Each month I do a review of the National Federation of Independent Business Small Business survey as it is a reflection of what I see as a small business owner/entrepreneur myself. Last month's report specifically discussed the lack of optimism by small businesses during the holiday shopping season (November And December):

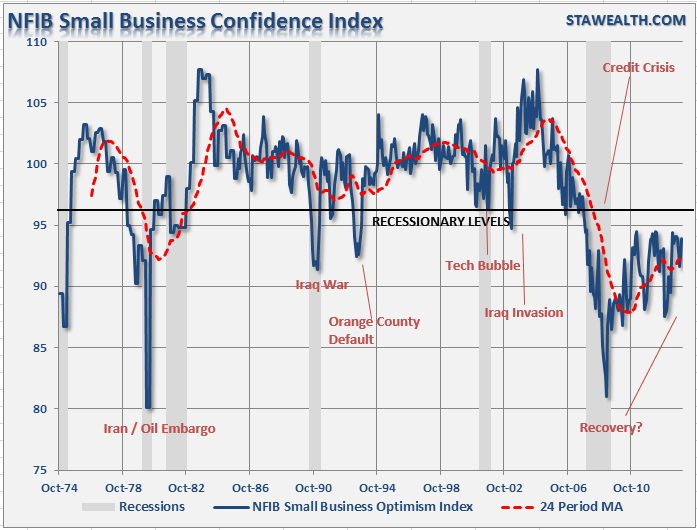

The latest release of the small business survey by the National Federation of Independent Business (NFIB) showed only a small rise in optimism following the government shutdown in October. As discussed previously in "NFIB: Optimism Fades"

'Two components, the outlook for business conditions and the outlook for real sales gains, accounted for 52 percent of the Index decline. A weaker outlook for business produced dissatisfaction with inventory stocks, and fewer plans to create new jobs. The average value of the Index since the recovery started is 91, 8 points below the 35 year average through 2007 and well below readings typically experienced in a recovery. The current reading is hardly something to cheer about.'

Unfortunately, the overall situation did not improve much in November as would have been expected by the onset of the holiday shopping season which did lead increases in employment needs but economic expectations deteriorated. From the NFIB:

'Owner sentiment increased by 0.9 points to 92.5, a dismal reading as has been the case since the recovery started. Over half of the improvement was accounted for by the labor market components which is certainly good news, lifting them closer to normal levels. Expected business conditions though deteriorated further - lots of dismal views of the economy coming next year. The Index has stayed in a “trading range” between 86.4 and 95.4 since the recovery started, poor in comparison to an average reading of 100 from 1973 through 2007.'

The January report showed that small business optimism did end the year slightly higher than November coming in at 93.9. Unfortunately, this is still well below the previous 3 mid-year readings of over 94 and 6 points below the pre-recession average.

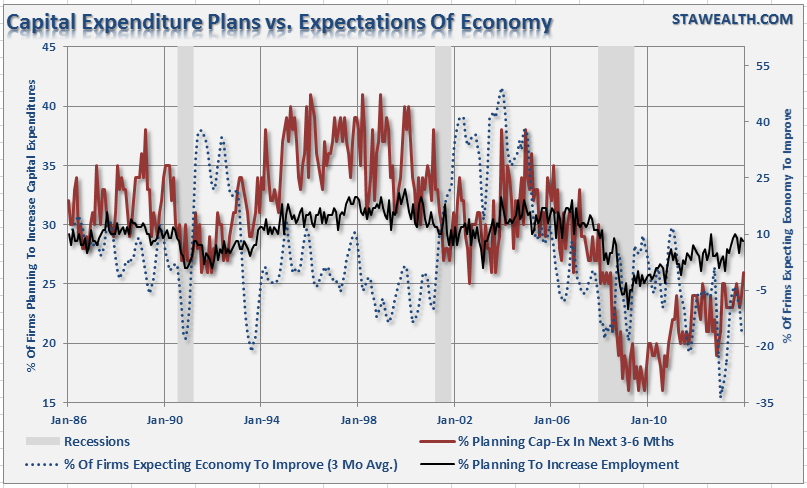

The good news is that the report showed improvement in capital spending intentions which rose by by 9 points. Job creation also hit the highest level since February 2006. Unfortunately, all of these levels, included the percentage of firms expecting economic improvement, while improved are still below historical recessionary troughs. This doesn't say much about an economy that is five years into recovery.

Here is some more color from the NFIB:

"While there has been no sign that a real recovery has begun, we can be encouraged that the economy is at least crawling forward and not heading in reverse," said NFIB chief economist Bill Dunkelberg. "Some segments of the economy are showing improvement (manufacturing, construction, professional services), but consumer spending, especially on services (70 percent of consumption), has lagged. Spending on items such as automobiles has certainly increased, however a corresponding rise in hiring has not yet materialized."

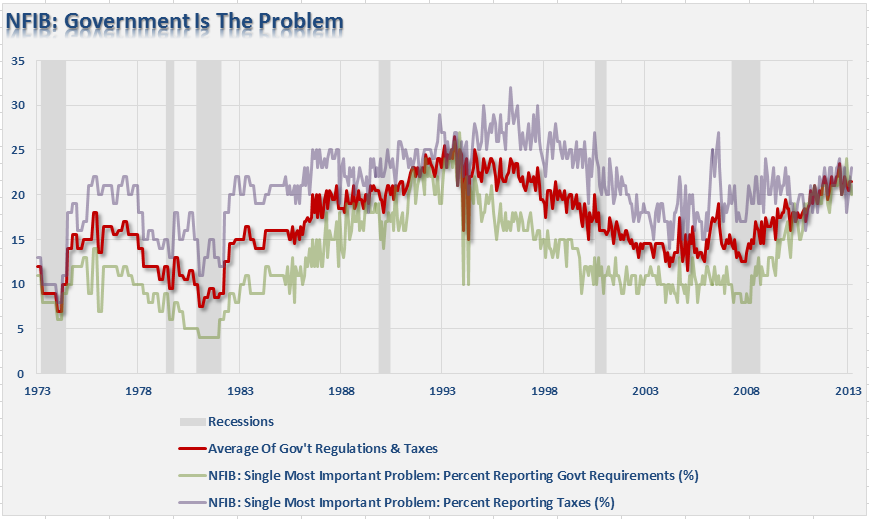

However, the real headwind that is keeping businesses from hiring, expanding and increasing wages stems from one primary source. To wit:

