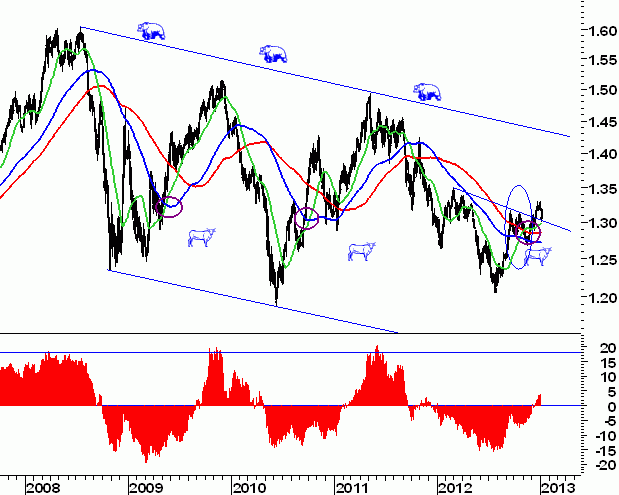

After the fear for of the fiscal cliff, the U.S. is now facing a new political battle related to its debt ceiling. The increase in the maximum level of public debt will be necessary to avoid default by the United States and this should be of benefit to XAU/USD, which is historically correlated to the amount of U.S. debt. The only noteworthy macroeconomic data in the coming week will be those related to the U.S. trade balance. Considering our medium term bullish view, the return of EUR/USD close to the support of area 1.30 provides us the opportunity to enter long on the cross with a target of 1.349.

The Start Of Europe's Electoral Year

While 2012 has been the year in which the ECB has managed to take time, 2013 will be the year of the policy responses from Italy and Germany. In Italy there the political elections will be held in February, while in Germany the election date is scheduled for the autumn. Meanwhile, the ECB meeting is scheduled on January 10th at the same time with the one of the Bank of England.

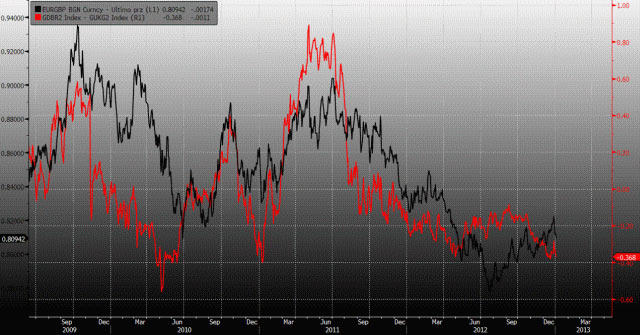

The most awaited event might be the trend of the Pound. EUR/GBP historically experiences a very bad first month of the year with an unfavorable seasonality on nine of the last 10 years. And anyway, a phase of pressure on the supports of area 0.80 for EUR/GBP is predictable on January, also to cover the difference of the spread between two-year German and English yields. As we can see from the chart the GER-UK 2 years spread has fallen from September, while EUR/GBP has risen, a sign that the EUR/GBP rally of the past few weeks was not reliable.

Focus on the macro data of January 8 to the German factory orders and business confidence in the Euro area.

Nobody Wants To Buy JPY Anymore?

Japanese elections have strengthened the weakening of JPY formalizing an evident bullish head and shoulder on USD/JPY with theoretical target at 92. Anyway, the rise is not always a straight line and the Adx has now reached a record level at 60, already registered in March 2012 with an overbought above 80 (RSI). Besides, the Cot analysis indicates a remarkable excess of pessimism about JPY that might lead to a cooling of the rise. Based on these considerations and as the data on the current account deficit of November will be published on January 11,we will strengthen the short position on USD/JPY at 88 to catch the expected retracement, but also closing the short operation NZD/JPY in stop to keep the exposure on the Japanese currency unchanged.

Other Macro Econimic World Data

There's not much macroeconomics data this next week.

Australia: January 8 deficit trade, January 9, retail sales, January 10 building permits.

- China: Inflation January 11

- South Africa: Industrial Production January 10

- Turkey: Industrial production January 8

- Norway: Industrial Production January 8, inflation January 10

- Sweden: Industrial Production and Inflation January 10

- Mexico: Industrial Production and Inflation January 11

- Czech Republic: Inflation and Unemployment January 9.

Gold has kept on falling due to the rise of the American real interest rates. However, for the above mentioned reasons, we still keep the exposure as long. EUR/TRY has not continued its bullish trend that started with the neck line break of 2.35. We suggest to remain long until the signal will not be denied under 2.30.