Recently, Rambus Chartology has been focusing on the Precious Metals for the most part as that is where the most compelling Chartolgy has been. But today I would like to switch gears and visit a different sector which is looking very interesting to say the least:

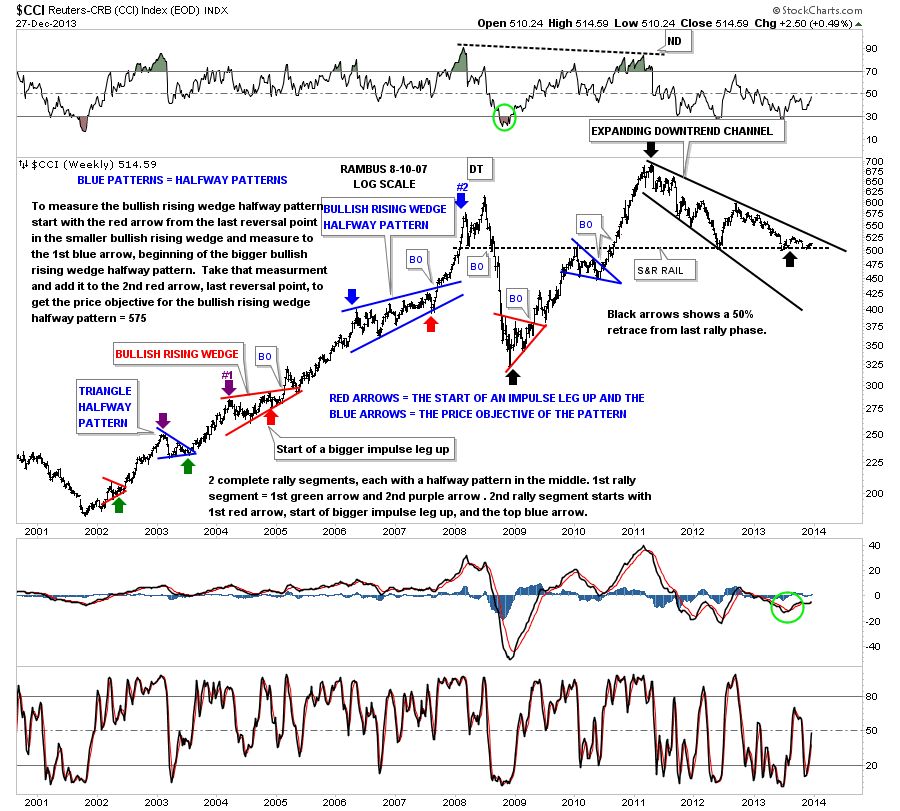

Every two or three months or so I do a post on the Basic Materials sector just too keep an eye one what is happening there. It has been somewhat mixed for the most part but it now seems to be gaining some momentum. As you know I’ve taken a couple of positions related to the area recently. I tried the shippers a month or so ago but got stopped out on a hard backtest but I could see the potential starting to build for this undervalued area. The latest bout of strength still hasn’t shown up in the CCI commodities index as it has been flat-lining on top of a long term support and resistance rail that goes all the way back to 2007. So far, the CCI has corrected 50% of the move off the 2008 low which it has been holding for some time now.

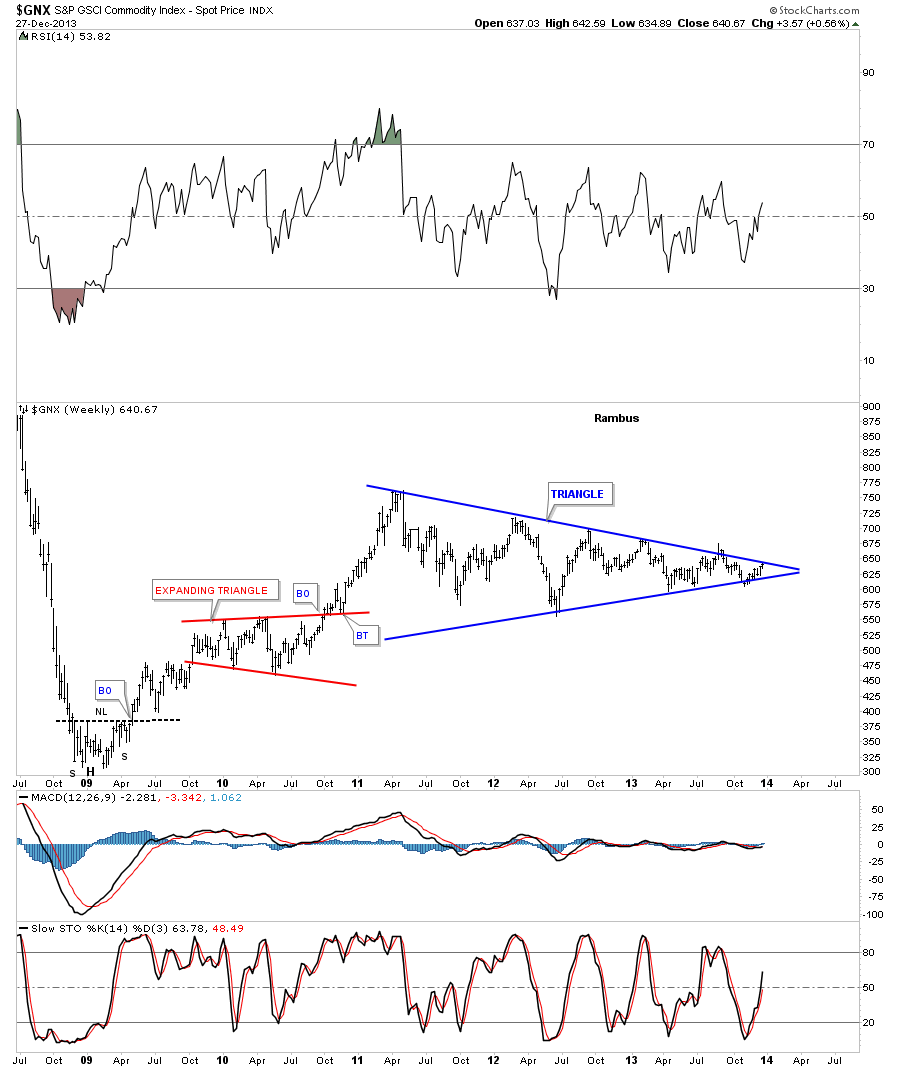

The S&P GSCI Commodity Index, GNX, is still trading inside a big blue triangle that may be getting close to breaking out. That top blue rail has five touches on it so we know it’s hot:

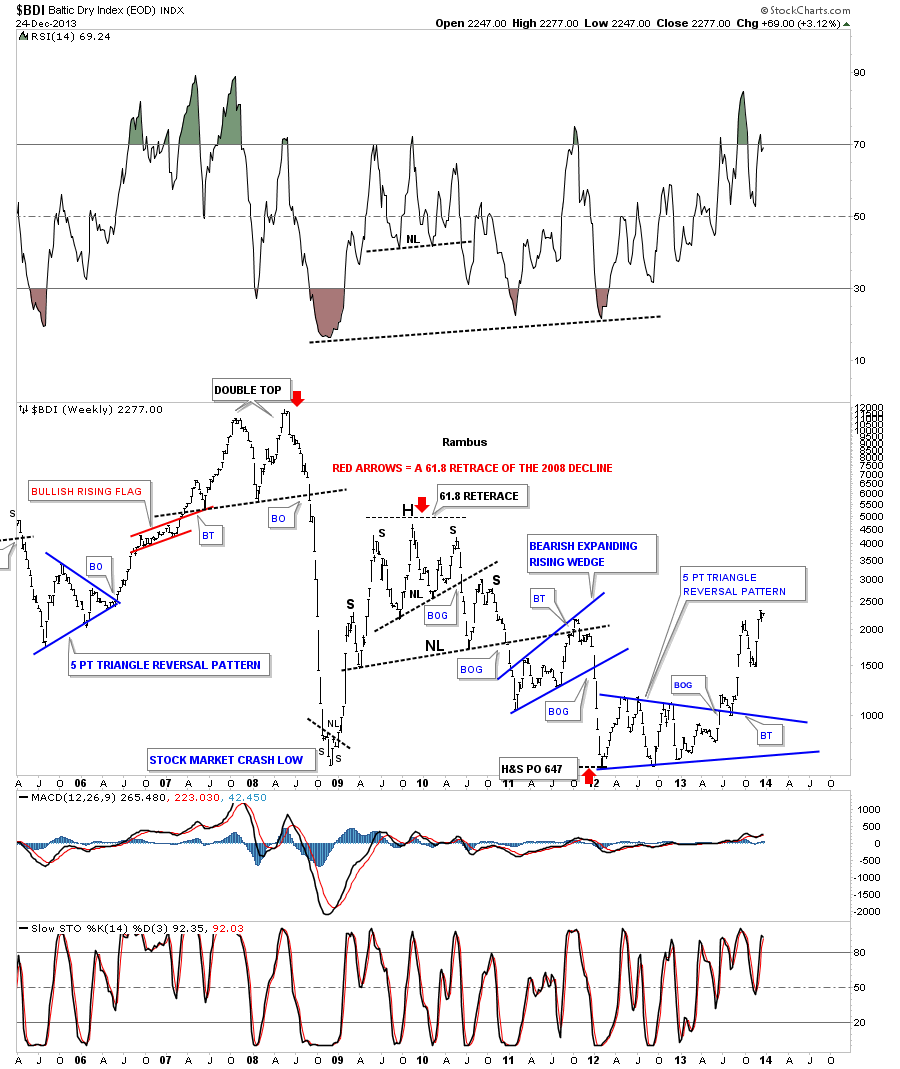

The Baltic Dry Index was the first really good indicator that the basic materials stocks were finally bottoming and a potentially decent rally was beginning. As you can see, it produced a nice five point triangle reversal pattern at its a bear market low, complete with a backtest.

