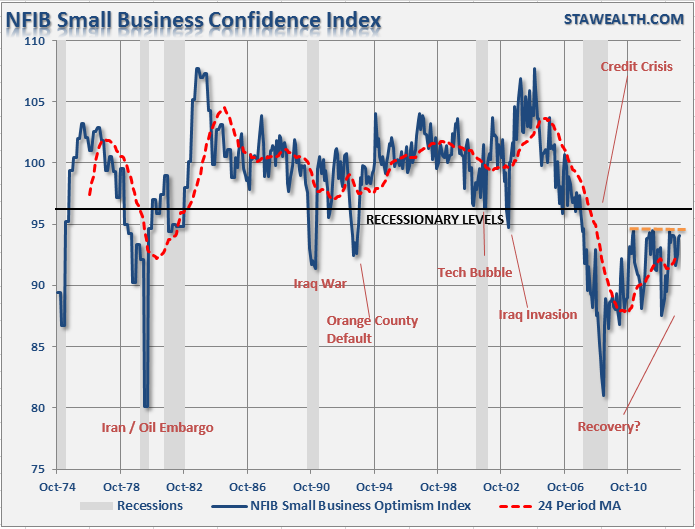

In last month's review of the National Federation of Independent Businesses survey, I discussed the overall subdued levels of optimism by small business owners.

"The December report showed that small business optimism did end the year slightly higher than November coming in at 93.9. Unfortunately, this is still well below the previous 3 mid-year readings of over 94 and 6 points below the pre-recession average."

The survey for January showed some very modest improvement in confidence which rose to 94.1 versus 93.9 in December. On the positive side, plans to increase employment rose by 4 to 12%, those expecting higher real sales rose by 7 to 15%, and inventory concerns improved by 3 to -2%. On the negative side was pretty much everything else. Plans to make capital outlays fell by 2, inventories slipped by 1, job openings declined by 1, earnings trends retraced by 5 and businesses believing this is a "good time to expand" backed up by 2.

In an attempt to put a positive spin on really rather disappointing data the NFIB stated:

"Only three of the Index components improved, two were unchanged, and five were lower indicating that the small business half of the economy was still adding little to growth beyond that needed to support population growth. Technically, January marks the third monthly increases in a row, but unfortunately, each monthly increase is lower than the last. But while improvements are losing steam, the increase still beats a decline."

My father would have phrased it as "the increase is better than a sharp stick in the eye." While it is true that the data did improve, the problem remains that the vast majority of the data points in the survey remain at levels normally associated with recessions. This is hardly what would be expected of an economy in its fifth year of expansion.

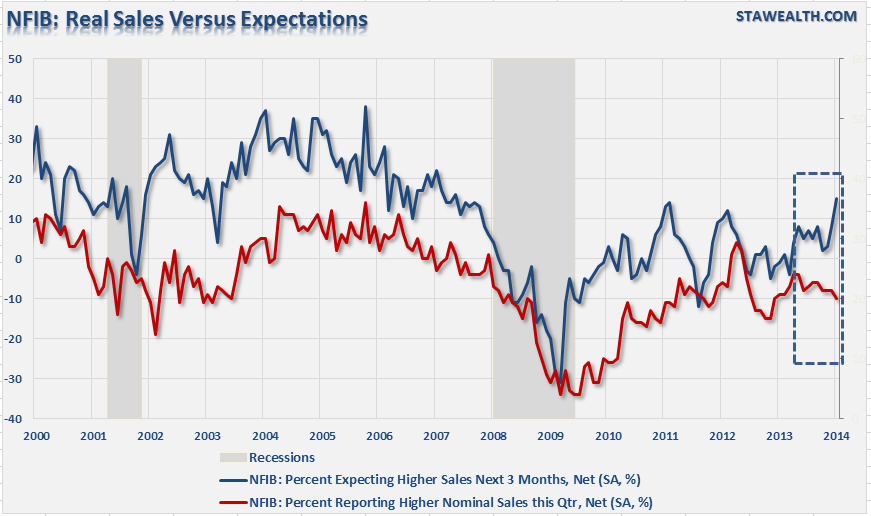

Furthermore, the issue of sales expectations versus actual sales really jumped out at me. With each passing month, there has been significant "hope" that consumer demand is going to pick up in the near future. However, actual sales have failed to occur. The chart below shows the historical relationship of expected sales over the next quarter versus what actually happened in the past quarter. The current divergence is quite extreme.

In the months ahead there will either be a very sharp pickup in consumption or expectations will fall.

The Impact Of Obama's Executive Actions

This past week President Obama once again took to his "pen and phone" to use executive action to extend the corporate mandate of the Affordable Car Act by another year. On the surface, this would appear to be a boon to the small businesses with less than 100 employees that his action affects. However, the reality may be somewhat different.

