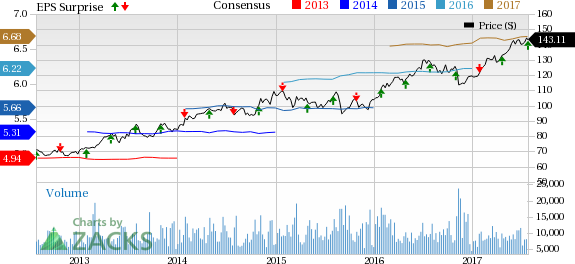

NextEra Energy, Inc. (NYSE:NEE) reported second-quarter 2017 adjusted earnings of $1.86 per share, beating the Zacks Consensus Estimate of $1.76 by 5.7%. Reported earnings were also up by 11.4% year over year.

The year-over-year growth in earnings was primarily due to solid contribution from both Florida Power & Light Company and NextEra Energy Resources segments.

On a GAAP basis, NextEra Energy recorded second-quarter earnings of $1.68 per share, up from $1.16 a year ago. The variance between GAAP and adjusted earnings was primarily due to loss of 32 cents from the non-qualifying hedges and merger related expenses of a penny. The loss was offset by a one-time gain of 14 cents from income tax expenses and income of one penny from Spanish solar projects.

Total Revenue

In the second quarter, NextEra Energy’s operating revenues were $4,404 million, surpassing the Zacks Consensus Estimate of $4,353 million by nearly 1.2%. Reported revenues also improved 15.4% from $3,817 million a year ago.

Segmental Results

Florida Power & Light Company (FPL): Earnings came in at $1.12 per share, up 16.7% from the prior-year quarter figure. Revenues amounted to $3,091 million, up 12.4% from $2,750 in the prior-year quarter.

NextEra Energy Resources (NEER): Quarterly earnings came in at 74 cents per share, up from 67 cents in the year-ago quarter. Revenues improved 33.5% to $1,295 million.

Corporate and Other: Quarterly earnings were breakeven compared with year-ago earnings of 4 cents. Revenues in the reported quarter came in at $18 million, down 81.4%.

Operational Update

In the reported quarter, NextEra Energy’s total operating expenses were up 17.8% to $3,119 million primarily due to higher fuel, purchased power and interchange.

Operating income rose 9.9% to $1,285 million from $1,169 million a year ago.

Interest expenses in the reported quarter were $430 million compared with $602 million in the year-ago quarter.

In the reported quarter, Florida Power & Light Company’s average price of electricity went up 10.6% year over year and total average customer count went up 1.3% year over year.

Financial Update

NextEra Energy had cash and cash equivalents of $642 million as of Jun 30, 2017, compared with $1,292 million as of Dec 31, 2016.

Long-term debt as of Jun 30, 2017 was $30.4 billion, up from $27.8 billion as of Dec 31, 2016.

NextEra Energy’s cash flow from operating activities in the first half of 2017 was $3,165 million, compared with $3,270 million in the year-ago period.

Guidance

NextEra Energy reiterated its adjusted earnings guidance in the range of $6.35–$6.85 for 2017 and $6.80–$7.30 for 2018. The company expects earnings to grow at a compound annual rate of 6–8% per year through 2020, off a 2016 base.

Zacks Rank

NextEra Energy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Peer Releases

Xcel Energy (NYSE:XEL) is scheduled to report second-quarter 2017 results on Jul 27. The Zacks Consensus Estimate of 42 cents remained unchanged in the last 30 days.

CMS Energy Corp. (NYSE:CMS) is scheduled to report second-quarter 2017 results on Jul 28. The Zacks Consensus Estimate of 42 cents remained unchanged in the last 30 days.

Entergy Corp. (NYSE:ETR) is slated to report second-quarter 2017 results on Aug 2. The Zacks Consensus Estimate of $1.22 moved up by a penny in the last 30 days.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

CMS Energy Corporation (CMS): Free Stock Analysis Report

Xcel Energy Inc. (XEL): Free Stock Analysis Report

NextEra Energy, Inc. (NEE): Free Stock Analysis Report

Entergy Corporation (ETR): Free Stock Analysis Report

Original post

Zacks Investment Research