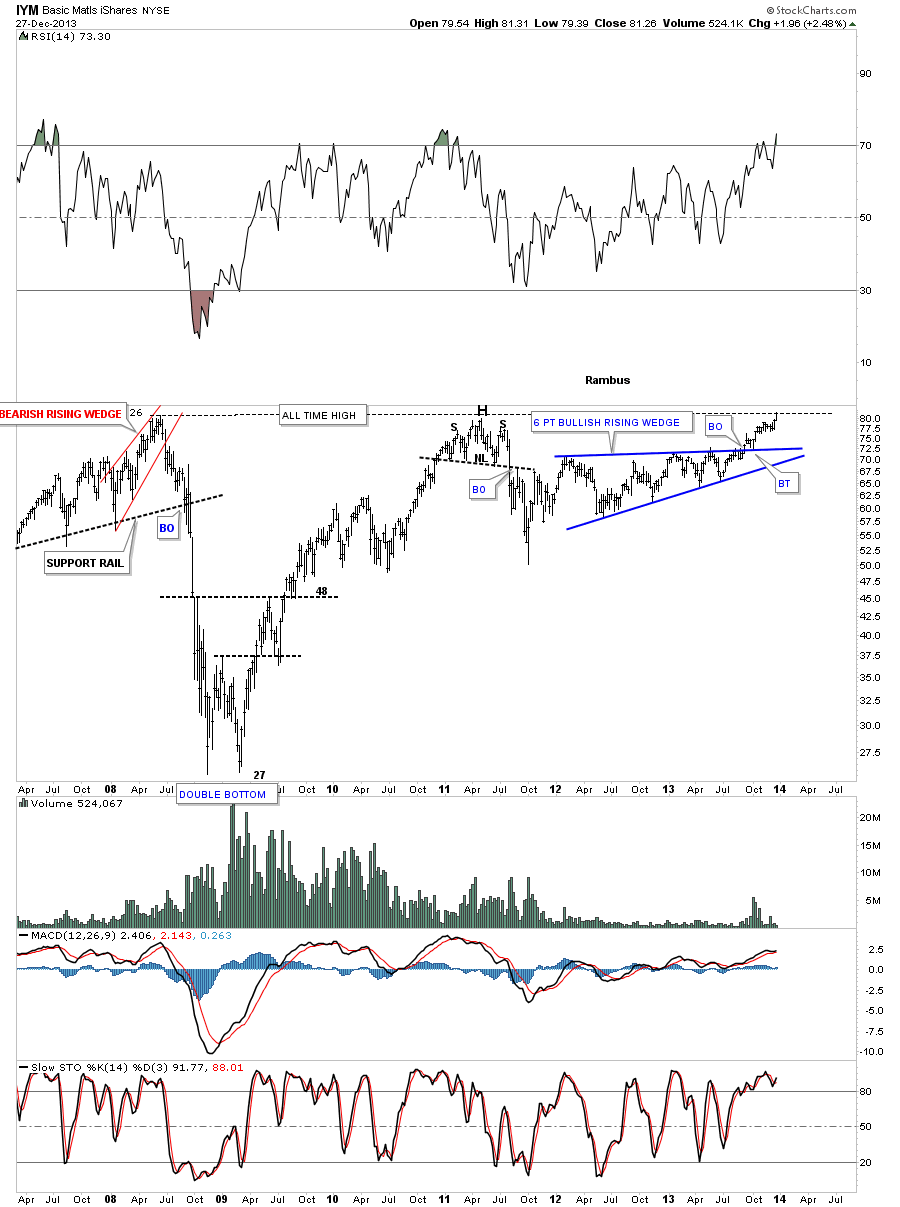

There are several ETFs out there that track the basic materials sector. One of my favorites is the iShares Dow Jones U.S. Basic Materials fund, (IYM) that is now just testing its all time highs, going all the way back to the 2008 high. It's built out an almost two-year, blue triangle that has broken out and had its backtest. As you can see, the price action is sitting right on the all time high, black-dashed, horizontal rail, at the top of the chart. Regardless of what we think of the fundamentals we have to respect the strength in this sector.

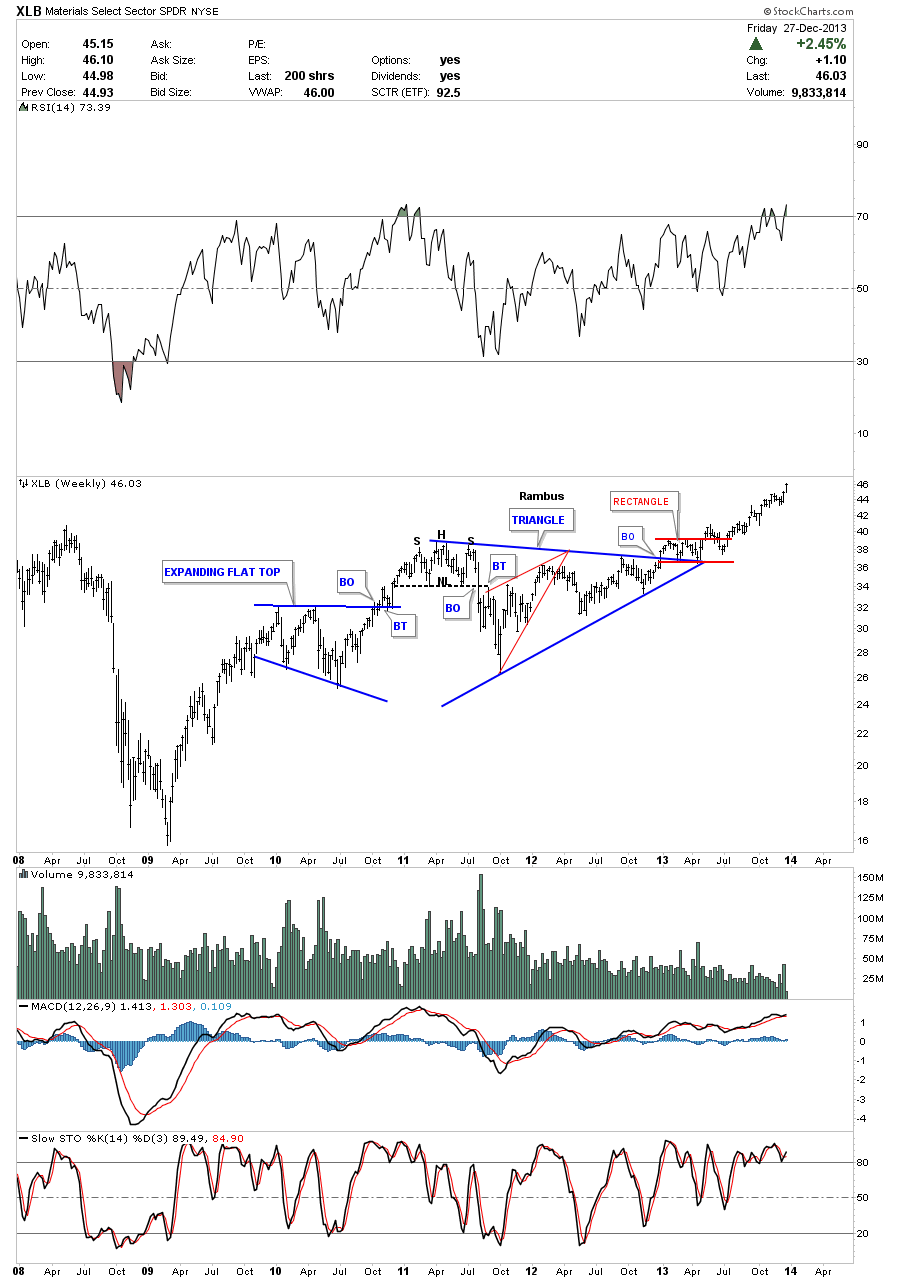

Another ETF that tracks the basic materials sector is the Materials Select Sector SPDR, (XLB).

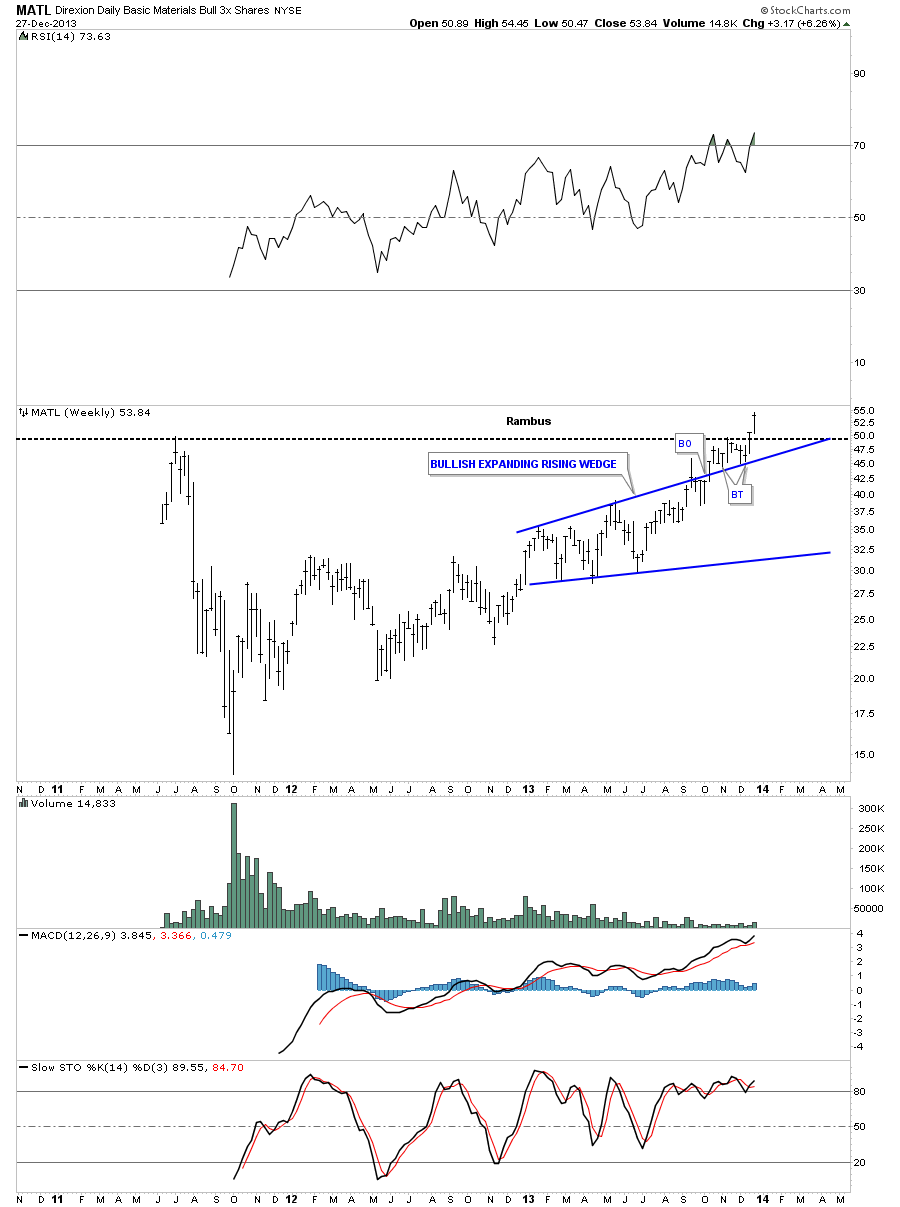

Below is a weekly chart for the Direxion Daily Basic Materials Bull 3X ETF, (MATL), that closed the week at a new high for this stock. It has very light volume though.