"Two monthly advances could be the start of a more positive trend, but there are many threats to improvement, including the majority of respondents feeling the current climate is not 'a good time to expand substantially' blaming the political climate, something that may not improve in an election year."

The chart below shows the two single biggest concerns relating to small business owners from the recent survey: Government Regulations and Taxes.

The issue of Obamacare, as I have addressed several times recently, is going to continue to generate issues for small business owners as well as individual consumers.

"Increasingly, experts in health insurance are becoming concerned that many of these first-time buyers will be in for a shock when they get medical care next year and discover they're on the hook for most of the initial cost.

If we just assume that healthcare costs rise by just $100 per month, based on a national per capita income level of $47,585 as of Q3-2013, that will equate to a $73.25 billion dollar impact to the overall economy each quarter going forward."

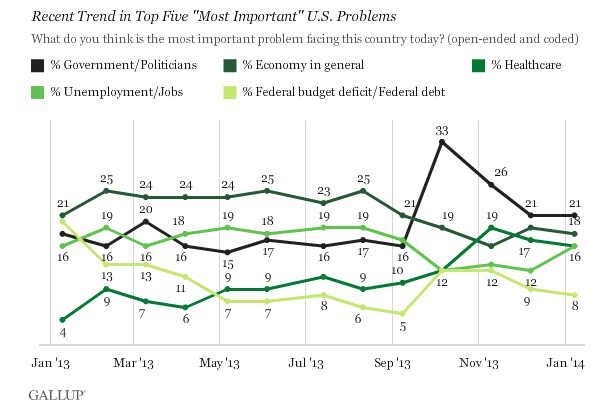

Of course, it is not just the NFIB that is seeing that government is the impediment to future economic growth. A recent Gallup poll showed exactly the same concerns.

"Americans start the new year with a variety of national concerns on their minds. Although none is dominant, the government, at 21%, leads the list of what Americans consider the most important problem facing the country. The economy closely follows at 18%, and then unemployment/jobs and healthcare, each at 16%. No other issue is mentioned by as much as 10% of the public; however, the federal budget deficit or debt comes close, at 8%."

What is interesting is the recent push higher in the "Unemployment/Jobs" category. The 4 point rise may point to the fact that the rather dismal December job report may not be just a weather related phenomenon. However, as discussed above, the other rising concern is "Healthcare" with "Government/Politicians" topping the list.

What issues were at the bottom of the list? Welfare, Immigration and the Wealth Gap.

Ironically, while these issues all ranked so low that they barely made the list of concerns, there are the very issues that are the focus of the current Administration. Unfortunately, these issues are not the ones currently impeding economic progress, but they are the issues that will garner "votes" come the mid-term elections.

Bill Dunkleberg summed it up best stating:

"The President thinks the way to address the malaise in the economy is to give another $26 billion to the long-term unemployed, shown to produce new jobs by 'independent economists' (we know who that is) according to the President. If you borrow $26 billion from China and give it to consumers, it probably does have a positive impact, but does nothing to fix the economy or encourage labor force participation or improve the labor force. Servicing this debt will soon put a real crimp in the government budget.

Also proposed are tax breaks in some part of the country for hiring unemployed people (which only benefits employers who were going to hire anyway; it doesn't produce extra job creation). Add to that a proposed increase in the minimum wage to $10, alleged to create more spending and jobs, proven by real economists (and common sense) to be incorrect. This is further evidence (if we needed it) that economic policy is about politics and winning votes, not improving the economy.

Even with the improved outlook, more owners still expect the economy to be worse mid-year than expect it to be better (27 percent vs 17 percent). Small business owners will also come face to face with the reality of Obamacare as the year progresses. Since it is an election year, the main theme will be addressing the disparities in income and wealth (i.e. tax the rich and increase welfare programs) rather than promoting policies that would create jobs and raise incomes in a growing economy. This year, policy will be all about votes."

While economists are raising their forecasts for 2014, there seems to be little change in the real underlying fundamentals. As I stated previously in "Will Corporate Spending Save The Economy:"

"Corporate decision making is always based around profitability. This is particularly the case with publically traded companies whose executives are compensated through stock options and grants. The problem going forward is the topline revenue is likely to weaken for two primary reasons:

1) The majority of the benefits received from cost reductions has already been seen.

2) With wage growth stagnant personal consumption expenditures have been on the decline as cost of living has risen faster. The onset of higher healthcare costs from the ACA in 2014 and 2015 will likely impede that growth further.

The importance of the second point should not be dismissed. Corporate profits are ultimately driven by consumer demand. If consumer demand weakens, so too will profitability which will keep businesses on the defensive."

It is quite apparent from both individuals and businesses that the government is the real issue that is impeding economic progress. Maybe it's time that the current Administration did a little less talking and did a little more listening to what the real drivers of the economy are saying.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

NFIB Gallup: Government Regulation, Taxes Of Concern

Published 01/16/2014, 02:05 AM

NFIB Gallup: Government Regulation, Taxes Of Concern

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.