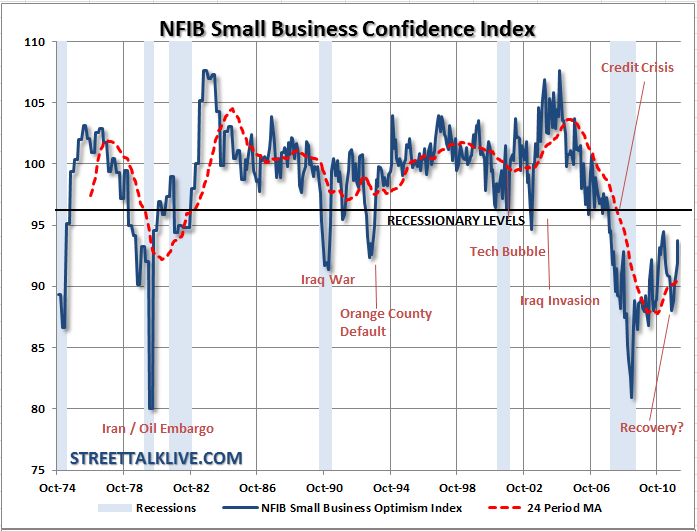

Small businesses are responding to the recent improvements in the economy. The latest release of the NFIB Small Business Optimism index rose in December for a 4th month almost recovering the losses from the summer confluence of the Japanese earthquake/tsunami/nuclear crisis, the debt ceiling debate and the Euro-crisis. The most recent release ticked up to 93.8 from 92 in November with many of the internals improving as well.

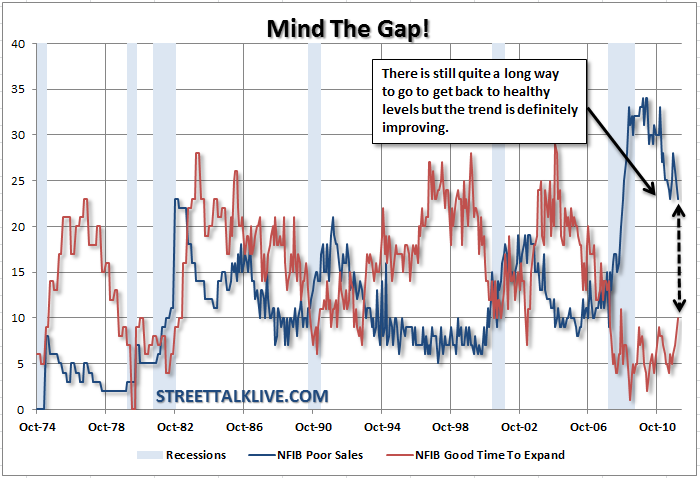

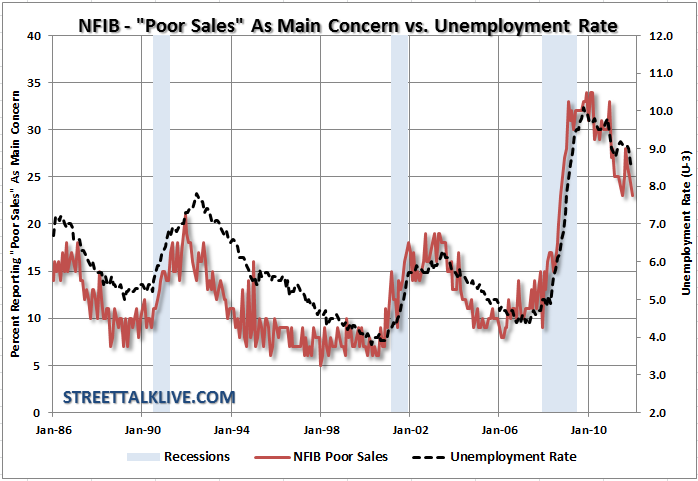

One of the biggest concerns that we have been watching for some time is the view of "poor sales" as a primary concern for small businesses. "Poor sales" has been a testament to a weak consumer which impacts the final demand on businesses suppressing future expansion.In the recent months that concern has been lifting and the view by small businesses that this is a good time to expand operations is beginning to thaw.