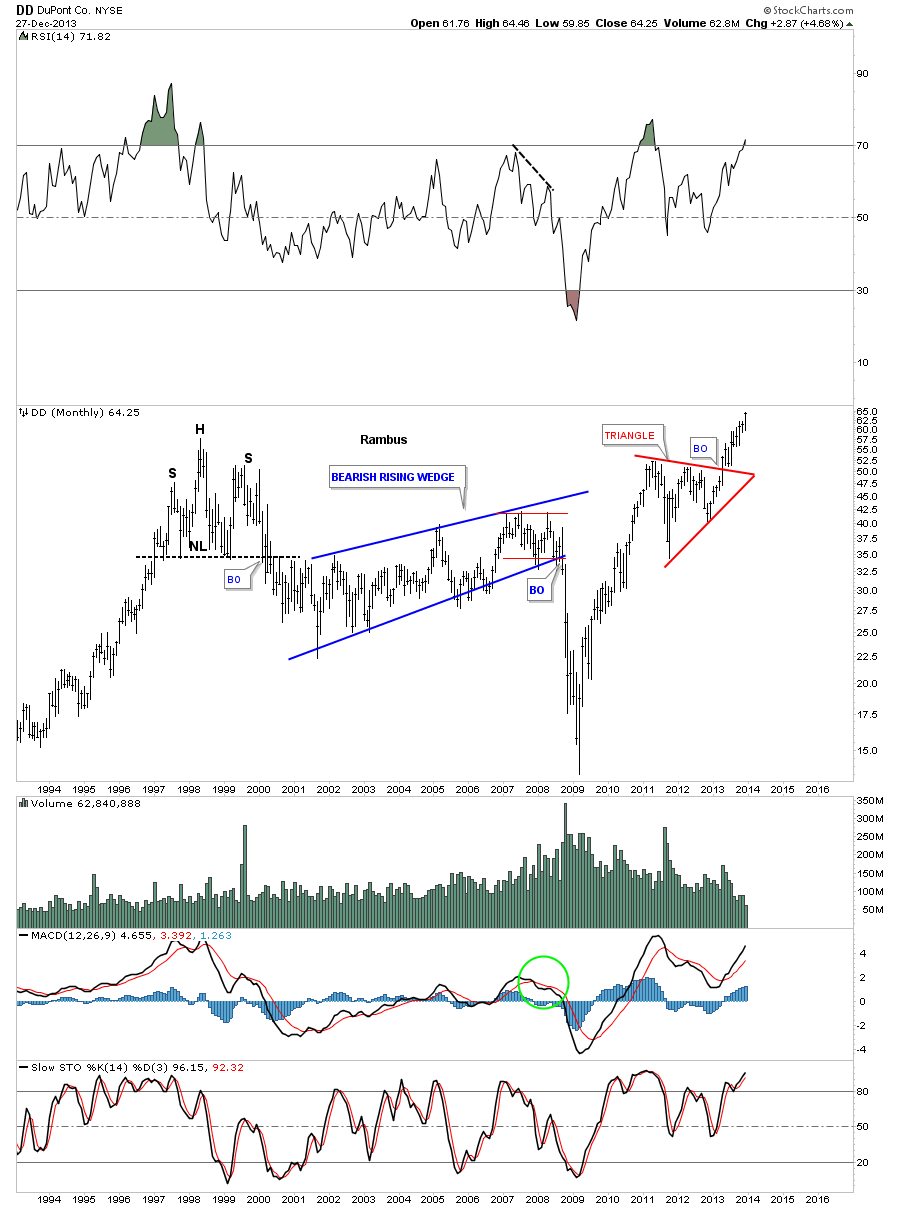

Let's now look at some of the stocks that make up this sector, some of which are part of the Dow Jones. EI du Pont de Nemours and Company, (DD) is a big part of the Dow Jones Index and shows why the Dow is still making new highs. On the monthly chart below you can see a beautiful red triangle that broke out some time ago and is currently in an impulse leg higher, making new all time highs.

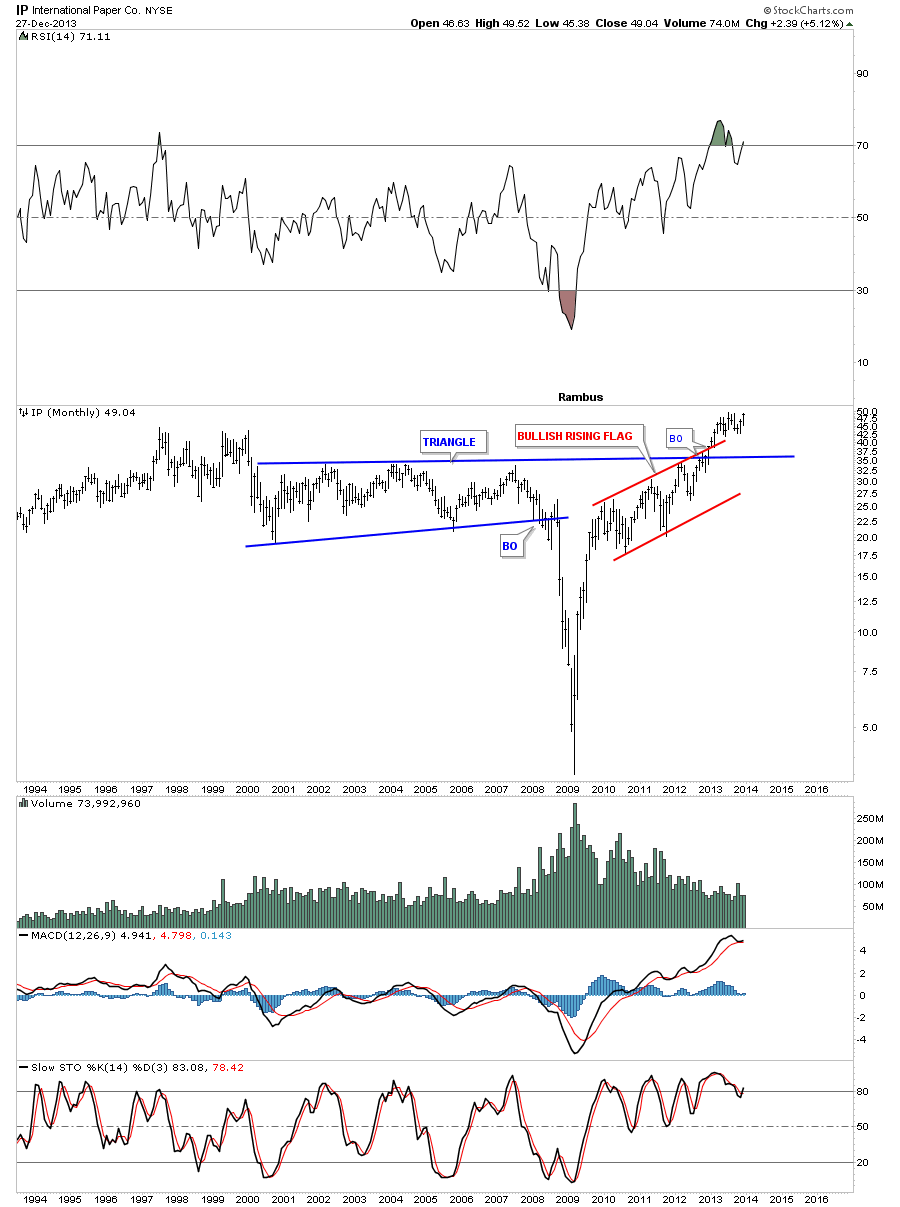

The monthly chart for International Paper Company, (IP) shows it’s trading at all time highs:

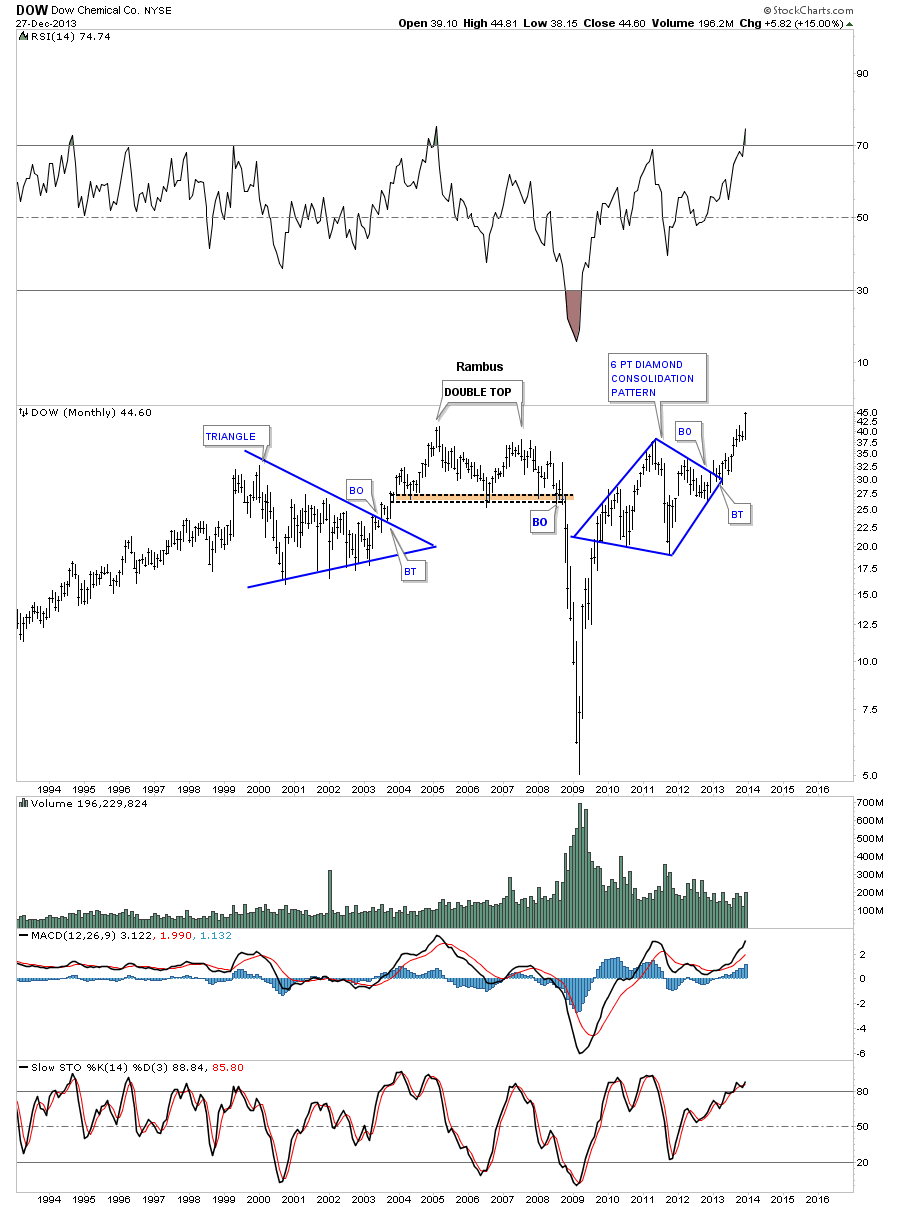

Dow Chemical Company, (DOW), is going to close out the month of December at new all time highs:

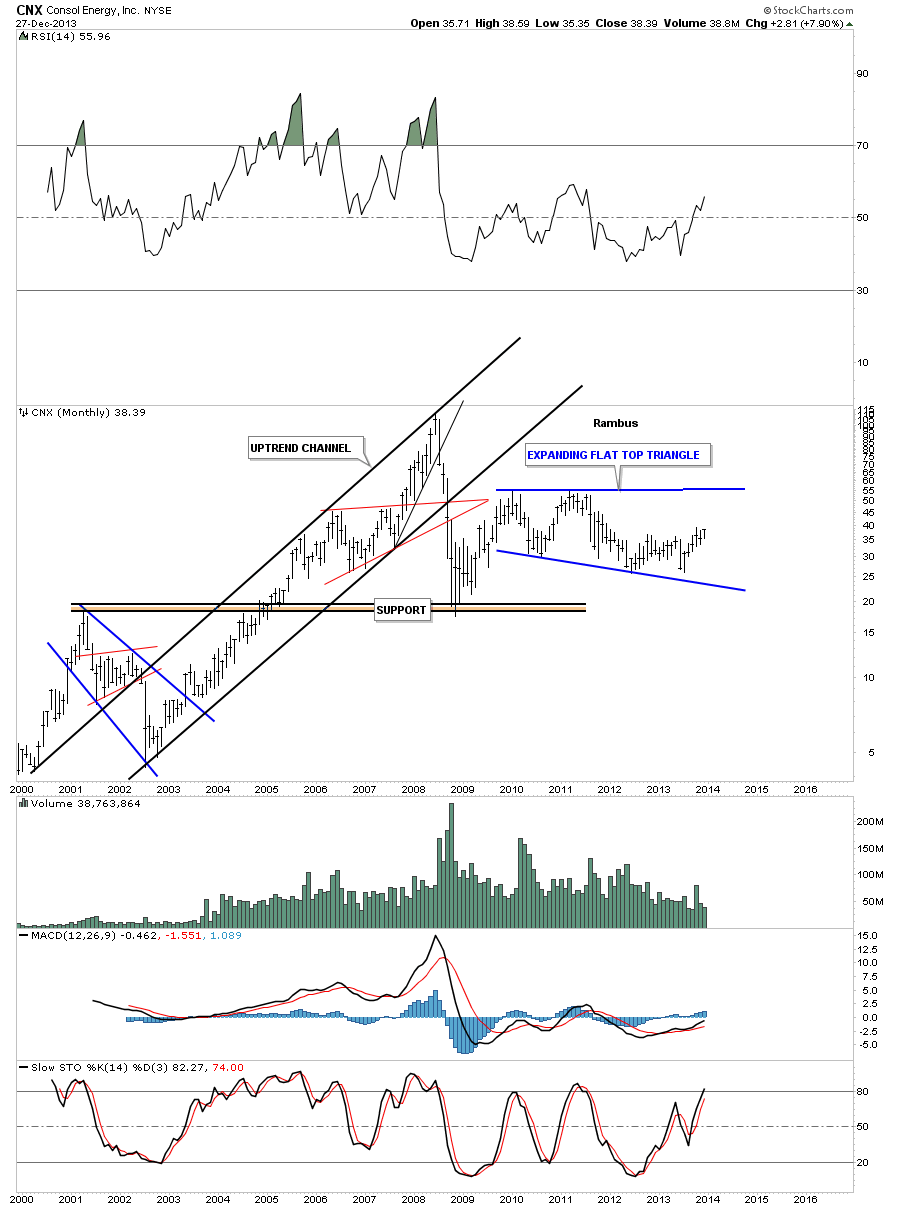

CONSOL Energy Inc, (CNX) is still well below its all time high but it looks like it could be forming a flat top expanding triangle:

