The market’s trepidations concerning the US labour market are definitively in the rear view mirror after the second consecutive resilient report. The 255k rise in nonfarm payrolls transcended even the most optimistic of expectations.

It is easy to check off good-news boxes within this stellar jobs report and tough to find any negatives. While stopping well short of stating USD Bulls are back in the driver’s seat, from the standpoint of the Fed narrative, the Labour market storyline could be very USD supportive and consistent with a US rate hike in December or even September.

Australia- A Crowded House

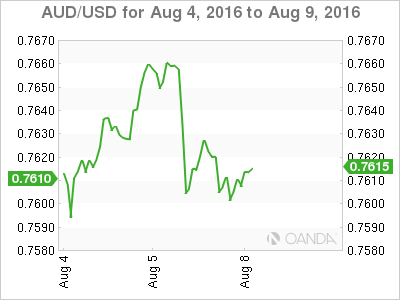

In the wake of strong US payroll data, the Australian Dollar held up even in the face of broader US strength. While clearly benefiting from the availability of cheap US finance, it would be naïve to assume the AUD would not experience substantial outflows if US rate hike expectations continue rising.

From a trader’s perspective: The current AUD Carry trade, given the small interest differential, is a tough way to make a living. Not only is this trade getting crowded, but collecting nickels (5 cent coins) in front of a freight train can be a risky business, especially when the prospects of narrowing US interest rate differentials, coupled with broader USD strength, looms on the horizon.

When the Fed raises interest rates, there will be a rewritten risk Chronicle as the potential for market fallout will intensify. How the Fed navigates the path to interest rate normalisation will be the medium term key for not only the Australian dollar but other G10 currencies. So it is imperative to keep close tabs on the Fed Fund Futures. The market is now pricing around a one in four chance of a September tightening a close to a 50/50 chance of a rate hike by the end of the year.

If there is another robust US jobs report in August, the near-term Fed rate hike expectations will likely jump twofold. Moreover, if the US election polls turn skewed for status quo by the next FOMC, the Feds may conceivably pull the rate-hike trigger as early as the September meeting.

Meanwhile, the Australian dollar trades advantageously against most major currencies and on the back of rising risk appetite, with the blend of the carry trade and the country’s Triple-A credit rating adding to appeal.

YEN -Not Quite Dire Straits

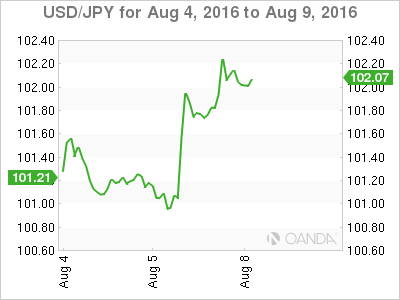

The revitalised labour market report came in at a good time for the Bank of Japan (BOJ) and has taken some pressure off the ¥101 assault. However, there needs to be more commitment from the BOJ to reinsure investors that Yen’s strength will deplete. With that in mind, if there was any lesson the BOJ could take away from the BOE policy decision, it is that size does matter when it comes to QE, as evidenced by the impact from the BOE actions on the currency and stock markets.

Now that Fed rate hike expectations are back on the table after Friday’s stellar NFP, there is still the overhang from the US Q2 GDP disappointment to factor into the equation. After all, the GDP miss put the bearish Fed committee members back in the driving seat. However, I expect the robust labour markets will give sufficient underlying support for the economy, which should shift the most dovish elements of the FOMC to a more hawkish stance. I do not view Friday’s NFP as an absolute game changer for USD/JPY, but it does offer a robust USD tailwind that may provide a significant and much needed near term buffer for USDJPY, while Kuroda and team plot their next move.

Yuan – No Widespread Panic

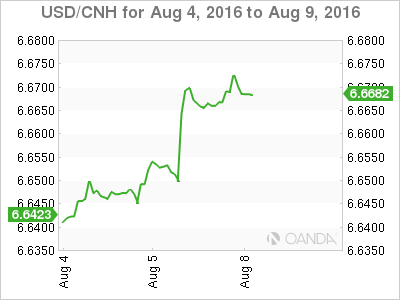

It is a very busy economic diary for China this week, which could bring the Mainland’s struggling economy back to the forefront.

Yuan volatility dropped to a nine-month low on expectations that the People’s Bank of China (PBOC) will maintain its iron fist on currency depreciation. This week’s heavy economic calendar, along with a sudden shift in US rate hike expectations, could be a precursor to another bout of Yuan weakness. The four key economic risk factors include CPI, Industrial Production, Retail Sales and Trade Data.

On the inflation front, the CPI should remain subdued, but a print significantly below expectations will increase the likelihood of further monetary easing.

Industrial production is likely to stay weak as the traditional smokestack industries in China continue struggling with few signs of bottoming out.

As China’s economy transitions from big industry to more consumer drove demand, Retail Sales figures play an important gauge for the ‘new’ economy. The slowdown in growth may start to affect this data as 2016 continues to be a year of economic struggle. July forecasts are coming in at 10.4 % Year over Year.

The Trade Data, while infamously questionable, is expected to show a deceleration in both export and import growth, coming in at -3. % and -7. % respectively, with the surplus to fall marginally to 47.6 billion (according to economists polled by Reuters).

Adding layers to the confusion about the PBOC’s rudderless monetary policies, late last week the PBOC published its Q2 Monetary Policy Implementation report. Within the report, it stated that a further cut in reserve requirements would add too much liquidity to the financial system and lead to Yuan depreciation expectations. This shift in policy is not a comforting sign to investors who may have been relying on additional stimulus to aid in economic recovery. Instead, this heightens concerns regarding China’s over-reliance of debt-powered stimulus.

USDASIA – Mixed ASIA

The hits keep on coming for Asia’s most struggling currency. The Ringgit remains wobbly mired by political scandal and falling energy prices. AS energy prices started to recover, the MYR took another blow when the US rate hike expectations increased on the back of Fridays NFP. However, with energy prices set to resume last week’s recovery the recovery we may see a more upbeat tone for the MYR this week

.AS for the rest of FX Asia, capital markets continued to see surging portfolio inflows on the back of the latest BOE easing and coupled with a relatively stable RMB, most ASEAN currencies should continue to see short-term support

In Thailand, there was an overwhelming Yes support to the constitutional referendum, which from a political and market landscape perspective should be a short term positive as investors could expect political calm as the country heads to its 2017 elections.