Small business owners are excellent allocators of capital. They deal daily with changes in demand, supply and impact of their decisions on profitability. When a new requirement, tax or regulation is imposed, business owners adjust accordingly making strategic decisions and moving forward.

The problem currently is that when the President arbitrarily changes rules or regulations, it leaves business owners in a state of uncertainty. Rather than knowing for certain what the costs and requirements will be under the Affordable Care Act and being able to adapt accordingly, they are now left in a state of uncertainty for another year. This will continue to suppress hiring and capital expenditure plans as the inability to plan means retaining more capital for an uncertain expense in the future.

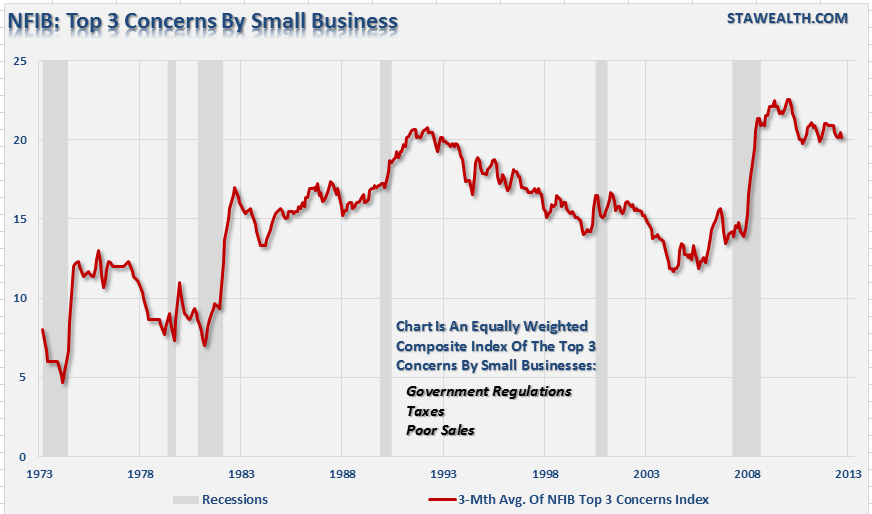

The chart below is a reflection of the three biggest impediments to small business planning, hiring and capital expenditures - government regulations (i.e. ObamaCare), taxes and poor sales (see chart above).

With the current President constantly threatening to enact legislative action through executive orders, such as immigration or income inequality reforms, is it any wonder that the concern composite remains near its highest levels on record?

The Affordable Care Act (ACA) guarantees higher taxes and insurance premiums on both individuals and business owners. Many businesses will see their premiums increase sharply this year as their annual policy renewals take effect. However, this does not include what will happen to their costs should their current policies not comply with the new requirements. The inability to plan for what the actual impact of the ACA will be in another 12 months will keep business owners on the defensive.

Bill Dunkleberg, NFIB Chief Economist, reiterated a very important point I made recently in "Summer Of Recovery Or Just A Bounce:"

"Last year finished with a fair uptick in economic activity, but probably not as strong as the 'headline' GDP numbers made it look. Overall, GDP was up only 1.9 percent in 2013, down from 2.8 percent in 2012. But the second half of the year posted above trend growth numbers, a rare showing in our 5 year recovery. Exports were strong, that’s good for manufacturing output, but less so for jobs – productivity looking good. A huge share of the growth was in inventory building, nice while it is happening, but usually followed by sub-normal production later as excess stocks are worked off. That will depress activity in the first half of 2014 and keep some prices down."

Each inventory restocking cycle over the past five years has mistakenly been believed as the start of an organic economic recovery. Each time it has turned to disappointment as the real economy is far weaker than the Wall Street economy. While surging asset prices driven by artificial stimulus may boost confidence for the top 10% that actually have investible assets, for the rest of America it has little affect on their ability to make ends meet as wages remain stagnant while costs of living rise.

However, this is something that the current Administration is well aware of which is why there is a continued focus on the policies, while bad for the long term economy, that will get votes in the short term. As Bill states:

"As noted last time, economic policy will be dominated by vote getting, not sensible strategies to improve economic growth and job creation, to wit, with a 20 percent teen unemployment rate, liberal policy makers want to raise the minimum wage. This will, barring a surge in economic activity that raises the values of these workers, undoubtedly worsen unemployment and job opportunities in the future."

While confidence has improved in recent months it appears to be a statistical issue within the weighting of the survey. With a bulk of the measures either flat or negative in January, and particularly in the areas of future expectations, it doesn't bode well for the months ahead.