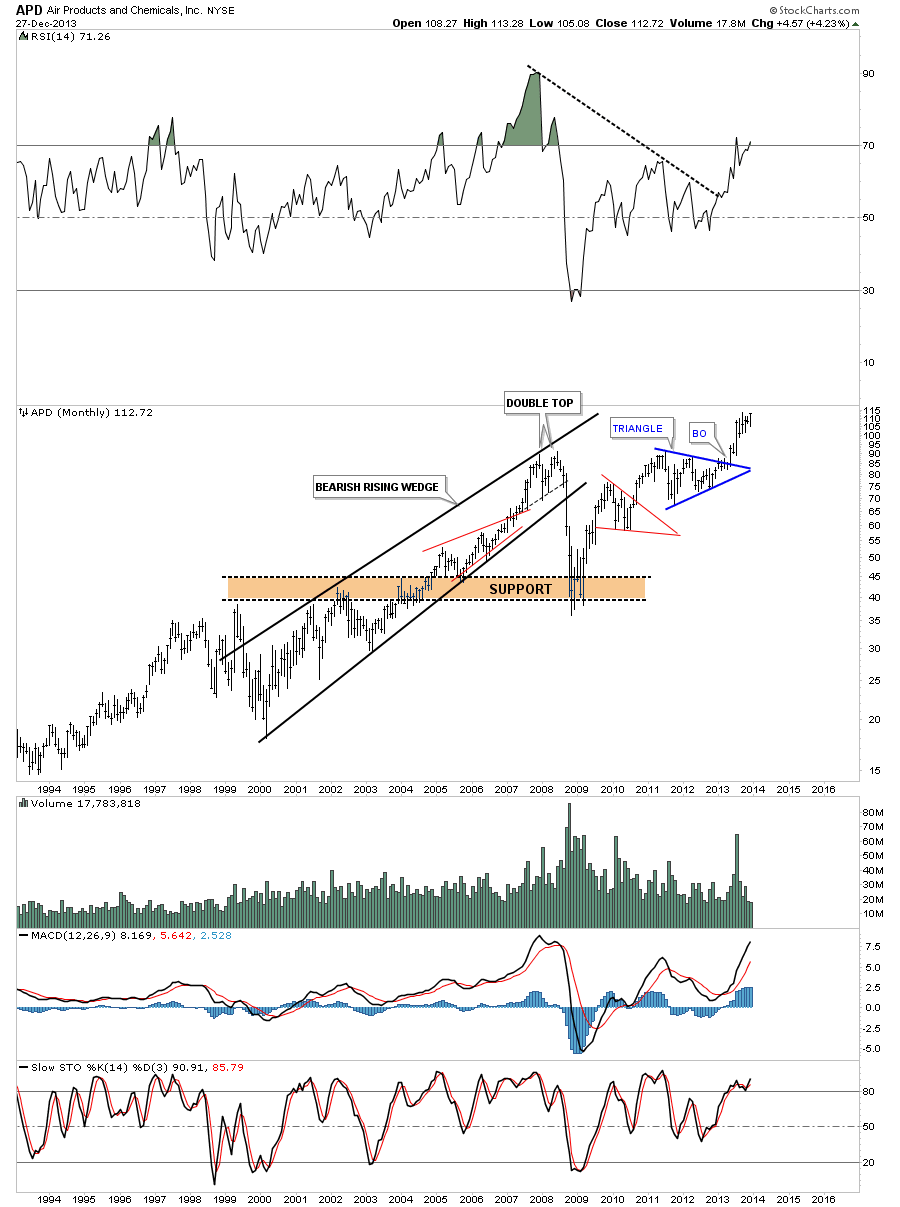

Air Products and Chemicals Inc, (APD), is breaking out to new all time highs too:

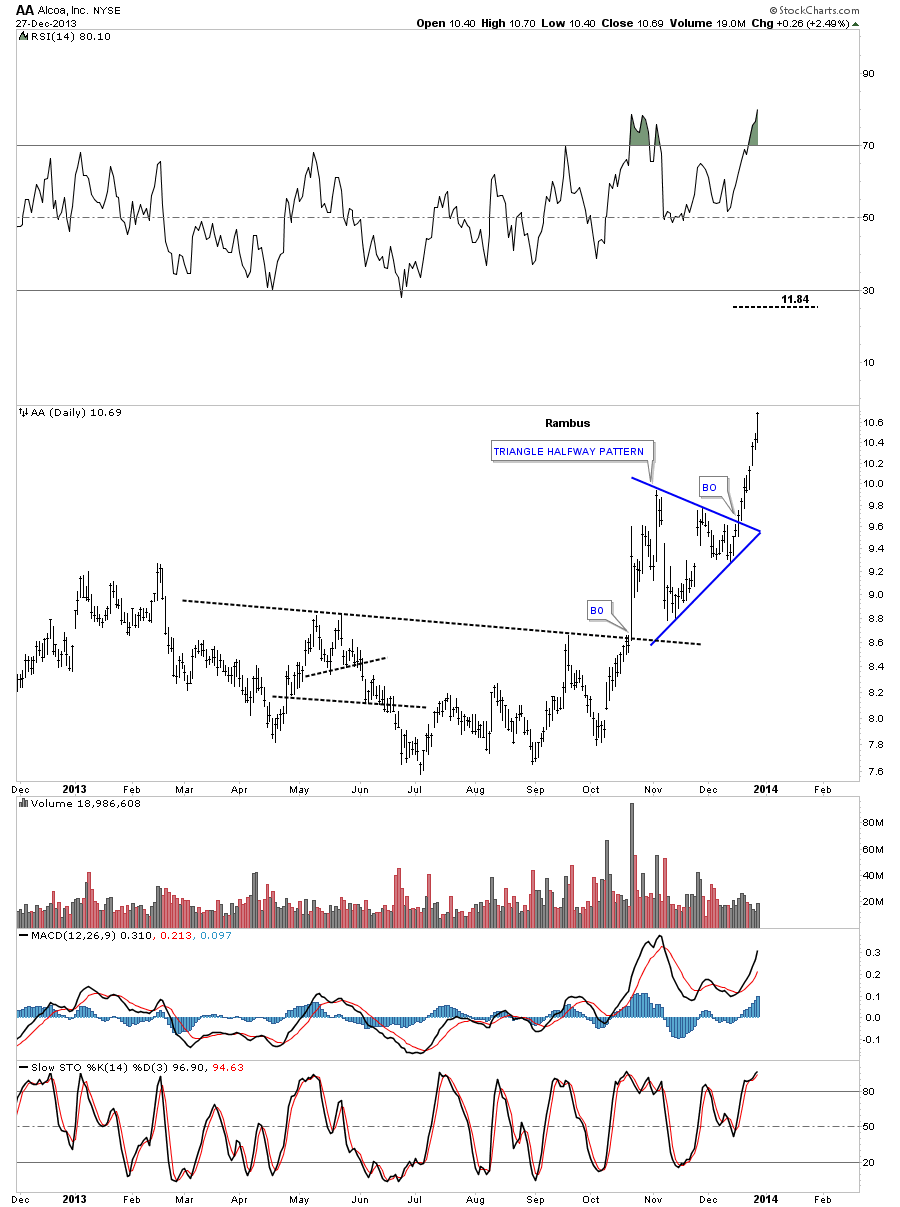

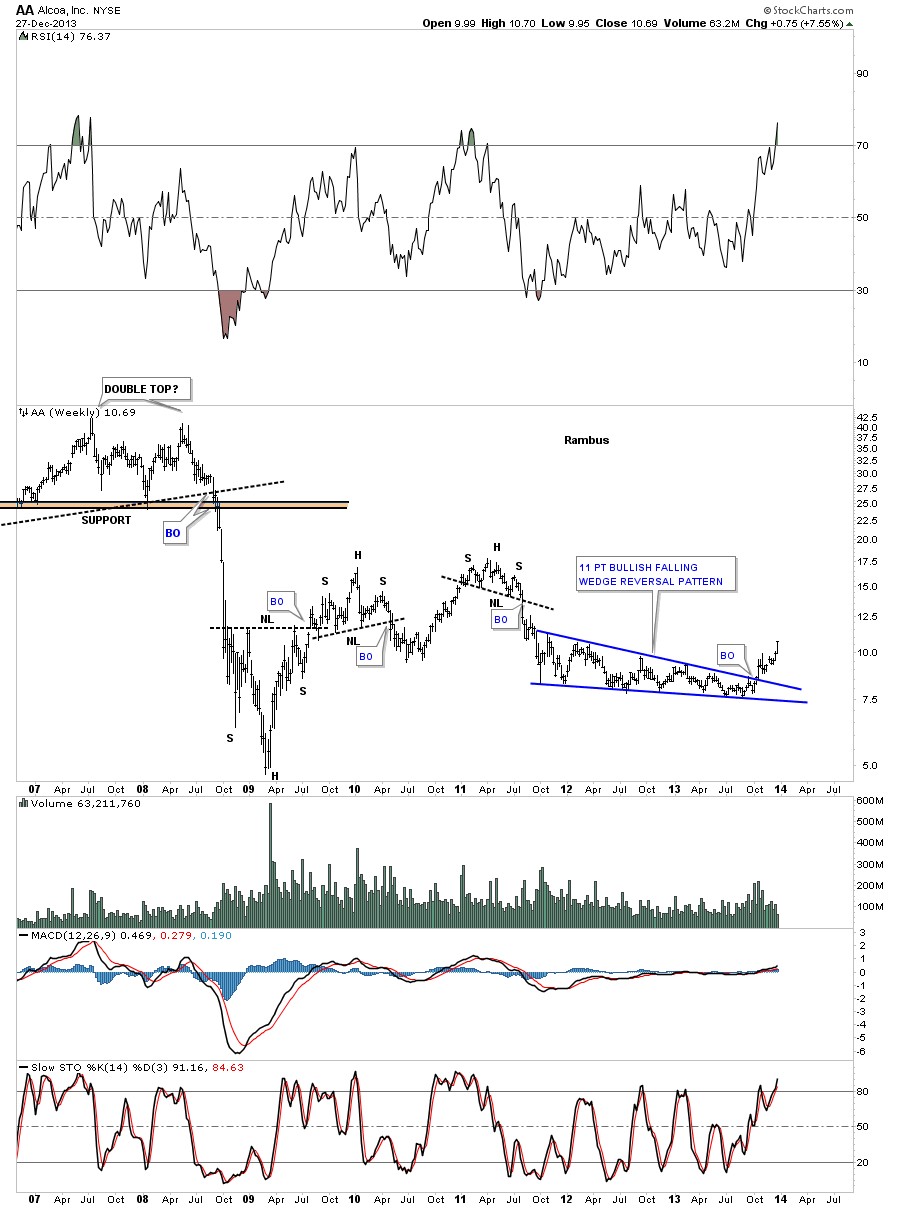

Alcoa Inc, (AA), is another stock that has recently broken out of a blue triangle consolidation pattern.