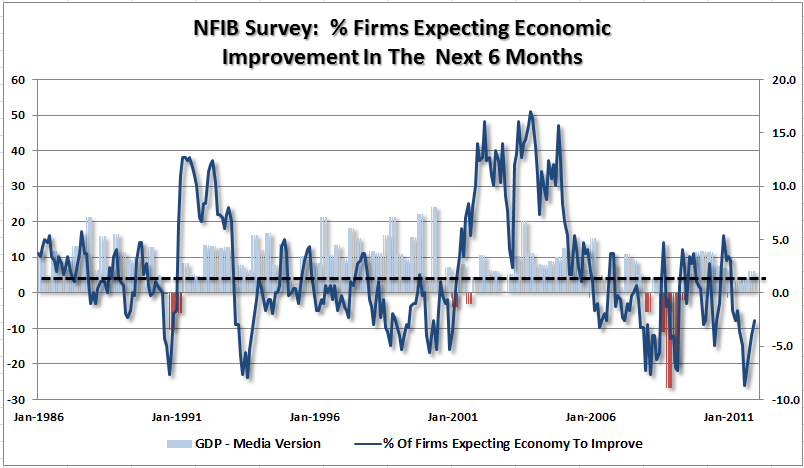

This improvement in attitude was reflected throughout the survey with plans to increase inventories rising by 2%, expectations of an improving economy rising 4%,the expectation of higher real sales rising by 5% and improving earnings trends rising by 6%. However, we must keep this improvement in line with reality. Sales DO remain a real problem for many small businesses - it is just beginning to improve somewhat. At a -7% there are still more firms with sales trending down than up. While consumption definitely increased in the past couple of quarters, most likely due to some pent up demand post the economic shut down this past summer, the question now remains whether or not that trend is sustainable going forward.

The sharp decreases in the personal savings rate combined with the sharp rise in consumer credit points to a consumer that is struggling to make ends meet. Given the declines in real personal incomes in recent quarters the sustainability of improvement remains a key concern.

While the improvement in the index is certainly welcome, and helps bolster our recent "buy" signal, this definitely does not mean it is an "all clear' sign. Employment trends have been improving while the outlook for sales improves. However, it hasn't improved enough to substantially increase employment within small businesses. Plans to make further capital outlays remained flat in the most recent report with plans to increase employment declining by 1% along with job openings which fell by 1%.

Access to credit remains at the bottom of concerns with only 4% reporting financing as a primary concern. Money is available to businesses but most owners are not interested in a loan to finance the purchase of equipment that they do not need. Cash is king and pushing employees to work longer hours for less pay is easy when an excess labor pool is readily available. Furthermore, while "expectations for the economy to improve" have increased in recent months - those expectations are still at recessionary levels.

Overall the report is positive. That is the good news. However, the index still remains entrenched well below normal healthy levels and any shock from another Euro-zone crisis or recession, political drama in the U.S. or a sharp rise in gasoline prices could change that landscape quickly.

As NFIB Chief Economist Bill Dunkelberg stated “But make no mistake: the economic winter is still here. Similar gains in the early part of 2011 quickly faded, and the Index is still well below where it should be at this point in the recovery. The economy appears to be slowly recovering, resolving imbalances in debt, housing and the like. But, it is unlikely that growth will be much better than 2011 even with a solid fourth quarter GDP growth. There is still a lot of work to be done.”

We agree with Bill's assessment. We are currently very long in the tooth in the current "economic recovery" and have seen very little of it so far. We remain cautiously optimistic with a watchful eye for breaks in the data. Consumer data will be the key to puzzle in the coming months ahead.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

NFIB - Small Businesses More Optimistic

Published 01/11/2012, 01:49 AM

Updated 02/15/2024, 03:10 AM

NFIB - Small Businesses More Optimistic

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.