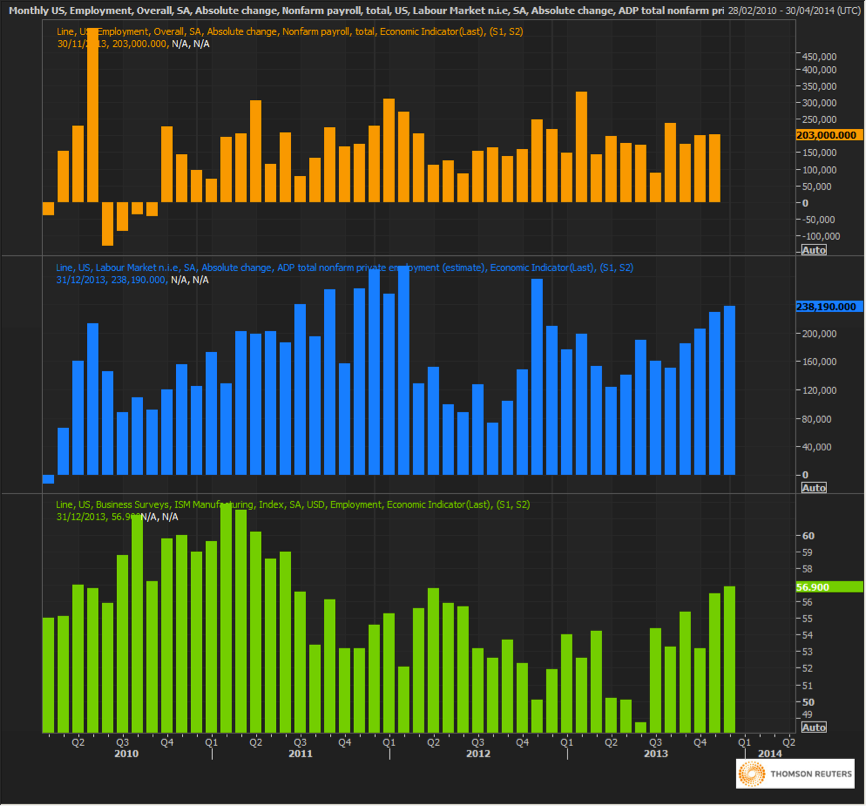

The upcoming NFP data will, as always, be keenly watched. The result will without doubt presage an increase in volatility throughout the majors and beyond. The forecasts, whilst not entirely sage, are supportive of the USD.

1. The I.S.M. report presented a reduction in service sector activity, however, the employment component of the report saw a rise, indicating an increase in the number of jobs in the service sector over the month before. This in turn would suggest an upcoming improvement in NFP figures compared to last time.

2. In addition ADP data was better than forecast, though it seemed not to bolster the Dollar in any real sense, USD/JPY rose briefly to 105. Conversely EUR/USD met consistent resistance on one month lows but recovered.

There are several possibilities for Friday:

1. Lower than expected NFP data; sub 160k for significant impact

2. Higher than expected NFP data; above 220k

3. Expected NFP data.

1) Though improbable by consensus, it could play out due to the upward revisions following the better than expected ADP number earlier in the week. If we see either of these we would expect a prompt sell off in the USD on speculation of a poorly timed tapering policy from the Fed, especially given the FOMC minutes showed broad consensus for the taper with some even after a more aggressive tapering of QE.

We give this a low probability and would look for a number sub 160k for this to have any significant longer term impacts on the USD, this is likely to have the largest effect on the markets in terms of volatility and offer the best risk reward for an intraday trade.

Look for large moves in the EUR/USD or GBP/USD.

2) The second possibility is that we will continue to see improvements in Non-Farm and a beat on expectations. This would lead to a stronger USD with weaker currencies (such as JPY) coming under pressure from the short trade. A number above 220k is likely to have a longer term impact.

An important factor for traders in the ‘considerably higher’ scenario will be to wait until the initial move to settle as we expect there would be some initial stop runs and moves for better pricing.

3) The last possibility is a number relatively in line with expectations, look for a number between 190k and 220k. We would expect some mild USD strength although would expect this number is already largely priced in.

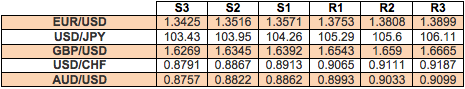

Key Resistance and Support