The weekly look for AA shows there is still a lot of room to move higher for this stock. It created an 11 point bullish falling wedge reversal pattern to end its decline.

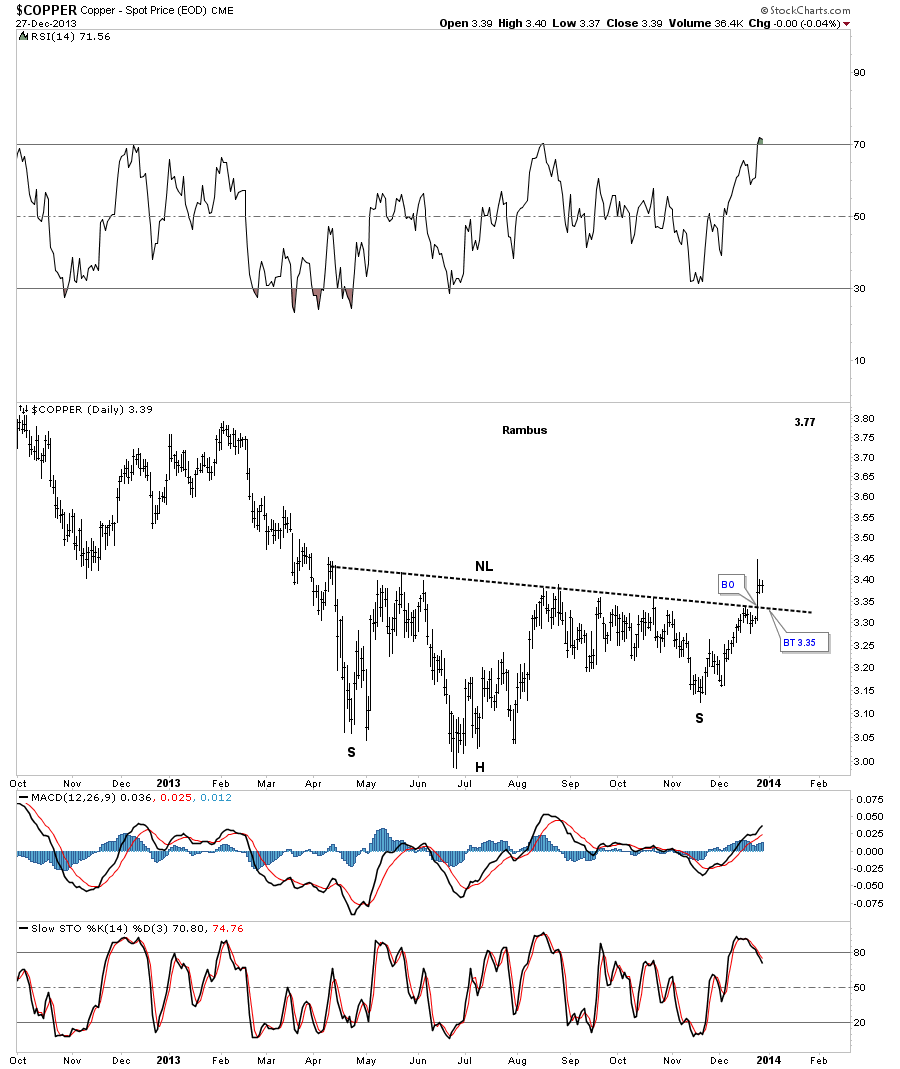

There are several areas in this sector that have yet to really take off and are still undervalued. There’s an old saying that however copper trades, so goes the stock market. This means if copper is strong, the economy should be as well, and vise a versa. I think copper finally showed its hand this past week, after breaking out of a nice eight month inverse H&S base. It's been lagging the Dow Jones for quite some time now, but maybe it’s getting ready to play catchup.

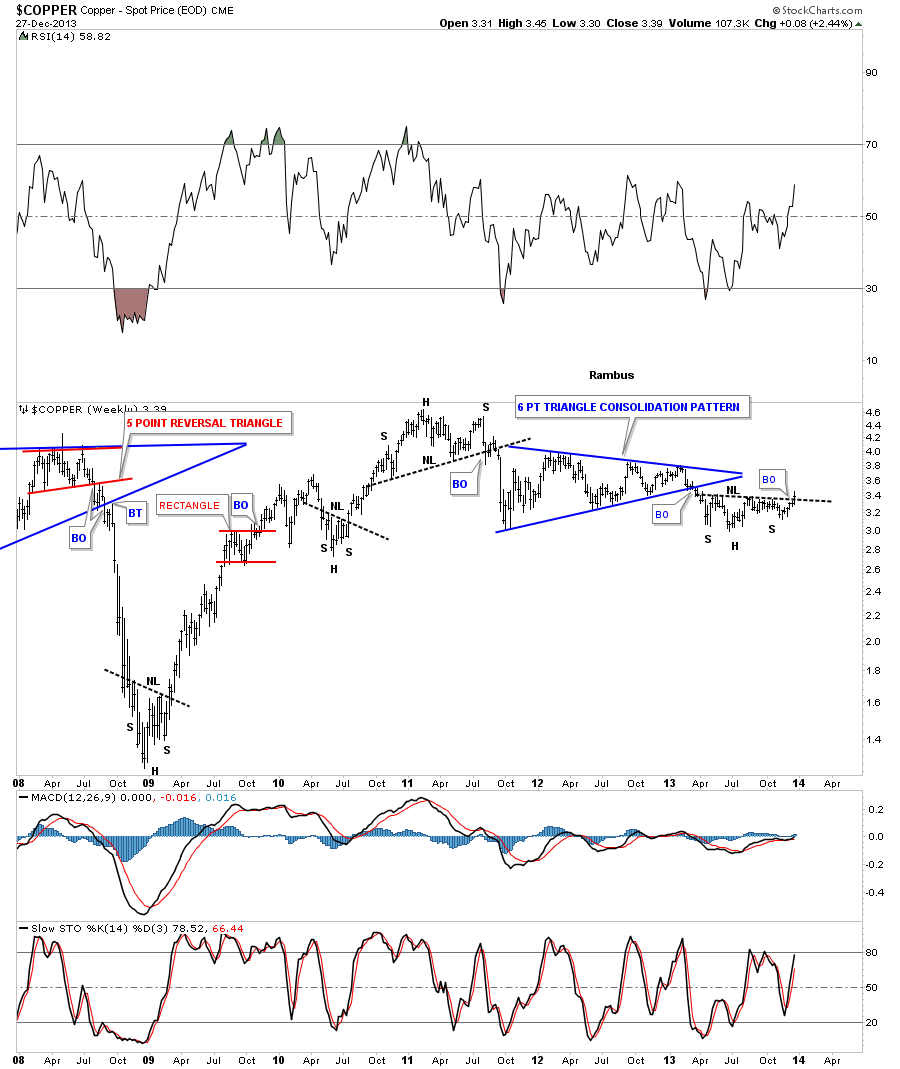

The weekly look at copper shows just how weak it's been since topping out in 2011. It built a beautiful 6 point blue triangle consolidation pattern but so far has failed to follow through to the downside. Note the small inverse H&S base on the lower right hand side of the chart that is the same inverse H&S base that I showed you on the chart above. This could be a very important development.

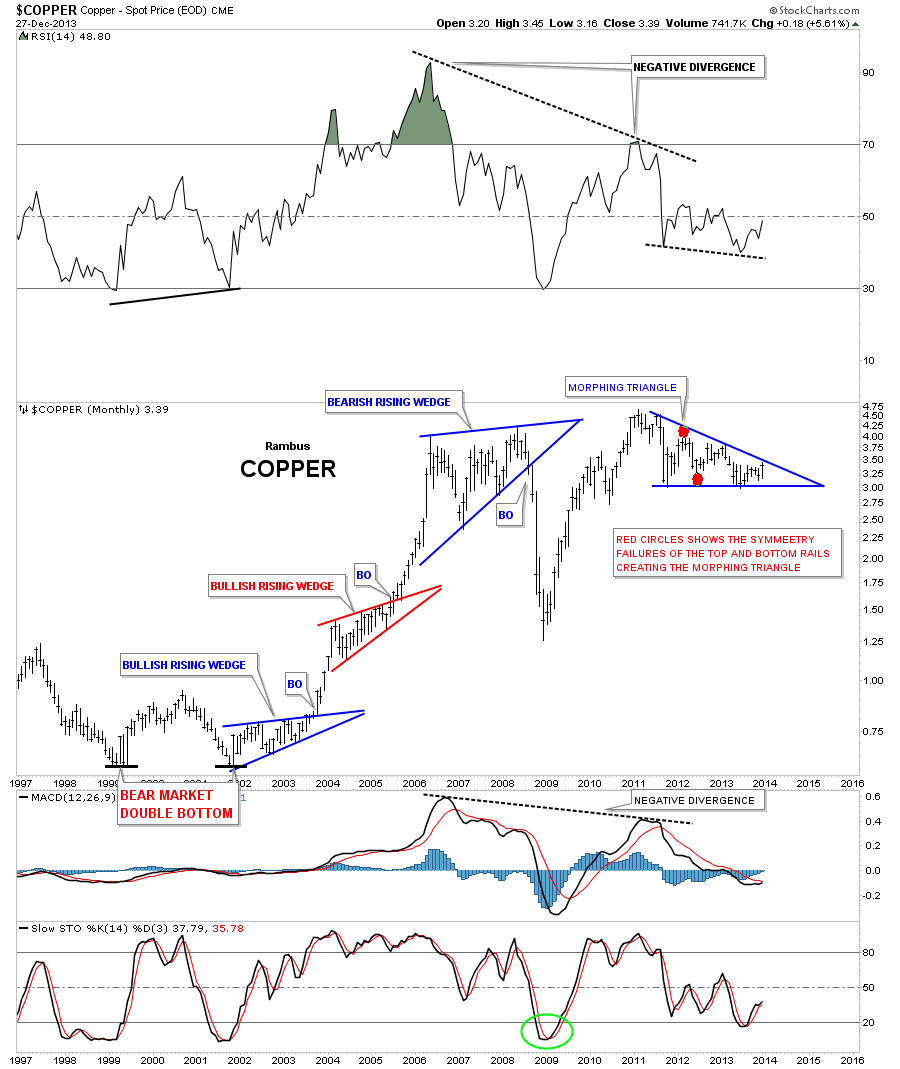

As I have shown you many times in the past, a triangle can morph into a bigger triangle, which doesn’t change the direction of the move, but just creates a bigger triangle. The monthly chart below shows how copper is morphing into a bigger triangle. Note the two red circles that show the failure of the top and bottom rails that are creating the bigger blue triangle consolidation pattern.

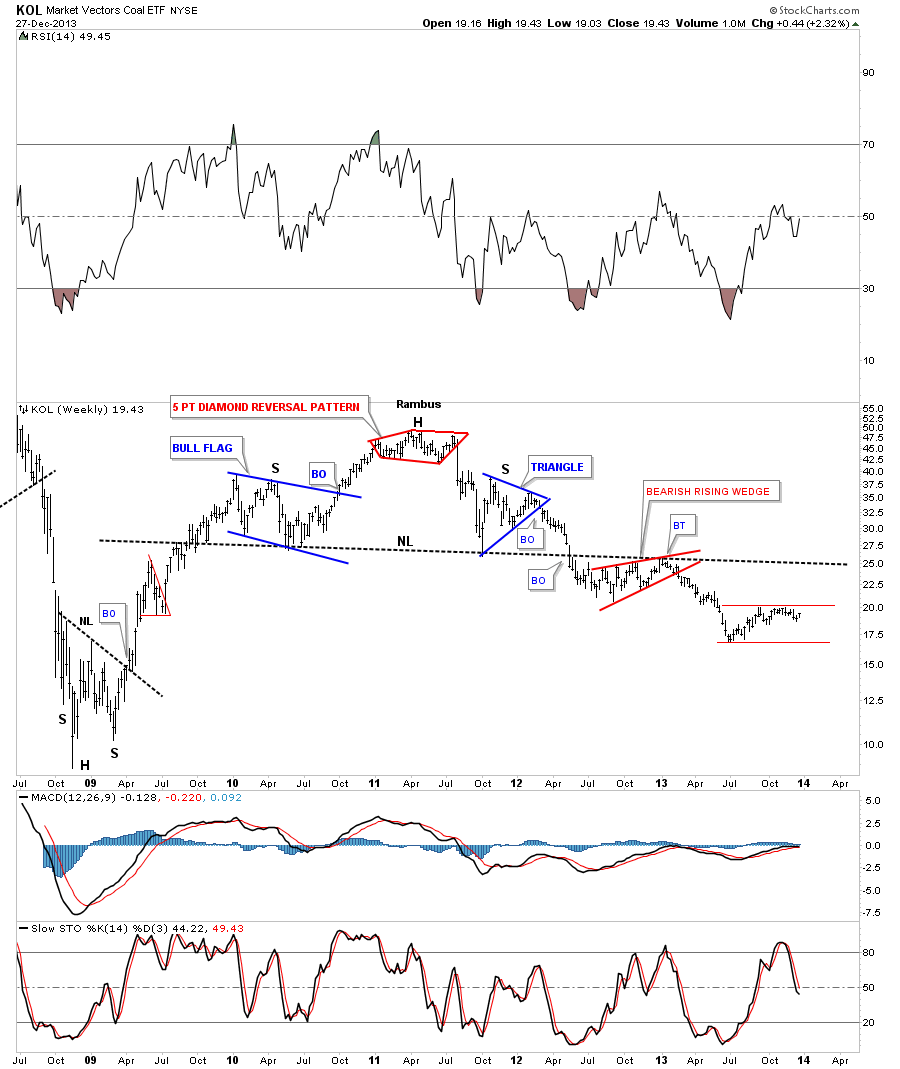

Coal is probably the weakest area inside the basic materials sector. It built out a beautiful H&S top with a blue triangle just above the neckline and red bearish rising wedge just below the neckline. This is usually a bearish setup. As you can see, the Market Vectors Coal ETF, (KOL), is basically trading in no man’s land at the moment:

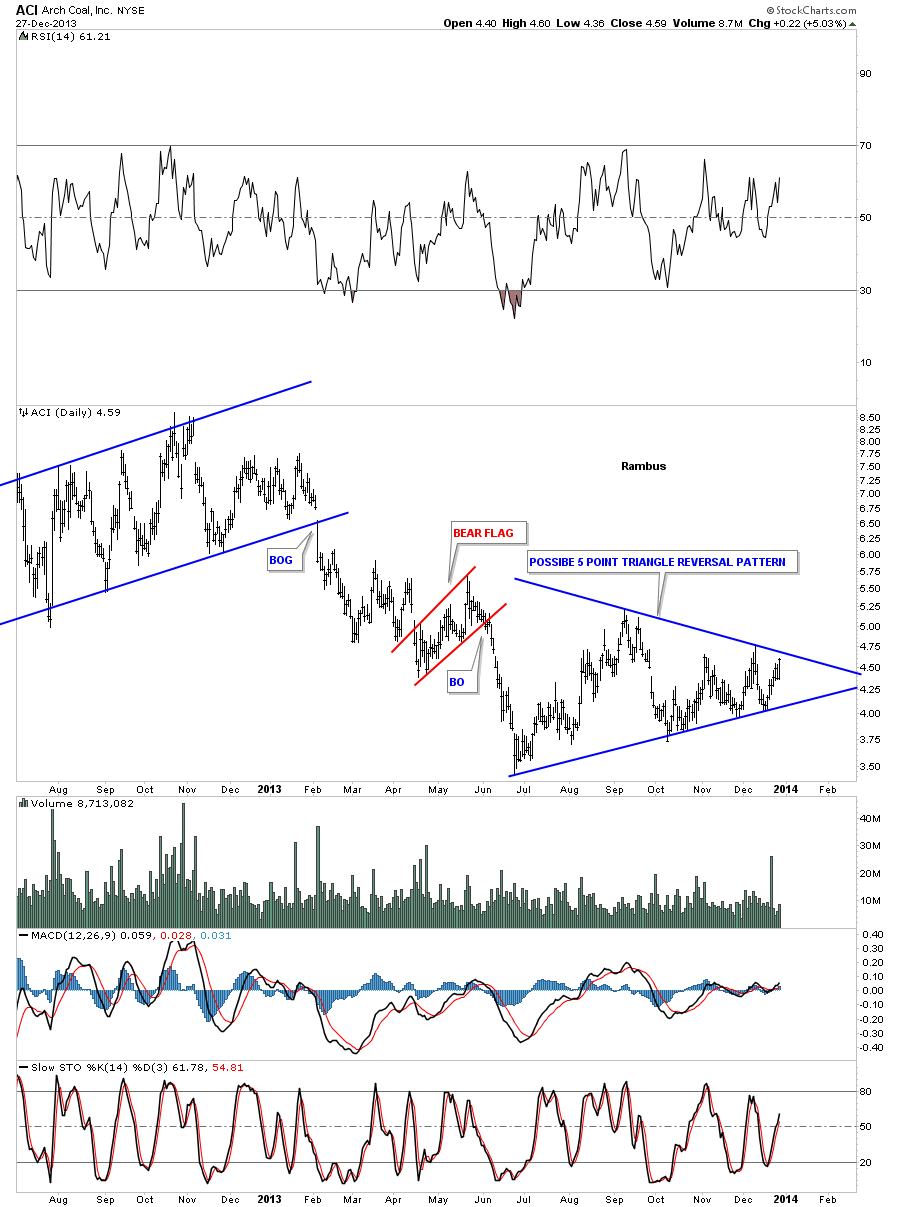

Even though the KOL is trading sideways, there is one coal stock, Arch Coal Inc, (ACI), that is close to breaking out of a 5 point blue triangle reversal pattern to the upside. This stock looks like a very good bargain right now and for the next year or two if it takes out the top blue rail.

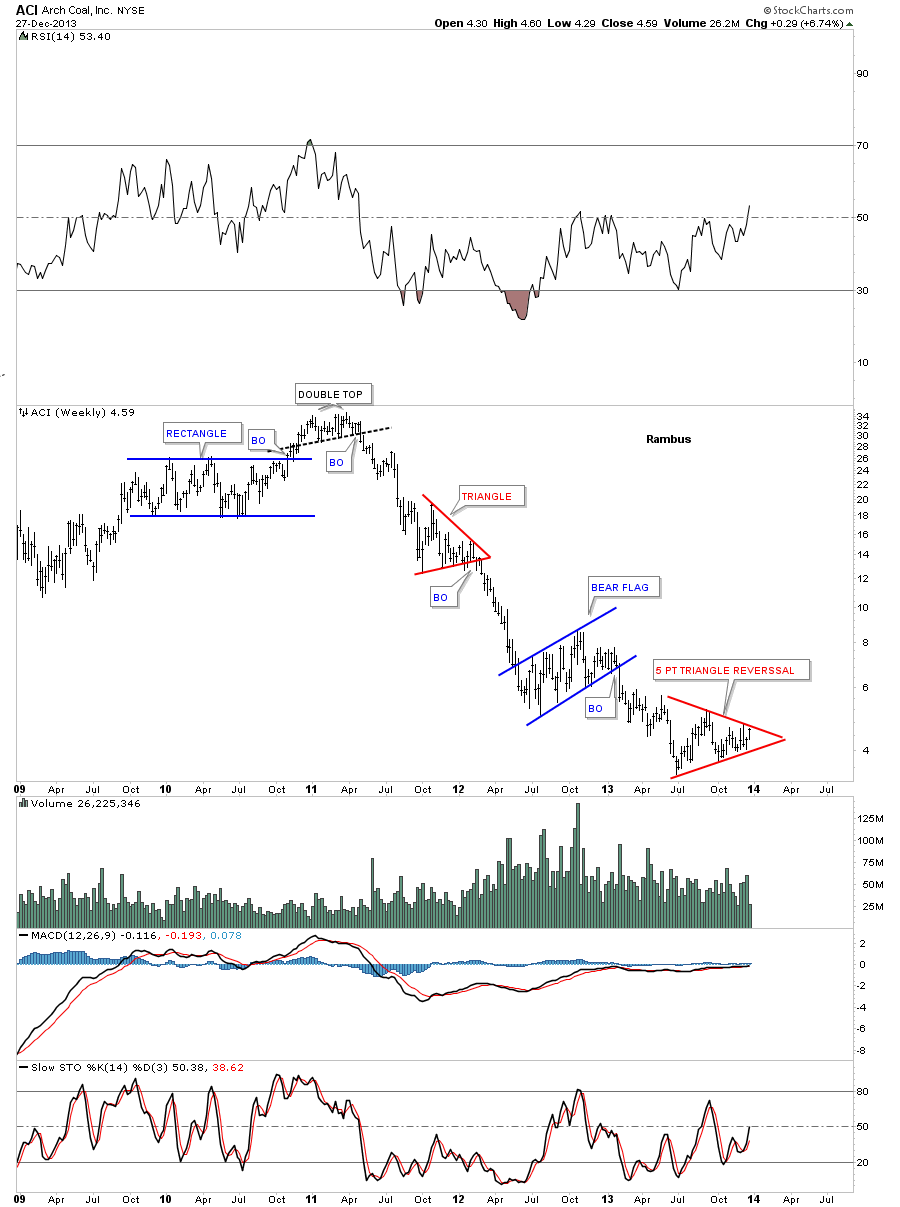

The weekly chart for ACI shows why it could be such a great bargain down here. Buy low and sell high applies here. As you can see, it's been in a three year bear market with one consolidation pattern forming below the next. Now we may see a 5 point triangle reversal pattern forming at the bottom. This is a perfect Chartology chart of a bear market, complete with a topping pattern and hopefully a bottoming pattern with consolidation patterns that make up the bear market.

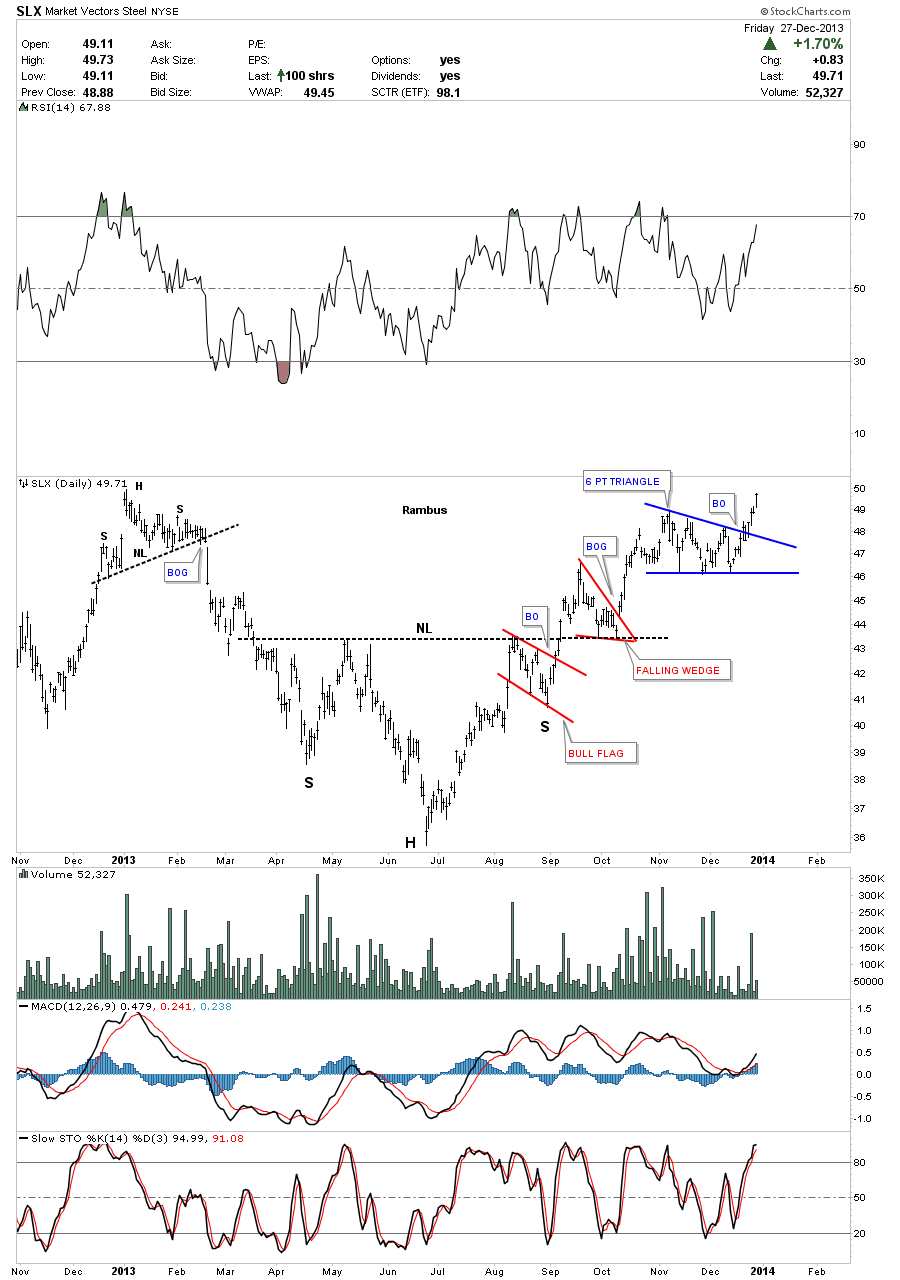

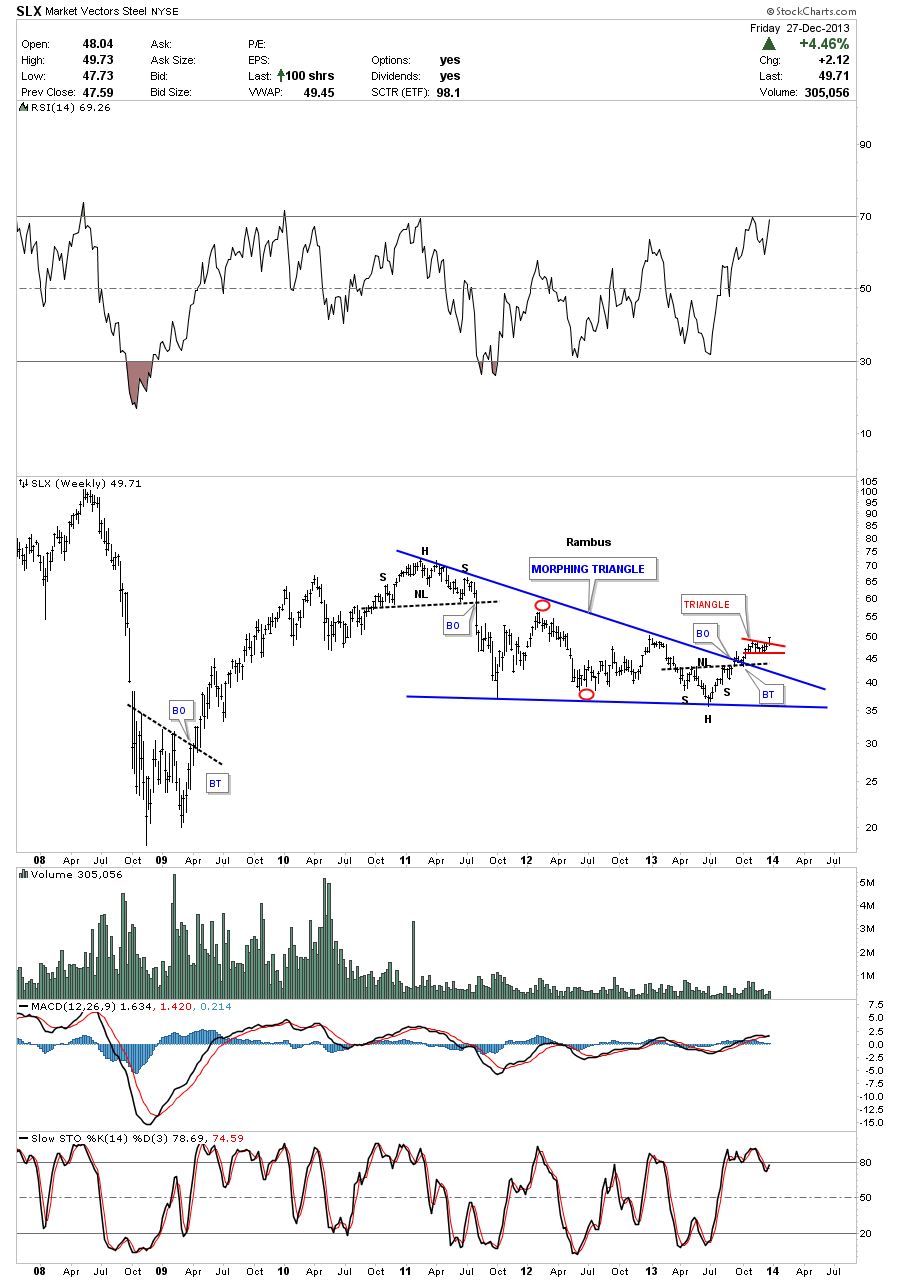

I believe the hottest area in the basic materials sector right now is among the steel companies. First let's look at the Market Vectors Steel ETF, (SLX). I have to admit I’ve been watching this rally taking place for sometime now and never pulled the trigger. It's been building out some very nice chart patterns that have shown this ETF to be in a bull market. Note the nice inverse H&S bottom followed by the red bull flag that formed just below the neckline and the red bullish falling wedge that formed just above the neckline. As I have shown in the past, when you get a consolidation pattern that forms just below the neckline, then one that forms right on top of the neckline, this is almost always a bullish setup. As you can see, the SLX broke out of a 6 point blue triangle last week:

When looking at the daily chart above, it looks like we already missed the big move up. But when you look at the weekly chart, you can see the rally is just really getting started. Just like the copper chart I showed earlier that had a morphing triangle, SLX also has the same morphing triangle, as shown by the red circles. These morphing triangles can be very aggravating as they will give you a false buy and sell signal.

When the price action doesn’t follow through after the breakout, that's when you should start to take into consideration that the triangle may be morphing. It’s still valid, but it will be just a bit bigger than previously thought. Most give up on these types of patterns but I find them very useful when its all said and done.

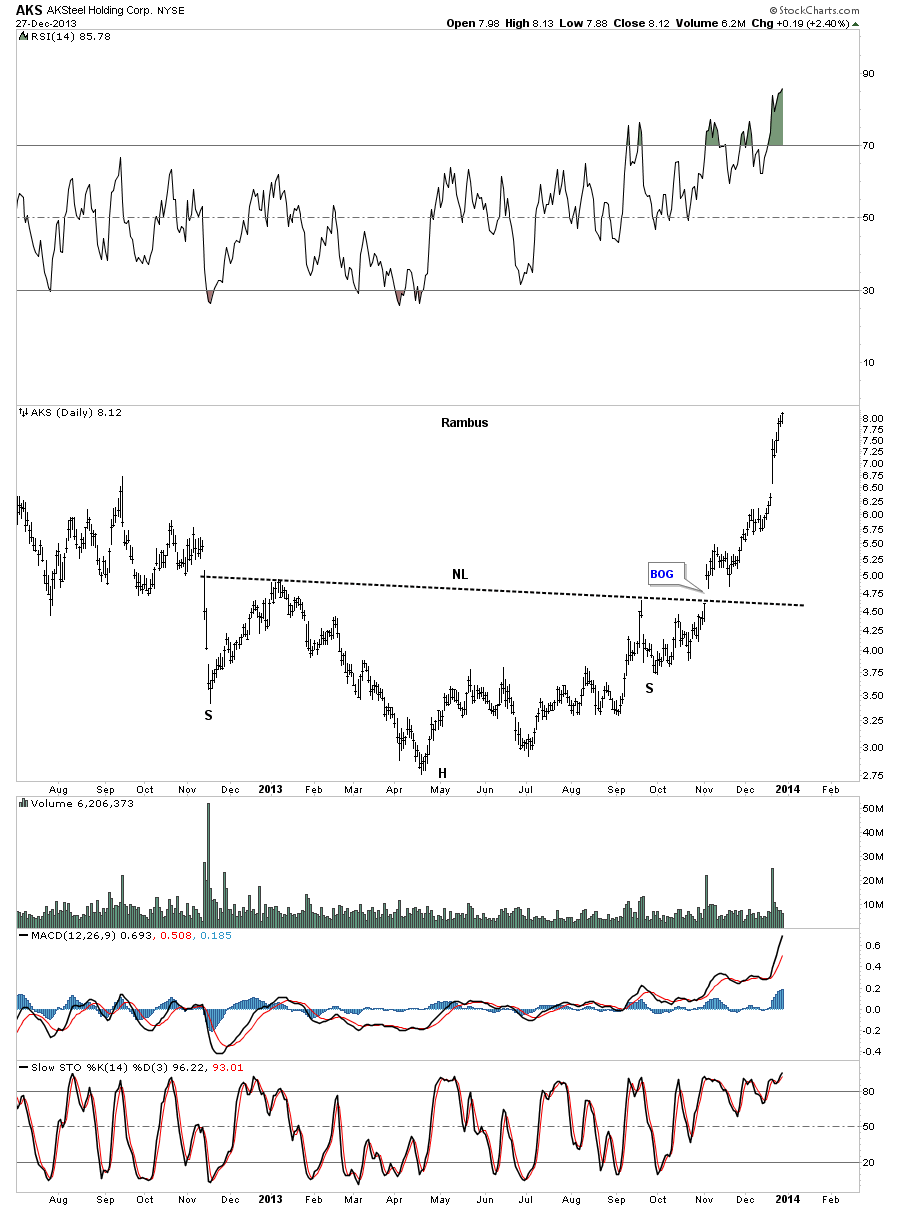

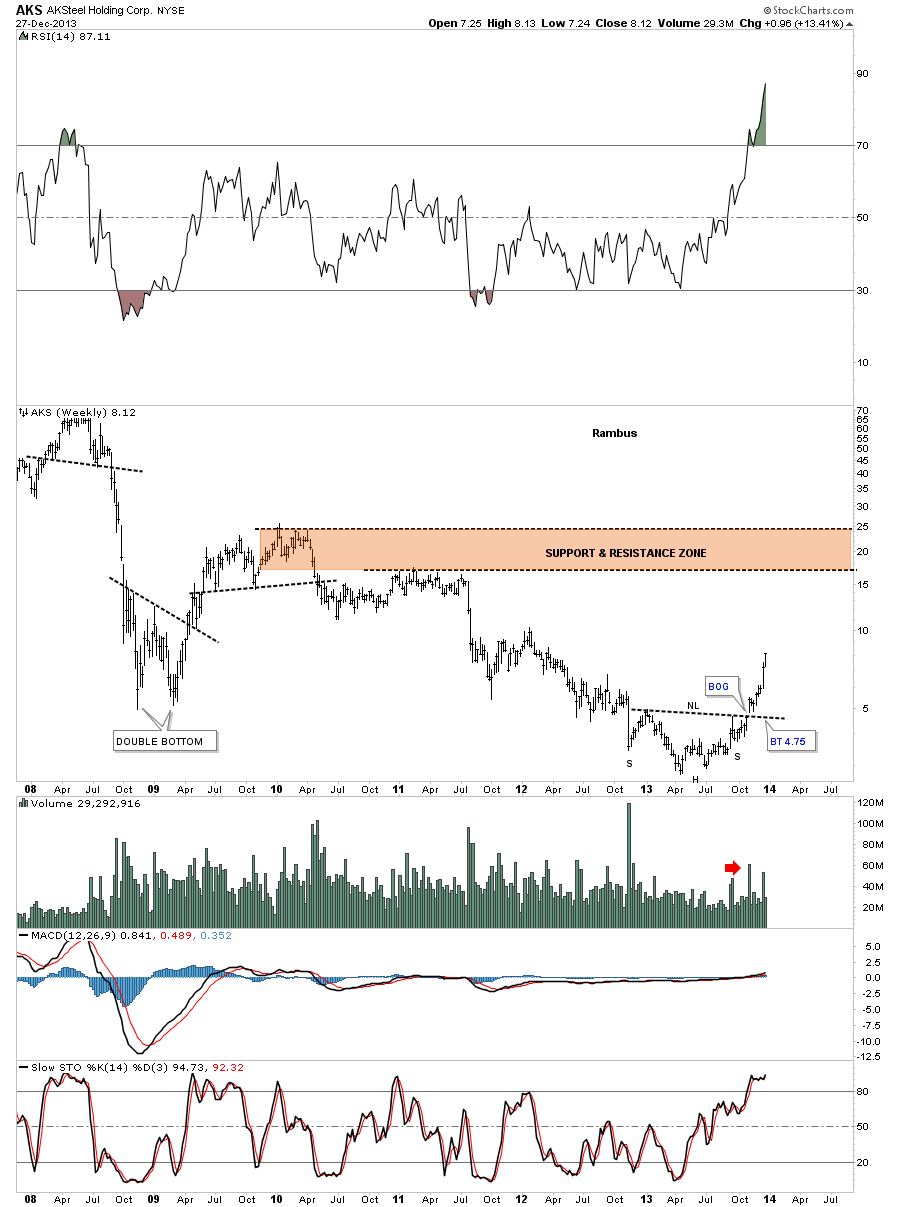

Let's now look at some individual steel stocks that are currently showing some strong moves. Of all the steel stocks I follow, AK Steel Holding Corporation, (AKS), has probably been the strongest. You can see it had a nice inverse H&S bottom that completed with a big breakout gap. It has hardly stopped yet to rest.

The weekly chart for AKS shows there is still a lot of upside potential left in this stock. At some point it will start to form a good consolidation pattern and that’s when it will be time to pounce.

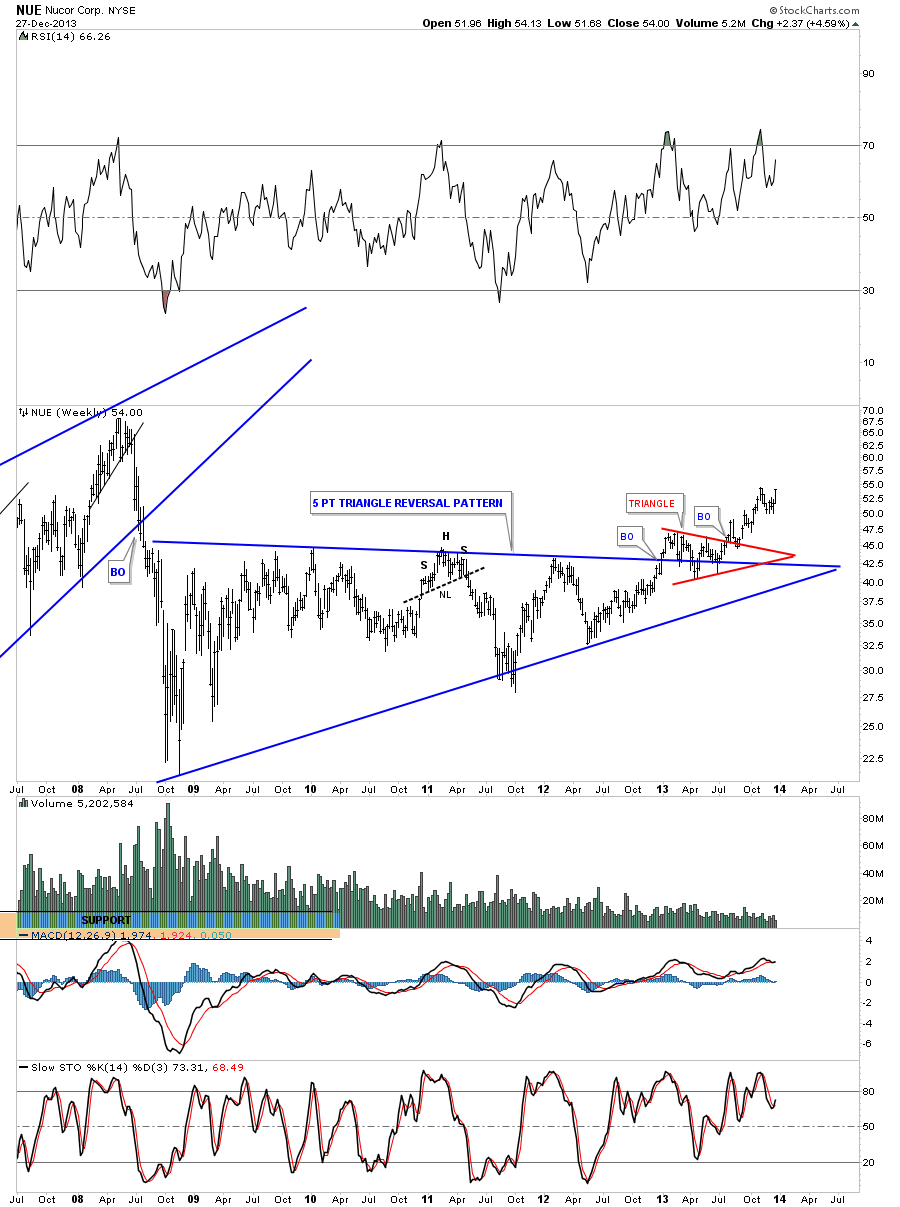

Nucor Corporation, (NUE), has been one of the strongest steel stocks, as shown by the weekly chart. Note the red triangle that formed right on the top rail of the blue triangle. This was a bullish setup:

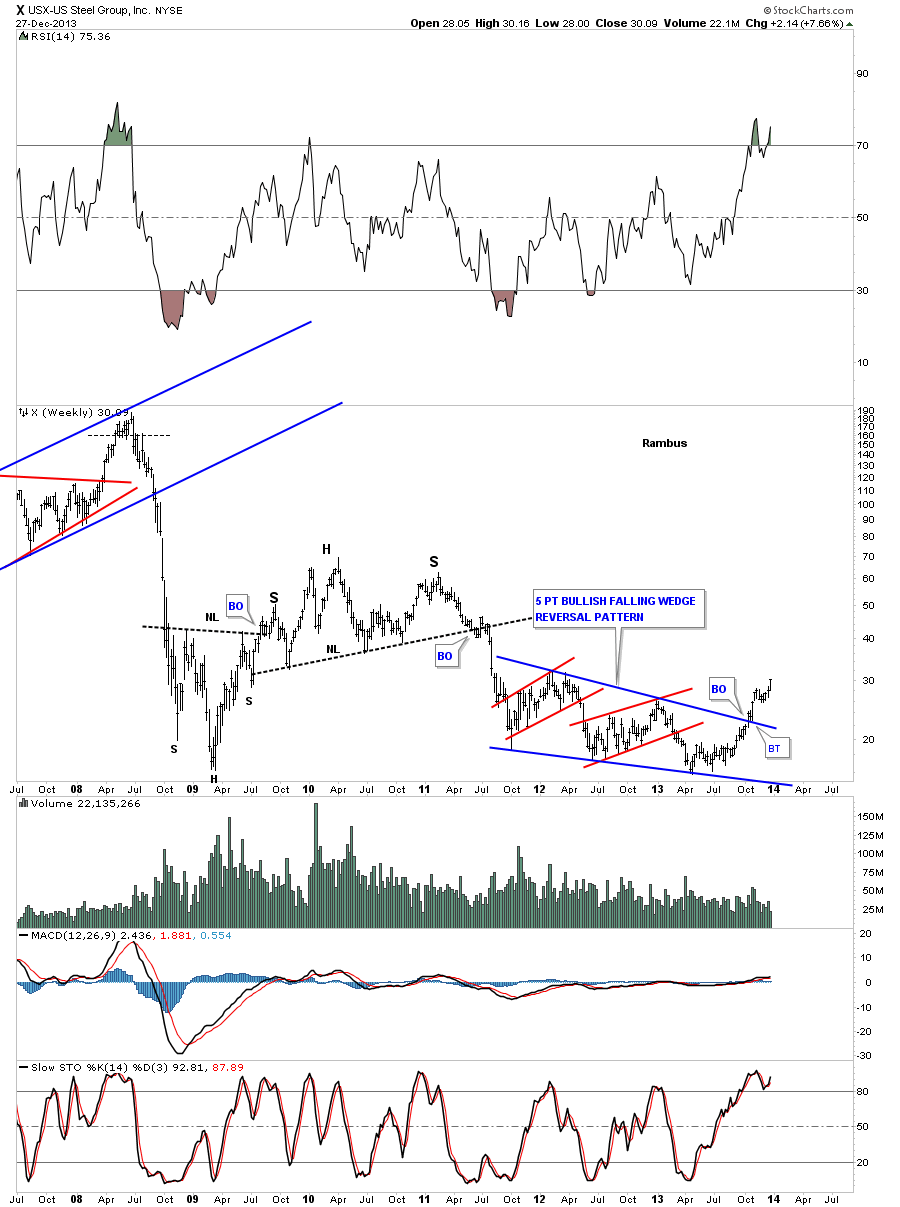

The last chart I would like to show is a weekly look at United States Steel Corporation, (X), which put in a five point bullish falling wedge reversal pattern to the upside. As you can see, there is huge potential for this stock:

The basic materials sector is telling us that there is truly a global recovery taking place at the moment. How long this recovery lasts is anybody's guess. The shippers have been confirming this for some time now and we can’t ignore what the charts are telling us. It’s never just black and white as there are always cross currents running through the markets that can make them difficult to read sometimes. With Chartolgoy on our side we can keep on top of the changes even though the fundamentals might not agree with what the charts are saying. It looks like there are some good bargains in this sector that we can take advantage of if we can keep a clear mind.